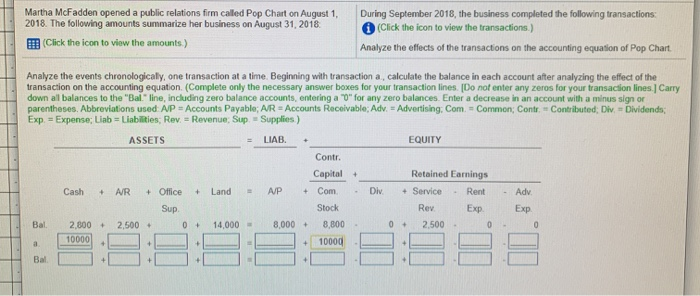

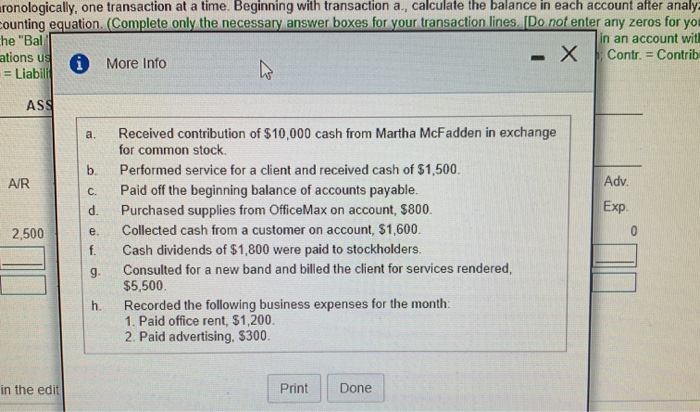

marto) PARA ASSE 2. 14 ch Me Martha McFadden opened a public relations firm called Pop Chart on August 1, 2018. The following amounts summarize her business on August 31, 2018 (Click the icon to view the amounts) During September 2018, the business completed the following transactions: (Click the icon to view the transactions.) Analyze the effects of the transactions on the accounting equation of Pop Chart = Analyze the events chronologically, one transaction at a time. Beginning with transaction a, calculate the balance in each account after analyzing the effect of the transaction on the accounting equation (Complete only the necessary answer boxes for your transaction lines. [Do not enter any zeros for your transaction lines. Carry down all balances to the "Bal" line, including zero balance accounts, entering a "U" for any zero balances. Enter a decrease in an account with a minus sign or parentheses. Abbreviations usedAJP = Accounts Payable, AR = Accounts Receivable: Adv. = Advertising: Com. = Common; Contr. Contributed: Div = Dividends: Exp = Expense; Liab = Liabilities; Rev. = Revenue: Sup - Supplies) ASSETS LIAB EQUITY Contr. Capital Retained Earnings Cash AR + Office Land AP Com Div + Service Rent Adv Sup Stock Rev. Exp. Exp Bal 2,800 2,500 14,000 8,000 + 8,800 0 2.500 10000 10000 + + 0 + 0 0 + + + + Bal + ronologically, one transaction at a time. Beginning with transaction a., calculate the balance in each account after analy= Counting equation (Complete only the necessary answer boxes for your transaction lines. Do not enter any zeros for you the "Bal in an account wit ations us * More Info - X Contr. = Contrib = Liabili ASS a. b. A/R Adv. C. d Exp 2.500 e Received contribution of $10,000 cash from Martha McFadden in exchange for common stock. Performed service for a client and received cash of $1,500. Paid off the beginning balance of accounts payable. Purchased supplies from OfficeMax on account, $800. Collected cash from a customer on account, $1,600. Cash dividends of $1,800 were paid to stockholders. Consulted for a new band and billed the client for services rendered, $5,500 Recorded the following business expenses for the month 1. Paid office rent, $1,200. 2. Paid advertising, $300 9. h. in the edit Print Done