Question

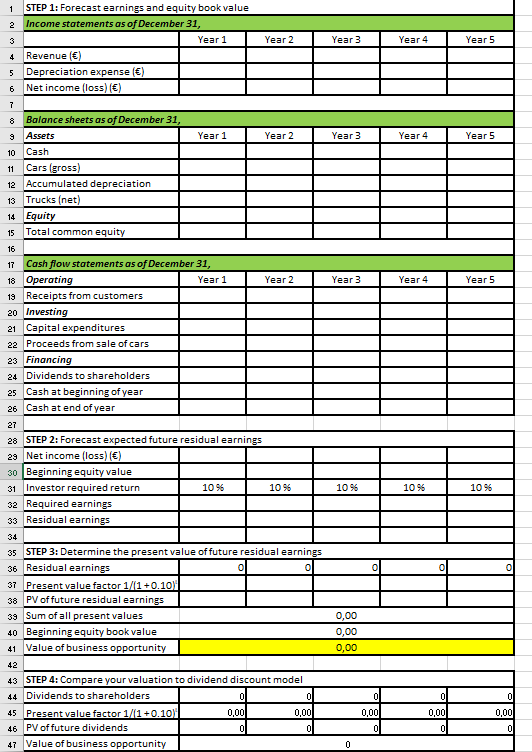

Mary Barth is thinking about starting a car rental business. She plans to buy four cars now and to then add a fifth car at

Mary Barth is thinking about starting a car rental business. She plans to buy four cars now and to then add a fifth car at the end of the second year. Each car will cost 20,000. Mary has carefully evaluated the local market for rental cars and believes that each car will generate 5,000 of net operating cash flow each year. At the end of five years, she believes the cars can be sold for 30,000 in total.

Additional information:

- Barth will put 80,000 cash into the business. This amount represents beginning equity.

- The company will pay out all excess cash as dividends each year. The cash needed to buy the car in Year 2 will come from operating cash flows that year. No new investment will be required.

- Car depreciation is 3,043.48 per car per year, which results in the cars having a book value of 30,000, the expected salvage value, at the end of Year 5.

- The appropriate discount rate is 10%.

Required. Fill the table and answer - How much is Year 1 net income for the company?

- How much is Year 3 net income for the company?

- How much is Year 5 net income for the company?

- How much is Year 2 residual income (undiscounted) for the company?

- How much is Year 4 residual income (undiscounted) for the company?

- How much is the sum of undiscounted residual incomes (from Year 1 to Year 5) for the company?

- How much is the business worth? So compute the net present value of business opportunity at Year 0.

- Compute the value of the firm using both dividend discount model (DDM) and residual income valuation model (RIM). Which of the following statements is correct?

a. DDM yields a higher valuation than RIM.

b. DDM yields the same valuation as RIM.

c. DDM yields a lower valuation than RIM.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started