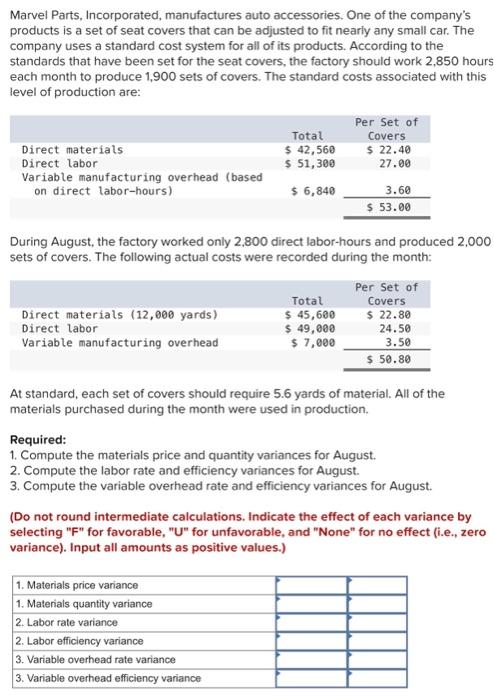

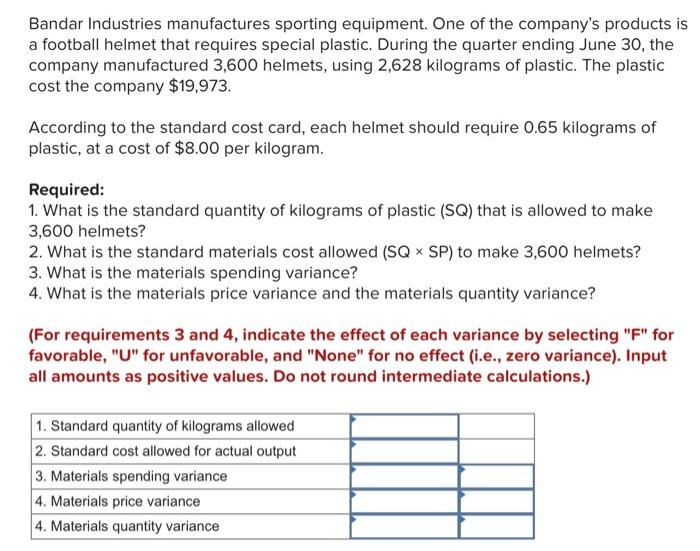

Marvel Parts, Incorporated, manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company uses a standard cost system for all of its products. According to the standards that have been set for the seat covers, the factory should work 2,850 hours each month to produce 1,900 sets of covers. The standard costs associated with this level of production are: During August, the factory worked only 2,800 direct labor-hours and produced 2,000 sets of covers. The following actual costs were recorded during the month: At standard, each set of covers should require 5.6 yards of material. All of the materials purchased during the month were used in production. Required: 1. Compute the materials price and quantity variances for August. 2. Compute the labor rate and efficiency variances for August. 3. Compute the variable overhead rate and efficiency variances for August. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Bandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30 , the company manufactured 3,600 helmets, using 2,628 kilograms of plastic. The plastic cost the company $19,973. According to the standard cost card, each helmet should require 0.65 kilograms of plastic, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,600 helmets? 2. What is the standard materials cost allowed (SQSP) to make 3,600 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? (For requirements 3 and 4 , indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.)