Answered step by step

Verified Expert Solution

Question

1 Approved Answer

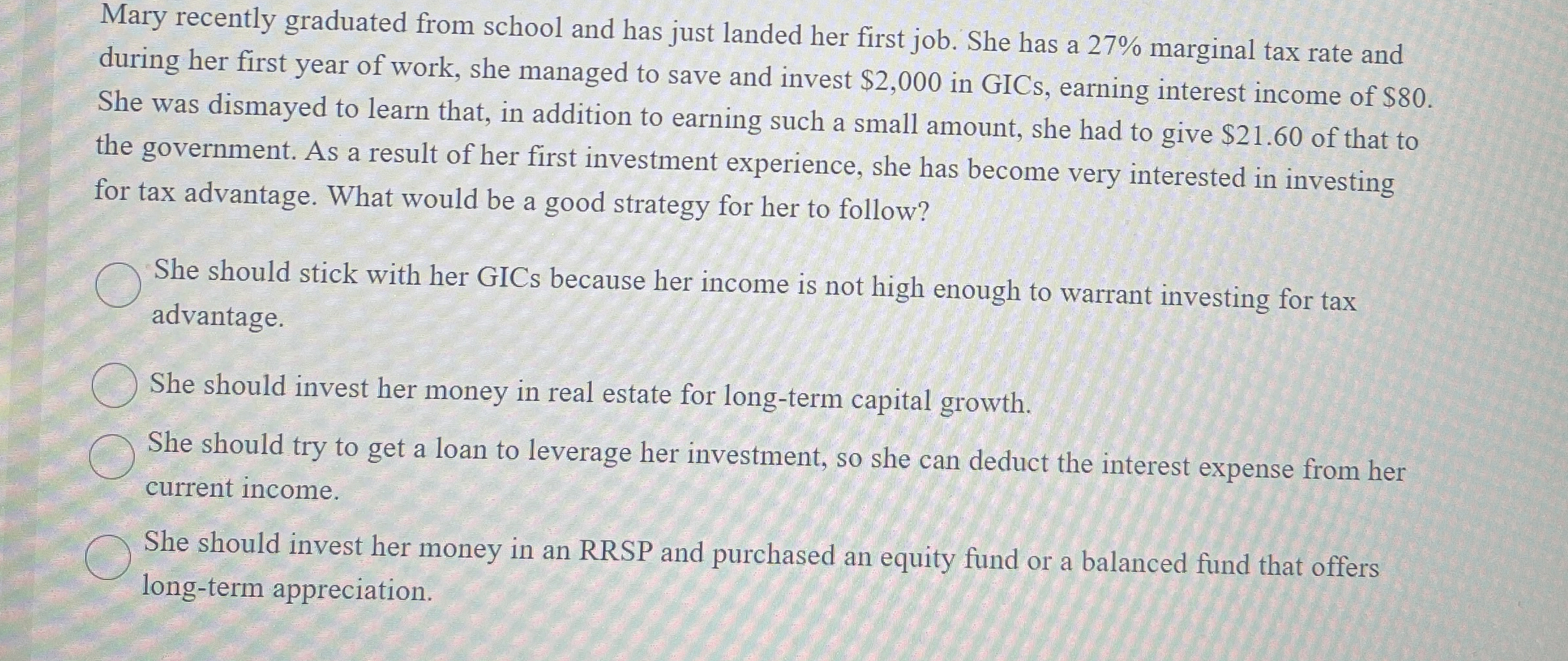

Mary recently graduated from school and has just landed her first job. She has a 2 7 % marginal tax rate and during her first

Mary recently graduated from school and has just landed her first job. She has a marginal tax rate and during her first year of work, she managed to save and invest $ in GICs, earning interest income of $ She was dismayed to learn that, in addition to earning such a small amount, she had to give $ of that to the government. As a result of her first investment experience, she has become very interested in investing for tax advantage. What would be a good strategy for her to follow?

She should stick with her GICs because her income is not high enough to warrant investing for tax advantage.

She should invest her money in real estate for longterm capital growth.

She should try to get a loan to leverage her investment, so she can deduct the interest expense from her current income.

She should invest her money in an RRSP and purchased an equity fund or a balanced fund that offers longterm appreciation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started