Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mary Brown graduated from London School of Economics May 2020 and has been a Junior Financial Analyst at Paper Products Ltd. When she arrived

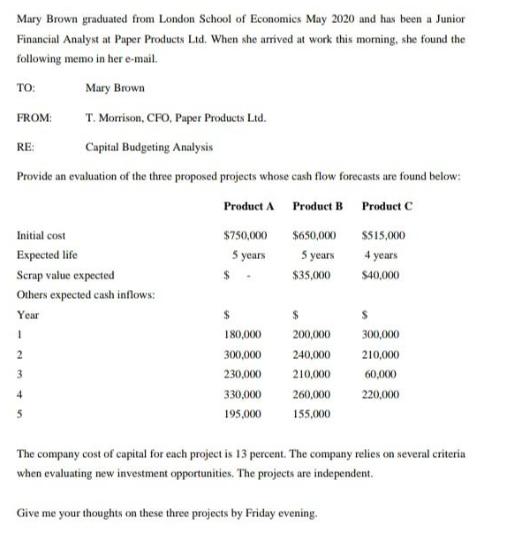

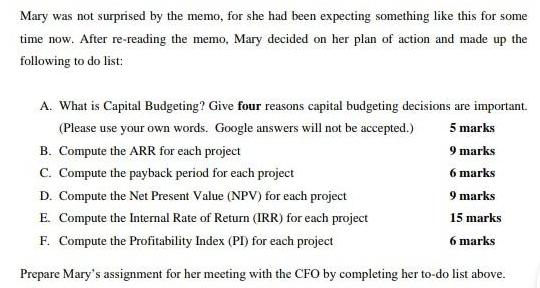

Mary Brown graduated from London School of Economics May 2020 and has been a Junior Financial Analyst at Paper Products Ltd. When she arrived at work this morning, she found the following memo in her e-mail. TO: Mary Brown FROM: T. Morrison, CFO, Paper Products Ltd. Capital Budgeting Analysis Provide an evaluation of the three proposed projects whose cash flow forecasts are found below: Product A Product B Product C $750,000 5 years RE: Initial cost Expected life Scrap value expected Others expected cash inflows: Year 1 3 $ $650,000 5 years $35,000 $ 180,000 300,000 230,000 330,000 260,000 195,000 155,000 $ 200,000 300,000 240,000 210,000 210,000 60,000 220,000 $$15,000 4 years $40,000 The company cost of capital for each project is 13 percent. The company relies on several criteria when evaluating new investment opportunities. The projects are independent. Give me your thoughts on these three projects by Friday evening. Mary was not surprised by the memo, for she had been expecting something like this for some time now. After re-reading the memo, Mary decided on her plan of action and made up the following to do list: A. What is Capital Budgeting? Give four reasons capital budgeting decisions are important. (Please use your own words. Google answers will not be accepted.) 5 marks 9 marks 6 marks 9 marks 15 marks 6 marks B. Compute the ARR for each project C. Compute the payback period for each project D. Compute the Net Present Value (NPV) for each project E. Compute the Internal Rate of Return (IRR) for each project F. Compute the Profitability Index (PI) for each project Prepare Mary's assignment for her meeting with the CFO by completing her to-do list above.

Step by Step Solution

★★★★★

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a capital budgeting is a technique that is used by a company to determine whether they should commit their cash to long term investments in anticipati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started