Question

Mary Abbott is a long-time employee of Love Enterprises, a manufacturer and distributor of farm implements. Abbott plans to retire on her 65th birthday, five

Mary Abbott is a long-time employee of Love Enterprises, a manufacturer and distributor of farm implements. Abbott plans to retire on her 65th birthday, five years from January 1, 2017. Her salary at January 1, 2017 is $48,000 per year, and her projected salary for her last year of employment is $60,000.

Love Enterprises sponsors a defined benefit pension plan. It provides for an annual pension benefit equal to 60% of the employees annual salary at retirement. Payments commence one year after the anniversary date of his or her retirement. The discount and earnings rate on plan assets is 8%. The average life expectancy for employees is 80. Using (PV of 1, PVAD of 1, and PVOA of 1) (Use the appropriate factor(s) from the tables provided.)

Required:

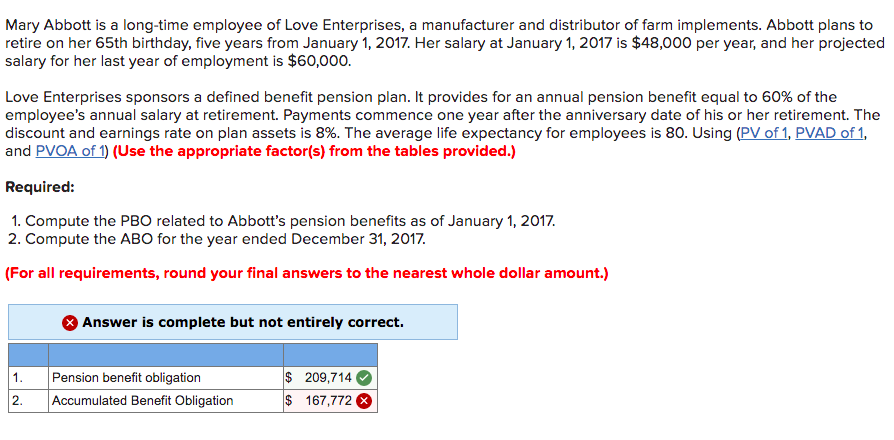

- Compute the PBO related to Abbotts pension benefits as of January 1, 2017.

- Compute the ABO for the year ended December 31, 2017.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started