Answered step by step

Verified Expert Solution

Question

1 Approved Answer

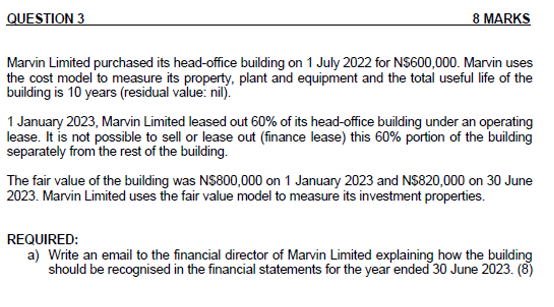

Marvin Limited purchased its head-office building on 1 July 2022 for N$600,000. Marvin uses the cost model to measure its property, plant and equipment and

Marvin Limited purchased its head-office building on 1 July 2022 for N\$600,000. Marvin uses the cost model to measure its property, plant and equipment and the total useful life of the building is 10 years (residual value: nil). 1 January 2023, Marvin Limited leased out 60% of its head-office building under an operating lease. It is not possible to sell or lease out (finance lease) this 60% portion of the building separately from the rest of the building. The fair value of the building was N\$800,000 on 1 January 2023 and N\$820,000 on 30 June 2023. Marvin Limited uses the fair value model to measure its investment properties. REQUIRED: a) Write an email to the financial director of Marvin Limited explaining how the building should be recognised in the financial statements for the year ended 30 June 2023. (8)

Marvin Limited purchased its head-office building on 1 July 2022 for N\$600,000. Marvin uses the cost model to measure its property, plant and equipment and the total useful life of the building is 10 years (residual value: nil). 1 January 2023, Marvin Limited leased out 60% of its head-office building under an operating lease. It is not possible to sell or lease out (finance lease) this 60% portion of the building separately from the rest of the building. The fair value of the building was N\$800,000 on 1 January 2023 and N\$820,000 on 30 June 2023. Marvin Limited uses the fair value model to measure its investment properties. REQUIRED: a) Write an email to the financial director of Marvin Limited explaining how the building should be recognised in the financial statements for the year ended 30 June 2023. (8) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started