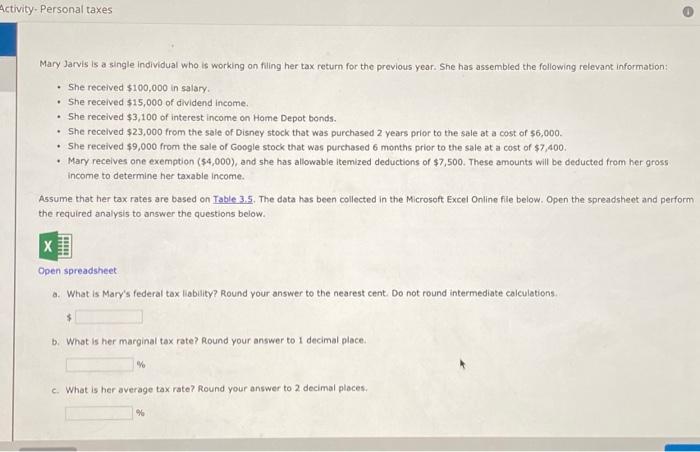

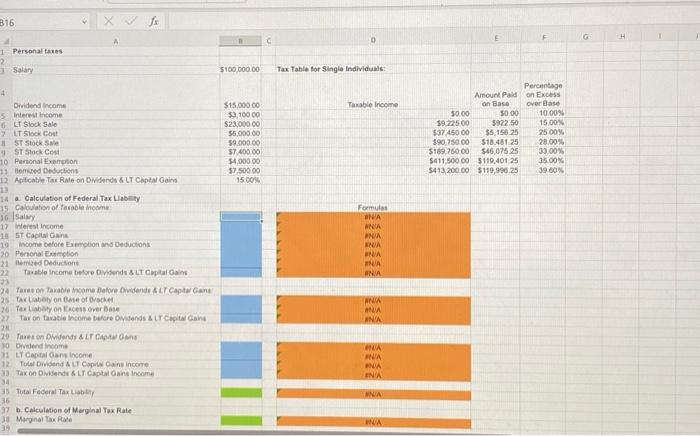

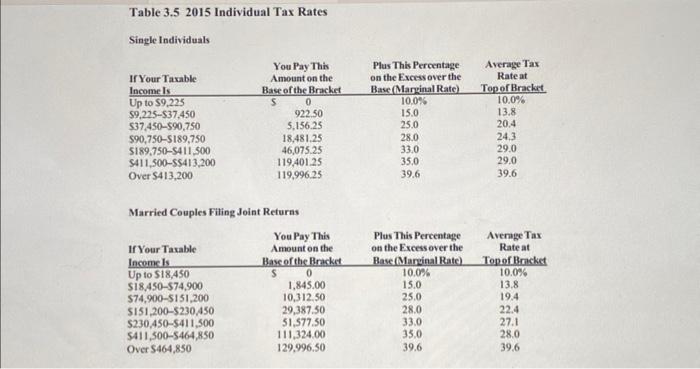

Mary Jarvis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevant information: - She received $100,000 in salary. - She received $15,000 of dividend income. - She recelved $3,100 of interest income on Home Depot bonds. - She recelved $23,000 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $6,000. - She received $9,000 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $7,400. - Mary recelves one exemption ($4,000), and she has allowable itemized deductions of $7,500. These amounts will be deducted from her gross income to determine her taxable income. Assume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a: What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermediate calculations. b. What is her marginal tax rate? Round your answer to 1 decimal place. % c. What is her average tax rate? Round your answer to 2 decimal places. % Personal tanes Satary $100,000.00 Tax Tahile for Single Individuals: Oridend haome interest ksome tis slock sale IT Slock Cout ST stock Sale ST Stock Cont Pernonal Exmmpton lemued Desuations Acticatile Tar Rate on Dividends S LT Caplad Oaim a. Calculation of Federat Tax them Cabulation of Tarable income Salmy Weitst income st coplat dans income betore Exemotion and Oeductions. Penonal Eutmption Aemited Deductions Tar Labeby on Gise of Brach Par tiahaly on Euces ever base Tams on Diviends \& Lr Captev Obhe Ovidend woome if Conitil Gint theome Tax on Dividende s L.T Captai Oains income Thail Federal Tar liahthr. b. Calculation of Merghal Tax Rate Margnal Tax Rate fx 0 E F G. H Percentage Amounk Pald on Excess $15.00000 Tanable income on Base over Bace $3,10000 50.00 1000% $27,00060 55,00000 15.00W $9.00000 2500% $7.40000 25002 $+00000 3200% 57,50000 3500% \begin{tabular}{|c|c|c|} \hline 5000 & 50.00 & 10.00% \\ \hline 225 & sin250 & 15.00N \\ \hline 500 & $5,156.25 & 2500% \\ \hline & $10.451.25 & 2000% \\ \hline & $46,07525 & 3200% \\ \hline & 5119,40125 & 35.00% \\ \hline & 5119.996 .2 & 3960 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline & Fomuls \\ \hlineF & IFVA \\ \hline r & arch \\ \hline r & muK \\ \hline r & rewa \\ \hliner & apeA \\ \hliner & nieis \\ \hline & IRin \\ \hline \end{tabular} FWA Table 3.5 2015 Individual Tax Rates Single Individuals Married Couples Filing Joint Returas