Answered step by step

Verified Expert Solution

Question

1 Approved Answer

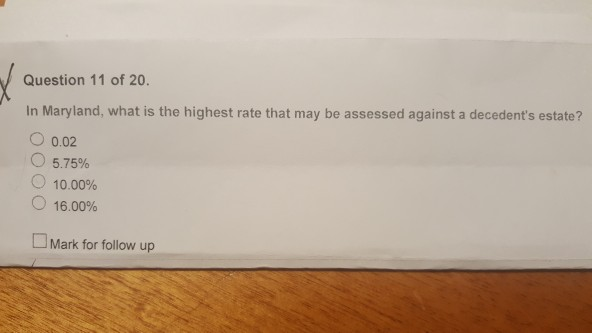

Maryland income tax question X Question 11 of 20. In Maryland, what is the highest rate that may be assessed against a decedent's estate? 0.02

Maryland income tax question

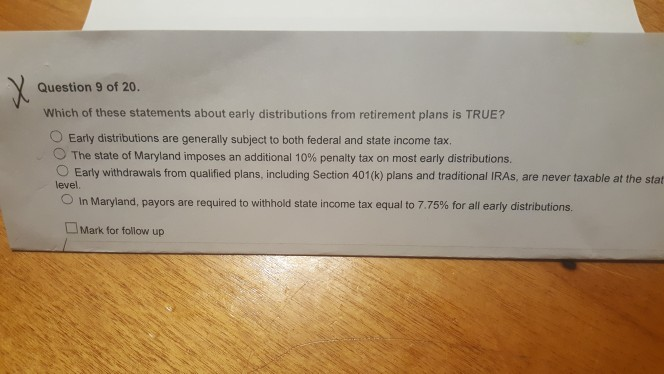

X Question 11 of 20. In Maryland, what is the highest rate that may be assessed against a decedent's estate? 0.02 5.75% 10.00% O 16.00% Mark for follow up X Question 9 of 20. Which of these statements about early distributions from retirement plans is TRUE? Early distributions are generally subject to both federal and state income tax The state of Maryland imposes an additional 10% penalty tax on most early distributions. Early withdrawals from qualified plans, including Section 401(k) plans and traditional IRAs, are never taxable at the star O in Maryland, payors are required to withhold state income tax equal to 7.75% for all early distributions. level Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started