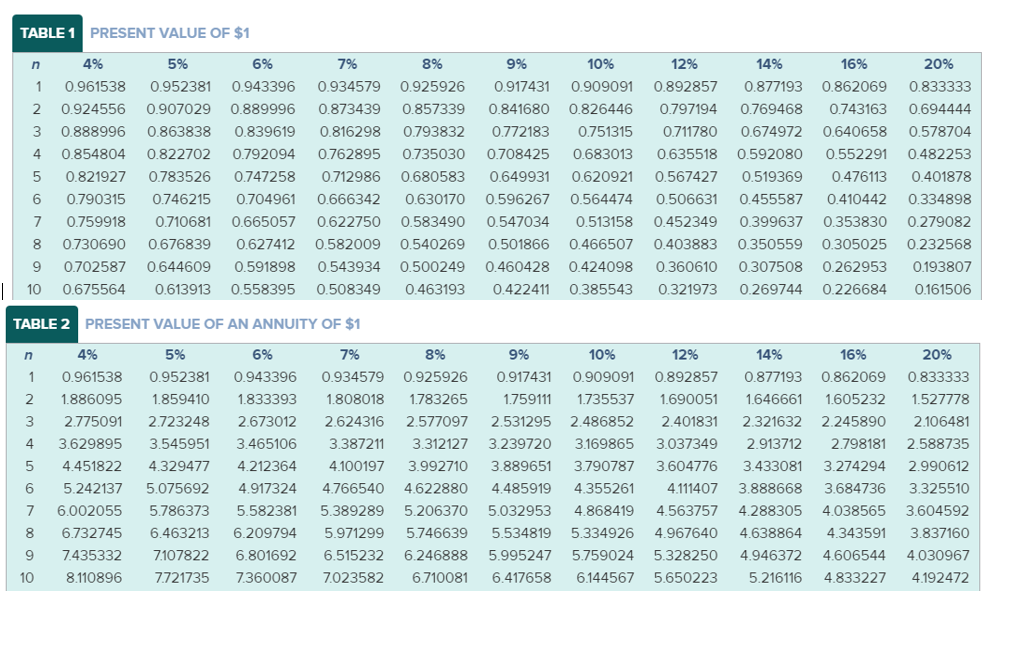

Mary is considering a real estate investment. She projects incoming cash flows of $100,000 per year for 5 years on the investment. Mary hopes to earn a return on her investment of at least 12%. Given this information, what is the maximum amount she should pay for the investment? (Round your answer to the nearest dollar.) Use the attached present value tables as needed to answer this question. Test 2 Tables.docx $360,478 $56,743 $446,429 $560,000 TABLE 1 PRESENT VALUE OF $1 n 7% 0.934579 9% 0.917431 1 2 3 4 4% 0.961538 0.924556 0.888996 0.854804 0.821927 0.790315 0.759918 0.730690 0.702587 0.675564 5 5% 0.952381 0.907029 0.863838 0.822702 0.783526 0.746215 0.710681 0.676839 0.644609 0.613913 6% 0.943396 0.889996 0.839619 0.792094 0.747258 0.704961 0.665057 0.627412 0.591898 0.558395 10% 0.909091 0.826446 0.751315 0.683013 0.620921 0.564474 0.513158 8% 0.925926 0.857339 0.793832 0.735030 0.680583 0.630170 0.583490 0.540269 0.500249 0.463193 0.873439 0.816298 0.762895 0.712986 0.666342 0.622750 0.582009 0.543934 0.508349 0.841680 0.772183 0.708425 0.649931 0.596267 0.547034 0.501866 0.460428 0.422411 12% 0.892857 0.797194 0.711780 0.635518 0.567427 0.506631 0.452349 0.403883 0.360610 0.321973 14% 16% 0.877193 0.862069 0.769468 0.743163 0.674972 0.640658 0.592080 0.552291 0.519369 0.476113 0.455587 0.410442 0.399637 0.353830 0.350559 0.305025 0.307508 0.262953 0.269744 0.226684 6 20% 0.833333 0.694444 0.578704 0.482253 0.401878 0.334898 0.279082 0.232568 0.193807 0.161506 7 8 9 0.466507 0.424098 0.385543 10 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 n 4% 0.961538 1 6% 0.943396 1.833393 2 3 4 5 5% 0.952381 1.859410 2.723248 3.545951 4.329477 5.075692 5.786373 6.463213 7.107822 7.721735 1.886095 2.775091 3.629895 4.451822 5.242137 6.002055 6.732745 7.435332 8.110896 7% 0.934579 1.808018 2.624316 3.387211 4.100197 4.766540 5.389289 5.971299 6.515232 7.023582 2.673012 3.465106 4.212364 4.917324 5.582381 6.209794 6.801692 7.360087 8% 0.925926 1.783265 2.577097 3.312127 3.992710 4.622880 5.206370 5.746639 6.246888 6.710081 9% 0.917431 1.759111 2.531295 3.239720 3.889651 4.485919 5.032953 5.534819 5.995247 6.417658 10% 0.909091 1.735537 2.486852 3.169865 3.790787 4.355261 4.868419 5.334926 5.759024 6.144567 12% 0.892857 1.690051 2.401831 3.037349 3.604776 4.111407 4.563757 4.967640 5.328250 5.650223 14% 0.877193 1.646661 2.321632 2.913712 3.433081 3.888668 4.288305 4.638864 4.946372 16% 0.862069 1.605232 2.245890 2.798181 3.274294 3.684736 4.038565 4.343591 4.606544 4.833227 6 20% 0.833333 1.527778 2.106481 2.588735 2.990612 3.325510 3.604592 3.837160 4.030967 4.192472 7 8 9 10 5.216116