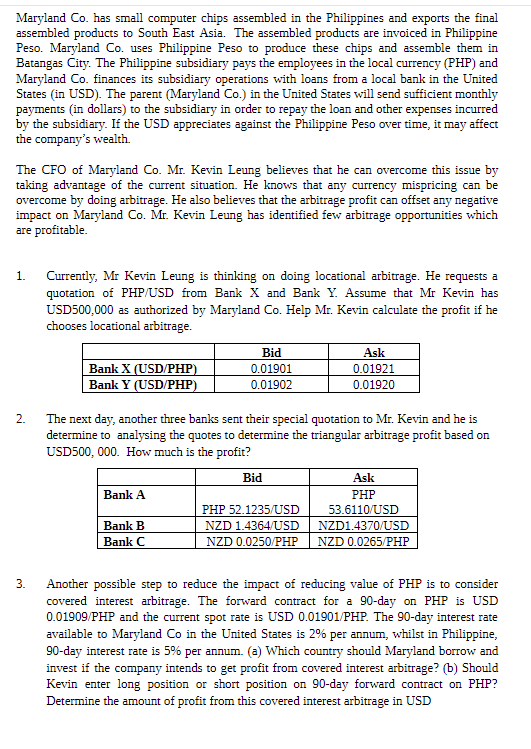

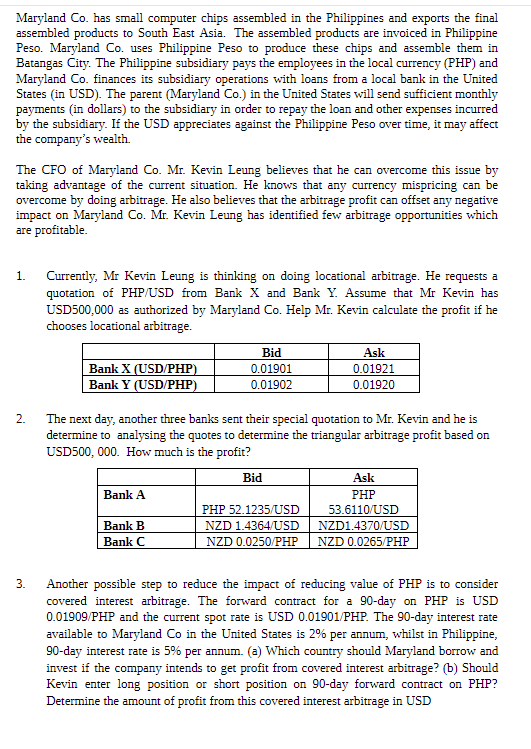

Maryland Co. has small computer chips assembled in the Philippines and exports the final assembled products to South East Asia. The assembled products are invoiced in Philippine Peso. Maryland Co. uses Philippine Peso to produce these chips and assemble them in Batangas City. The Philippine subsidiary pays the employees in the local currency (PHP) and Maryland Co. finances its subsidiary operations with loans from a local bank in the United States (in USD). The parent (Maryland Co.) in the United States will send sufficient monthly payments (in dollars) to the subsidiary in order to repay the loan and other expenses incurred by the subsidiary. If the USD appreciates against the Philippine Peso over time, it may affect the company's wealth. The CFO of Maryland Co. Mr. Kevin Leung believes that he can overcome this issue by taking advantage of the current situation. He knows that any currency mispricing can be overcome by doing arbitrage. He also believes that the arbitrage profit can offset any negative impact on Maryland Co. Mr. Kevin Leung has identified few arbitrage opportunities which are profitable. 1. Currently, Mr Kevin Leung is thinking on doing locational arbitrage. He requests a quotation of PHP/USD from Bank X and Bank Y. Assume that Mr Kevin has USD500,000 as authorized by Maryland Co. Help Mr. Kevin calculate the profit if he chooses locational arbitrage. Bid Ask 0.01901 0.01921 Bank X (USD/PHP) Bank Y (USD/PHP) 0.01902 0.01920 2. The next day, another three banks sent their special quotation to Mr. Kevin and he is determine to analysing the quotes to determine the triangular arbitrage profit based on USD500, 000. How much is the profit? Bid Ask Bank A PHP 52.1235/USD NZD 1.4364/USD PHP 53.6110/USD NZD1.4370/USD NZD 0.0265/PHP Bank B Bank C NZD 0.0250/PHP 3. Another possible step to reduce the impact of reducing value of PHP is to consider covered interest arbitrage. The forward contract for a 90-day on PHP is USD 0.01909/PHP and the current spot rate is USD 0.01901/PHP. The 90-day interest rate available to Maryland Co in the United States is 2% per annum, whilst in Philippine, 90-day interest rate is 5% per annum. (a) Which country should Maryland borrow and invest if the company intends to get profit from covered interest arbitrage? (b) Should Kevin enter long position or short position on 90-day forward contract on PHP? Determine the amount of profit from this covered interest arbitrage in USD Maryland Co. has small computer chips assembled in the Philippines and exports the final assembled products to South East Asia. The assembled products are invoiced in Philippine Peso. Maryland Co. uses Philippine Peso to produce these chips and assemble them in Batangas City. The Philippine subsidiary pays the employees in the local currency (PHP) and Maryland Co. finances its subsidiary operations with loans from a local bank in the United States (in USD). The parent (Maryland Co.) in the United States will send sufficient monthly payments (in dollars) to the subsidiary in order to repay the loan and other expenses incurred by the subsidiary. If the USD appreciates against the Philippine Peso over time, it may affect the company's wealth. The CFO of Maryland Co. Mr. Kevin Leung believes that he can overcome this issue by taking advantage of the current situation. He knows that any currency mispricing can be overcome by doing arbitrage. He also believes that the arbitrage profit can offset any negative impact on Maryland Co. Mr. Kevin Leung has identified few arbitrage opportunities which are profitable. 1. Currently, Mr Kevin Leung is thinking on doing locational arbitrage. He requests a quotation of PHP/USD from Bank X and Bank Y. Assume that Mr Kevin has USD500,000 as authorized by Maryland Co. Help Mr. Kevin calculate the profit if he chooses locational arbitrage. Bid Ask 0.01901 0.01921 Bank X (USD/PHP) Bank Y (USD/PHP) 0.01902 0.01920 2. The next day, another three banks sent their special quotation to Mr. Kevin and he is determine to analysing the quotes to determine the triangular arbitrage profit based on USD500, 000. How much is the profit? Bid Ask Bank A PHP 52.1235/USD NZD 1.4364/USD PHP 53.6110/USD NZD1.4370/USD NZD 0.0265/PHP Bank B Bank C NZD 0.0250/PHP 3. Another possible step to reduce the impact of reducing value of PHP is to consider covered interest arbitrage. The forward contract for a 90-day on PHP is USD 0.01909/PHP and the current spot rate is USD 0.01901/PHP. The 90-day interest rate available to Maryland Co in the United States is 2% per annum, whilst in Philippine, 90-day interest rate is 5% per annum. (a) Which country should Maryland borrow and invest if the company intends to get profit from covered interest arbitrage? (b) Should Kevin enter long position or short position on 90-day forward contract on PHP? Determine the amount of profit from this covered interest arbitrage in USD