Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mary is the sole shareholder of Company A, Inc., an S corporation, as well as a 50% shareholder in Company B, Inc., also an S

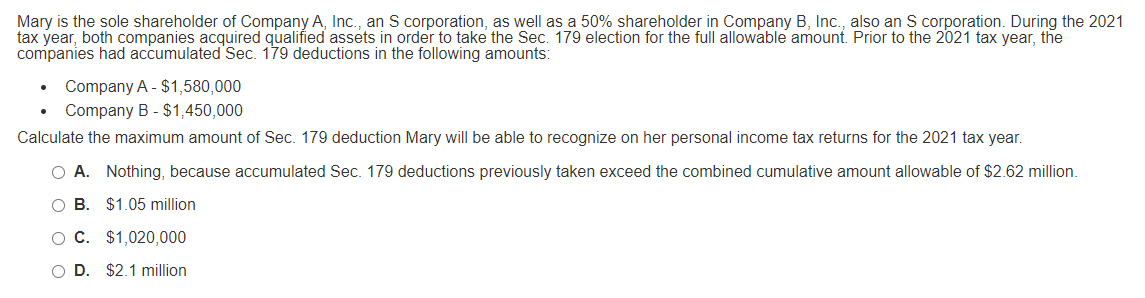

Mary is the sole shareholder of Company A, Inc., an S corporation, as well as a 50% shareholder in Company B, Inc., also an S corporation. During the 202 tax year, both companies acquired qualified assets in order to take the Sec. 179 election for the full allowable amount. Prior to the 2021 tax year, the companies had accumulated Sec. 179 deductions in the following amounts: - Company A - $1,580,000 - Company B - $1,450,000 Calculate the maximum amount of Sec. 179 deduction Mary will be able to recognize on her personal income tax returns for the 2021 tax year. A. Nothing, because accumulated Sec. 179 deductions previously taken exceed the combined cumulative amount allowable of $2.62 million. B. $1.05 million C. $1,020,000 D. \$2.1 million

Mary is the sole shareholder of Company A, Inc., an S corporation, as well as a 50% shareholder in Company B, Inc., also an S corporation. During the 202 tax year, both companies acquired qualified assets in order to take the Sec. 179 election for the full allowable amount. Prior to the 2021 tax year, the companies had accumulated Sec. 179 deductions in the following amounts: - Company A - $1,580,000 - Company B - $1,450,000 Calculate the maximum amount of Sec. 179 deduction Mary will be able to recognize on her personal income tax returns for the 2021 tax year. A. Nothing, because accumulated Sec. 179 deductions previously taken exceed the combined cumulative amount allowable of $2.62 million. B. $1.05 million C. $1,020,000 D. \$2.1 million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started