Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maryland income tax question X Question 13 of 20. Maryland uses a gross income test as one of the criteria to determine whether a resident

Maryland income tax question

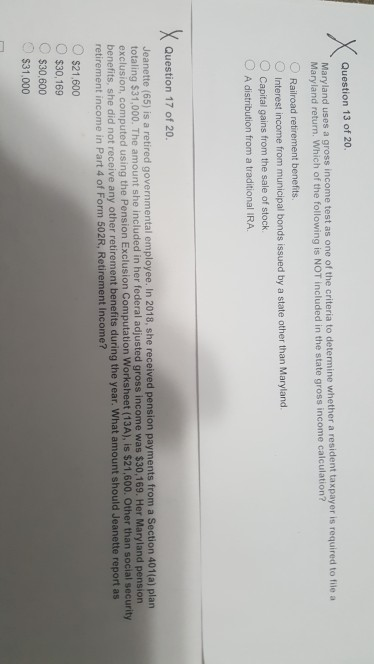

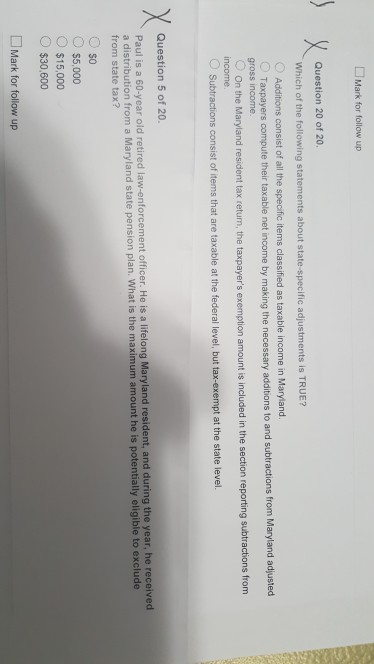

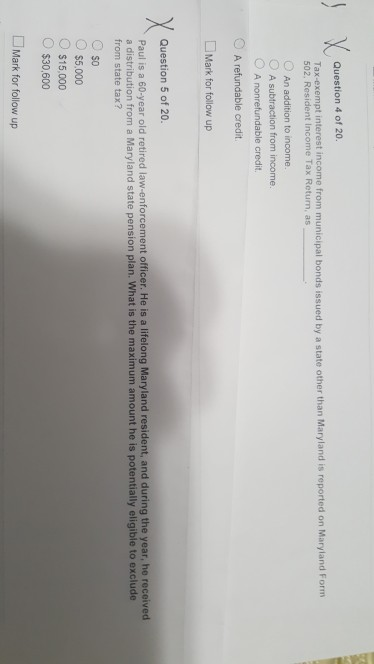

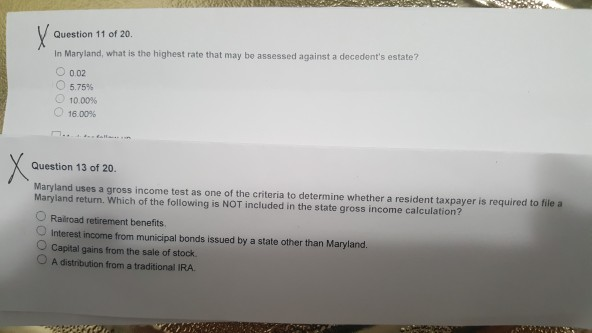

X Question 13 of 20. Maryland uses a gross income test as one of the criteria to determine whether a resident taxpayer is required to file a Maryland return. Which of the following is NOT included in the state gross income calculation? Railroad retirement benefits Interest income from municipal bonds issued by a state other than Maryland. Capital gains from the sale of stock A distribution from a traditional IRA. x Question 17 of 20. Jeanette (65) is a retired governmental employee. In 2018, she received pension payments from a Section 401(a) plan totaling $31,000. The amount she included in her federal adjusted gross income was $30,169. Her Maryland pension exclusion, computed using the Pension Exclusion Computation Worksheet (13A), is $21,600. Other than social security benefits, she did not receive any other retirement benefits during the year. What amount should Jeanette report as retirement income in Part 4 of Form 502R, Retirement Income? $21.600 $30, 169 $30,600 $31.000 Mark for follow up 1 x Question 20 of 20. Which of the following statements about state-specific adjustments is TRUE? Additions consist of all the specific items classified as taxable income in Maryland Taxpayers compute their taxable net income by making the necessary additions to and subtractions from Maryland adjusted gross income On the Maryland resident tax retum, the taxpayer's exemption amount is included in the section reporting subtractions from income Subtractions consist of items that are taxable at the federal level, but tax-exempt at the state level. X Question 5 of 20. Paul is a 60-year old retired law-enforcement officer. He is a lifelong Maryland resident, and during the year, he received a distribution from a Maryland state pension plan. What is the maximum amount he is potentially eligible to exclude from state tax? $0 $5,000 $15,000 $30,600 Mark for follow up X Question 4 of 20. Tax-exempt interest income from municipal bonds issued by a state other than Maryland is reported on Maryland Form 502, Resident Income Tax Retum, as An addition to income. A subtraction from income A nonrefundable credit A refundable credit Mark for follow up Question 5 of 20. Paul is a 60-year old retired law enforcement officer. He is a lifelong Maryland resident, and during the year, he received a distribution from a Maryland state pension plan. What is the maximum amount he is potentially eligible to exclude from state tax? OOO SO $5,000 $15.000 $30,600 Mark for follow up X Question 11 of 20. In Maryland, what is the highest rate that may be assessed against a decedent's estate? O 0.02 5.759 10.00% 16.00% Question 13 of 20. Maryland uses a gross income test as one of the criteria to determine whether a resident taxpayer is required to file a Maryland return. Which of the following is NOT included in the state gross income calculation? Railroad retirement benefits Interest income from municipal bonds issued by a state other than Maryland. Capital gains from the sale of stock A distribution from a traditional IRA 0000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started