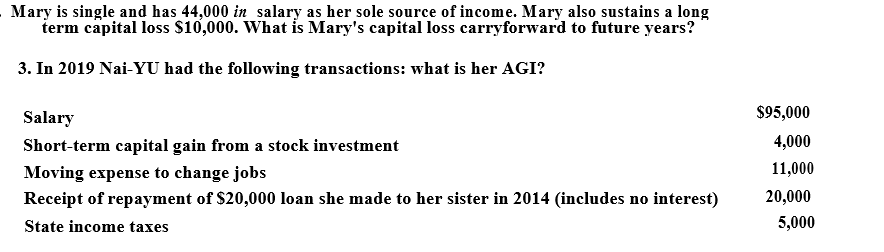

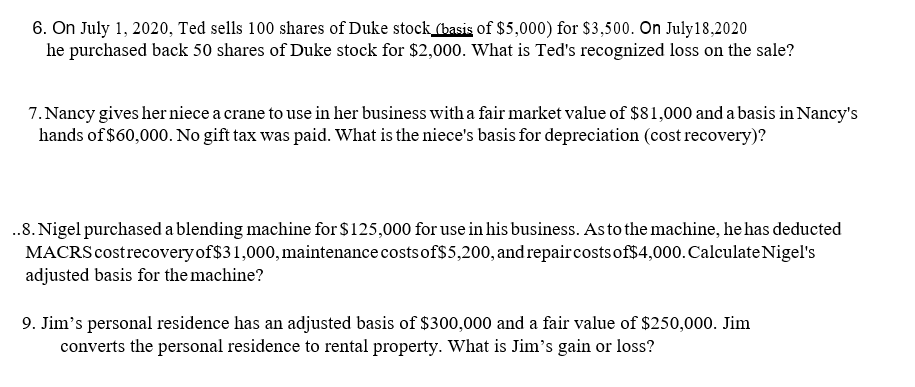

Mary is single and has 44,000 in salary as her sole source of income. Mary also sustains a long term capital loss $10,000. What is Mary's capital loss carryforward to future years? 3. In 2019 Nai-YU had the following transactions: what is her AGI? Salary Short-term capital gain from a stock investment Moving expense to change jobs Receipt of repayment of $20,000 loan she made to her sister in 2014 (includes no interest) State income taxes $95,000 4,000 11,000 20,000 5,000 6. On July 1, 2020, Ted sells 100 shares of Duke stock (basis of $5,000) for $3,500. On July18,2020 he purchased back 50 shares of Duke stock for $2,000. What is Ted's recognized loss on the sale? 7. Nancy gives her niece a crane to use in her business with a fair market value of $81,000 and a basis in Nancy's hands of $60,000. No gift tax was paid. What is the niece's basis for depreciation (cost recovery)? ..8. Nigel purchased a blending machine for $125,000 for use in his business. As to the machine, he has deducted MACRS cost recovery of$31,000, maintenance costs of$5,200, and repaircosts of$4,000. Calculate Nigel's adjusted basis for the machine? 9. Jim's personal residence has an adjusted basis of $300,000 and a fair value of $250,000. Jim converts the personal residence to rental property. What is Jim's gain or loss? Mary is single and has 44,000 in salary as her sole source of income. Mary also sustains a long term capital loss $10,000. What is Mary's capital loss carryforward to future years? 3. In 2019 Nai-YU had the following transactions: what is her AGI? Salary Short-term capital gain from a stock investment Moving expense to change jobs Receipt of repayment of $20,000 loan she made to her sister in 2014 (includes no interest) State income taxes $95,000 4,000 11,000 20,000 5,000 6. On July 1, 2020, Ted sells 100 shares of Duke stock (basis of $5,000) for $3,500. On July18,2020 he purchased back 50 shares of Duke stock for $2,000. What is Ted's recognized loss on the sale? 7. Nancy gives her niece a crane to use in her business with a fair market value of $81,000 and a basis in Nancy's hands of $60,000. No gift tax was paid. What is the niece's basis for depreciation (cost recovery)? ..8. Nigel purchased a blending machine for $125,000 for use in his business. As to the machine, he has deducted MACRS cost recovery of$31,000, maintenance costs of$5,200, and repaircosts of$4,000. Calculate Nigel's adjusted basis for the machine? 9. Jim's personal residence has an adjusted basis of $300,000 and a fair value of $250,000. Jim converts the personal residence to rental property. What is Jim's gain or loss