Question

Mary Walker, president of Rusco Company, considers $45,000 to be the minimum cash balance for operating purposes. As can be seen from the following statements,

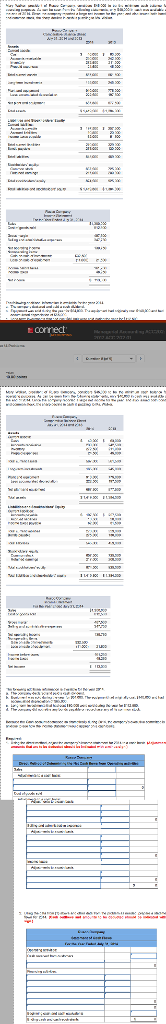

Mary Walker, president of Rusco Company, considers $45,000 to be the minimum cash balance for operating purposes. As can be seen from the following statements, only $40,000 in cash was available at the end of 2014. Since the company reported a large net income for the year, and also issued both bonds and common stock, the sharp decline in cash is puzzling to Ms. Walker.

| Rusco Company Comparative Balance Sheet July 31, 2014 and 2013 | ||||

| 2014 | 2013 | |||

| Assets | ||||

| Current assets: | ||||

| Cash | $ | 40,000 | $ | 63,000 |

| Accounts receivable | 230,000 | 242,500 | ||

| Inventory | 272,500 | 211,000 | ||

| Prepaid expenses | 24,500 | 45,000 | ||

| Total current assets | 567,000 | 561,500 | ||

| Long-term investments | 165,000 | 245,000 | ||

| Plant and equipment | 910,000 | 775,000 | ||

| Less accumulated depreciation | 222,500 | 197,500 | ||

| Net plant and equipment | 687,500 | 577,500 | ||

| Total assets | $ | 1,419,500 | $ | 1,384,000 |

| Liabilities and Stockholders' Equity | ||||

| Current liabilities: | ||||

| Accounts payable | $ | 197,500 | $ | 257,500 |

| Accrued liabilities | 10,500 | 20,000 | ||

| Income taxes payable | 62,000 | 51,500 | ||

| Total current liabilities | 270,000 | 329,000 | ||

| Bonds payable | 275,000 | 130,000 | ||

| Total liabilities | 545,000 | 459,000 | ||

| Stockholders equity: | ||||

| Common stock | 657,500 | 725,000 | ||

| Retained earnings | 217,000 | 200,000 | ||

| Total stockholders' equity | 874,500 | 925,000 | ||

| Total liabilities and stockholders' equity | $ | 1,419,500 | $ | 1,384,000 |

| Rusco Company Income Statement For the Year Ended July 31, 2014 | |||

| Sales | $ | 1,300,000 | |

| Cost of goods sold | 812,500 | ||

| Gross margin | 487,500 | ||

| Selling and administrative expenses | 347,750 | ||

| Net operating income | 139,750 | ||

| Nonoperating items: | |||

| Gain on sale of investments | $32,500 | ||

| Loss on sale of equipment | (11,000) | 21,500 | |

| Income before taxes | 161,250 | ||

| Income taxes | 48,250 | ||

| Net income | $ | 113,000 | |

| The following additional information is available for the year 2014. |

| a. | The company declared and paid a cash dividend. |

| b. | Equipment was sold during the year for $64,000. The equipment had originally cost $140,000 and had accumulated depreciation of $65,000. |

| c. | Long-term investments that had cost $80,000 were sold during the year for $112,500. |

| d. | The company did not retire any bonds payable or repurchase any of its common stock. |

| Because the Cash account decreased so dramatically during 2014, the companys executive committee is anxious to see how the income statement would appear on a cash basis. |

| Required: |

| 1. | Using the direct method, adjust the companys income statement for 2014 to a cash basis. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) |

| 2. Using the data from (1) above and other data from the problem as needed, prepare a statement of cash flows for 2014. (Cash outflows and amounts to be deducted should be indicated with a minus sign.) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started