Martins Inc., a Russian company, carries out its day-to-day operations in Russian rubles (RUB) and acts independently of House plc. On 1 January 2011,

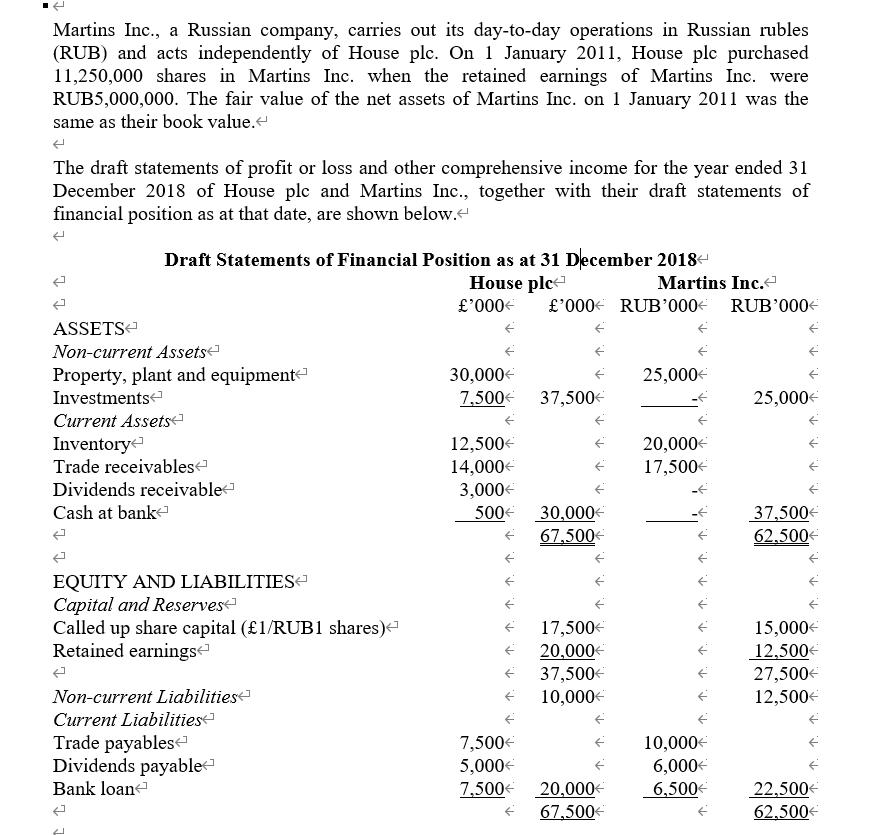

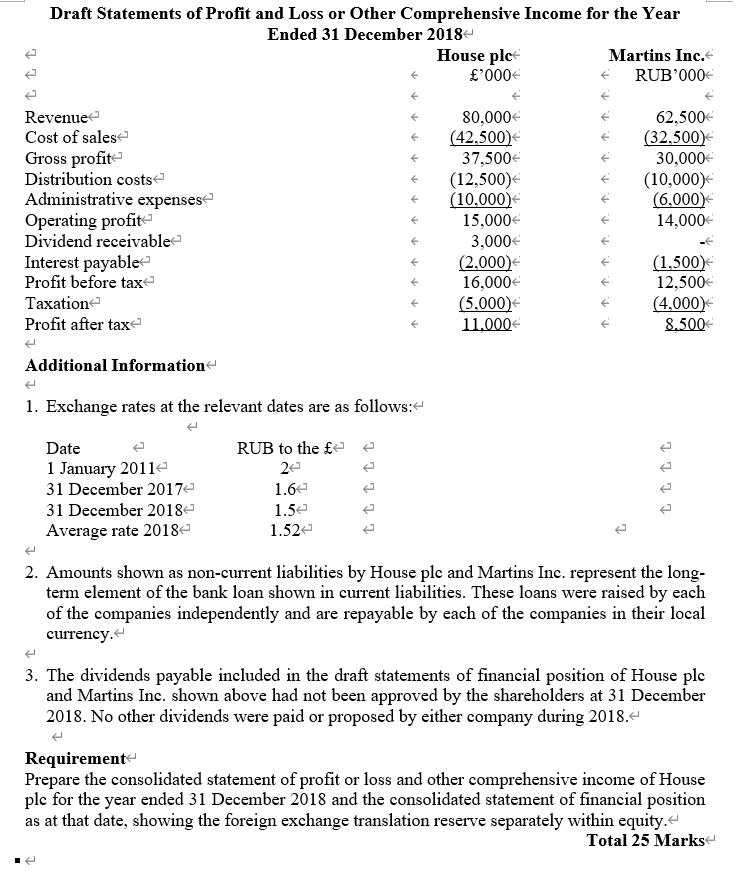

Martins Inc., a Russian company, carries out its day-to-day operations in Russian rubles (RUB) and acts independently of House plc. On 1 January 2011, House plc purchased 11,250,000 shares in Martins Ine. when the retained earnings of Martins Inc. were RUB5,000,000. The fair value of the net assets of Martins Inc. on 1 January 2011 was the same as their book value.e The draft statements of profit or loss and other comprehensive income for the year ended 31 December 2018 of House plc and Martins Inc., together with their draft statements of financial position as at that date, are shown below. Draft Statements of Financial Position as at 31 December 2018 Martins Inc. House ple '000 '000 RUB'000 RUB'000- ASSETS Non-current Assets Property, plant and equipment Investments Current Assetse 30,000 7,500 37,500- 25,000- 25,000 Inventory Trade receivables < 12,500 20,000 17,500 14,000 Dividends receivable 3,000 500 30,000 67,500 Cash at banke 37,500 62,500 EQUITY AND LIABILITIES Capital and Reserves Called up share capital (1/RUB1 shares) < Retained earnings 17,500 20,000 15,000- 12,500 37,500 10,000 27,500 Non-current Liabilities Current Liabilities Trade payables Dividends payable 12,500 7,500 10,000- 6,000 6,500 5,000 22,500 62,500 Bank loan 7,500 20,000- 67,500 Draft Statements of Profit and Loss or Other Comprehensive Income for the Year Ended 31 December 2018- House plc '000 Martins Inc. RUB'000 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Operating profit Dividend receivable Interest payable Profit before taxe 62,500- 80,000 (42,500) 37,500 (12,500)- (10.000)- (32.500)- 30,000- (10,000)- (6.000)- 14,000- 15,000 3,000 (2.000)- 16,000 (1.500)- 12,500 (4.000)- 8,500- Taxatione (5.000)- 11.000 Profit after tax Additional Informatione 1. Exchange rates at the relevant dates are as follows: Date RUB to the e e 1 January 2011e 31 December 2017e 2 1.6 31 December 2018e 1.5e Average rate 2018= 1.52e 2. Amounts shown as non-current liabilities by House ple and Martins Inc. represent the long- term element of the bank loan shown in current liabilities. These loans were raised by each of the companies independently and are repayable by each of the companies in their local currency. 3. The dividends payable included in the draft statements of financial position of House ple and Martins Inc. shown above had not been approved by the shareholders at 31 December 2018. No other dividends were paid or proposed by either company during 2018.4 Requirement Prepare the consolidated statement of profit or loss and other comprehensive income of House ple for the year ended 31 December 2018 and the consolidated statement of financial position as at that date, showing the foreign exchange translation reserve separately within equity. Total 25 Markse *.1.

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started