Answered step by step

Verified Expert Solution

Question

1 Approved Answer

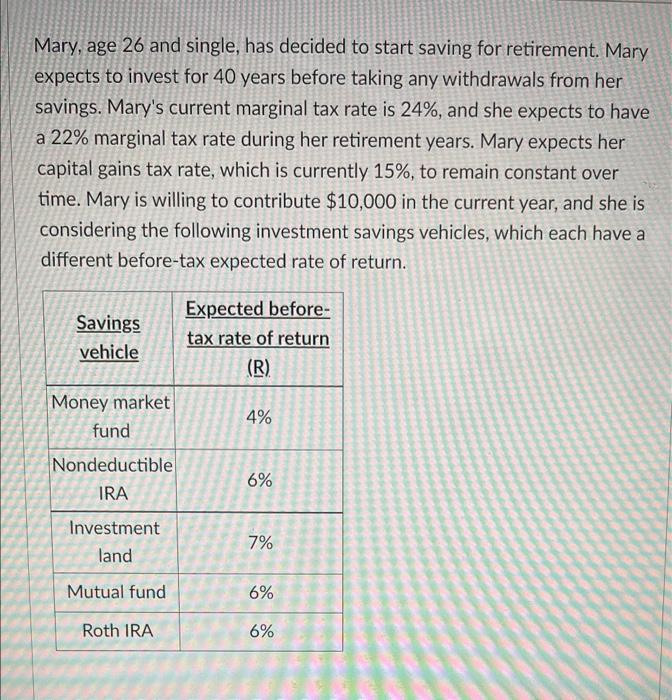

Mary, age 26 and single, has decided to start saving for retirement. Mary expects to invest for 40 years before taking any withdrawals from

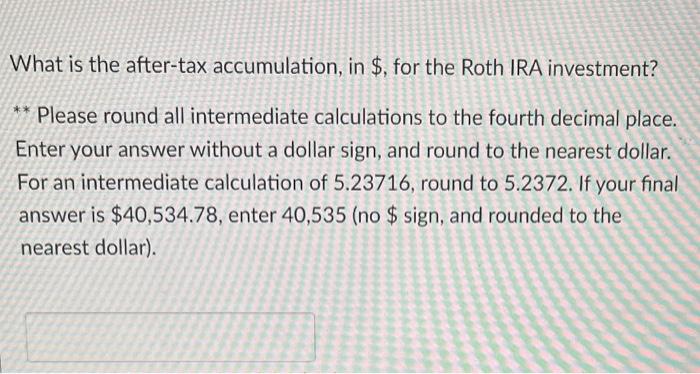

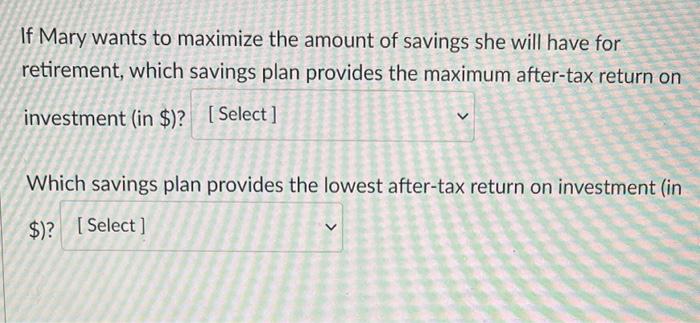

Mary, age 26 and single, has decided to start saving for retirement. Mary expects to invest for 40 years before taking any withdrawals from her savings. Mary's current marginal tax rate is 24%, and she expects to have a 22% marginal tax rate during her retirement years. Mary expects her capital gains tax rate, which is currently 15%, to remain constant over time. Mary is willing to contribute $10,000 in the current year, and she is considering the following investment savings vehicles, which each have a different before-tax expected rate of return. Expected before- Savings vehicle tax rate of return (R) Money market 4% fund Nondeductible 6% IRA Investment 7% land Mutual fund 6% Roth IRA 6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started