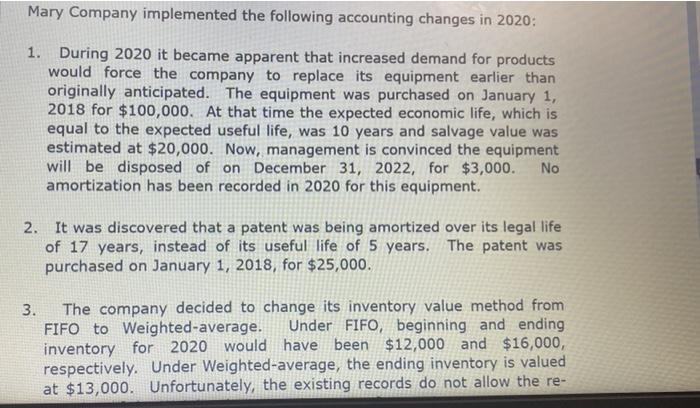

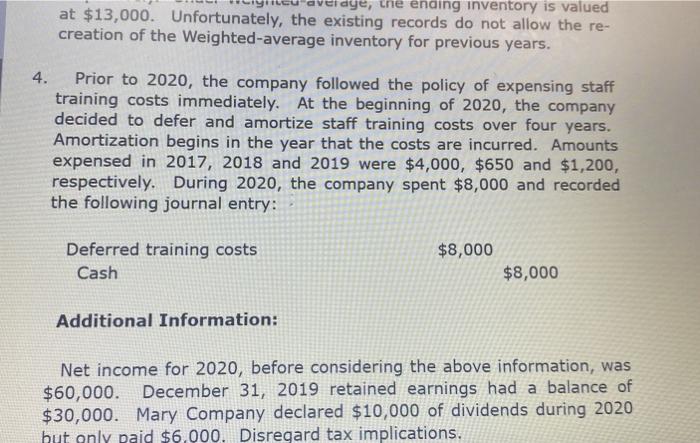

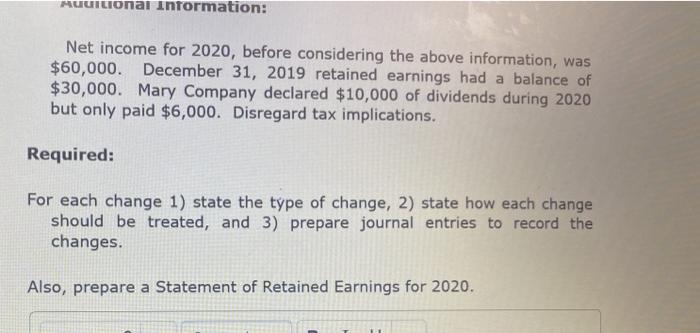

Mary Company implemented the following accounting changes in 2020: 1. During 2020 it became apparent that increased demand for products would force the company to replace its equipment earlier than originally anticipated. The equipment was purchased on January 1, 2018 for $100,000. At that time the expected economic life, which is equal to the expected useful life, was 10 years and salvage value was estimated at $20,000. Now, management is convinced the equipment will be disposed of on December 31, 2022, for $3,000. No amortization has been recorded in 2020 for this equipment. 2. It was discovered that a patent was being amortized over its legal life of 17 years, instead of its useful life of 5 years. The patent was purchased on January 1, 2018, for $25,000. 3. The company decided to change its inventory value method from FIFO to Weighted average. Under FIFO, beginning and ending inventory for 2020 would have been $12,000 and $16,000, respectively. Under Weighted-average, the ending inventory is valued at $13,000. Unfortunately, the existing records do not allow the re- ye, the ending inventory is valued at $13,000. Unfortunately, the existing records do not allow the re- creation of the Weighted average inventory for previous years. 4. Prior to 2020, the company followed the policy of expensing staff training costs immediately. At the beginning of 2020, the company decided to defer and amortize staff training costs over four years. Amortization begins in the year that the costs are incurred. Amounts expensed in 2017, 2018 and 2019 were $4,000, $650 and $1,200, respectively. During 2020, the company spent $8,000 and recorded the following journal entry: Deferred training costs Cash $8,000 $8,000 Additional Information: Net income for 2020, before considering the above information, was $60,000. December 31, 2019 retained earnings had a balance of $30,000. Mary Company declared $10,000 of dividends during 2020 but only paid $6.000. Disregard tax implications. MULLIOnai Information: Net income for 2020, before considering the above information, was $60,000. December 31, 2019 retained earnings had a balance of $30,000. Mary Company declared $10,000 of dividends during 2020 but only paid $6,000. Disregard tax implications. Required: For each change 1) state the type of change, 2) state how each change should be treated, and 3) prepare journal entries to record the changes. Also, prepare a Statement of Retained Earnings for 2020. Mary Company implemented the following accounting changes in 2020: 1. During 2020 it became apparent that increased demand for products would force the company to replace its equipment earlier than originally anticipated. The equipment was purchased on January 1, 2018 for $100,000. At that time the expected economic life, which is equal to the expected useful life, was 10 years and salvage value was estimated at $20,000. Now, management is convinced the equipment will be disposed of on December 31, 2022, for $3,000. No amortization has been recorded in 2020 for this equipment. 2. It was discovered that a patent was being amortized over its legal life of 17 years, instead of its useful life of 5 years. The patent was purchased on January 1, 2018, for $25,000. 3. The company decided to change its inventory value method from FIFO to Weighted average. Under FIFO, beginning and ending inventory for 2020 would have been $12,000 and $16,000, respectively. Under Weighted-average, the ending inventory is valued at $13,000. Unfortunately, the existing records do not allow the re- ye, the ending inventory is valued at $13,000. Unfortunately, the existing records do not allow the re- creation of the Weighted average inventory for previous years. 4. Prior to 2020, the company followed the policy of expensing staff training costs immediately. At the beginning of 2020, the company decided to defer and amortize staff training costs over four years. Amortization begins in the year that the costs are incurred. Amounts expensed in 2017, 2018 and 2019 were $4,000, $650 and $1,200, respectively. During 2020, the company spent $8,000 and recorded the following journal entry: Deferred training costs Cash $8,000 $8,000 Additional Information: Net income for 2020, before considering the above information, was $60,000. December 31, 2019 retained earnings had a balance of $30,000. Mary Company declared $10,000 of dividends during 2020 but only paid $6.000. Disregard tax implications. MULLIOnai Information: Net income for 2020, before considering the above information, was $60,000. December 31, 2019 retained earnings had a balance of $30,000. Mary Company declared $10,000 of dividends during 2020 but only paid $6,000. Disregard tax implications. Required: For each change 1) state the type of change, 2) state how each change should be treated, and 3) prepare journal entries to record the changes. Also, prepare a Statement of Retained Earnings for 2020