Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mary owns an investment property from which she derives rent. Mary uses a low value pool which, at 30th of June 2020, had a

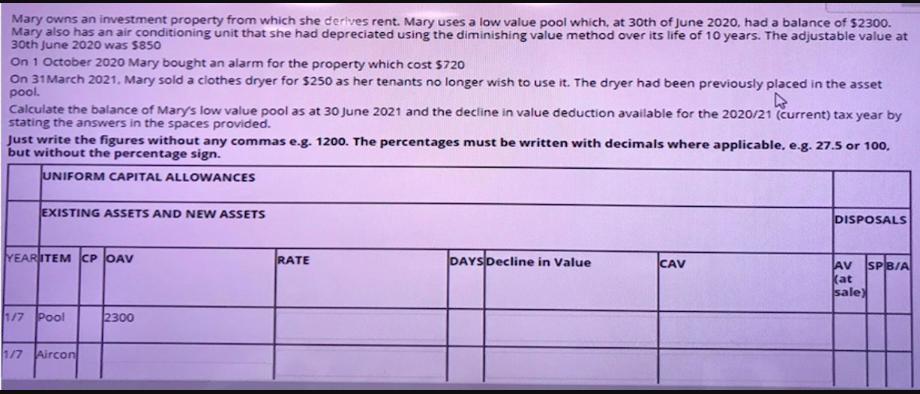

Mary owns an investment property from which she derives rent. Mary uses a low value pool which, at 30th of June 2020, had a balance of $2300. Mary also has an air conditioning unit that she had depreciated using the diminishing value method over its life of 10 years. The adjustable value at 30th June 2020 was $850 On 1 October 2020 Mary bought an alarm for the property which cost $720 On 31 March 2021. Mary sold a clothes dryer for $250 as her tenants no longer wish to use it. The dryer had been previously placed in the asset pool. Calculate the balance of Mary's low value pool as at 30 June 2021 and the decline in value deduction available for the 2020/21 (current) tax year by stating the answers in the spaces provided. Just write the figures without any commas e.g. 1200. The percentages must be written with decimals where applicable, e.g. 27.5 or 100, but without the percentage sign. UNIFORM CAPITAL ALLOWANCES EXISTING ASSETS AND NEW ASSETS YEARITEM CP OAV 1/7 Pool 1/7 Aircon 2300 RATE DAYS Decline in Value CAV DISPOSALS AV SPB/A (at sale)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The balance of Marys low value pool as at 30 Ju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started