Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maryland income tax question Would you mind to give me the answer for these questions? Thank you Question 5 of 20. Paul is a 60-year

Maryland income tax question Would you mind to give me the answer for these questions? Thank you

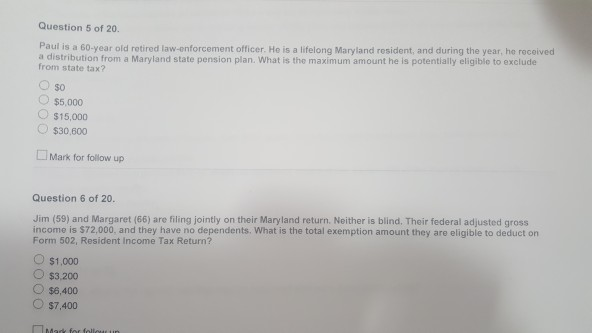

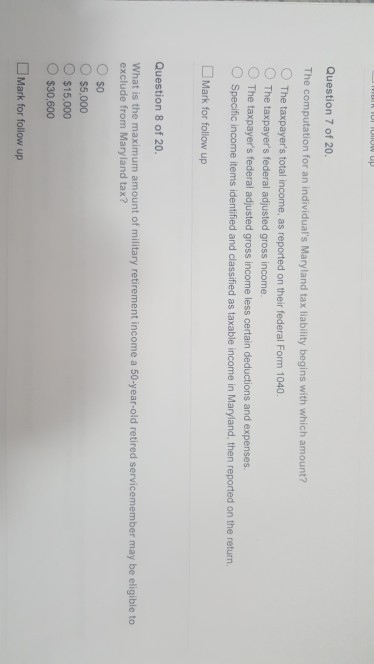

Question 5 of 20. Paul is a 60-year old retired law-enforcement officer. He is a lifelong Maryland resident, and during the year, he received a distribution from a Maryland state pension plan. What is the maximum amount he is potentially eligible to exclude from state tax? SO $5.000 $15,000 $30,600 Mark for follow up Question 6 of 20. Jim (59) and Margaret (66) are filing jointly on their Maryland return. Neither is blind. Their federal adjusted gross income is $72,000, and they have no dependents. What is the total exemption amount they are eligible to deduct on Form 502, Resident Income Tax Return? $1.000 $3.200 $6,400 $7.400 mark for follo TORUL UNUWUP Question 7 of 20. The computation for an individual's Maryland tax liability begins with which amount? The taxpayer's total income, as reported on their federal Form 1040 The taxpayer's federal adjusted gross income The taxpayer's federal adjusted gross income less certain deductions and expenses. Specific income items identified and classified as taxable income in Maryland, then reported on the return Mark for follow up Question 8 of 20. What is the maximum amount of military retirement income a 50-year-old retired servicemember may be eligible to exclude from Maryland tax? SO $5.000 $15.000 $30,600 Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started