Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maryland income tax. Would you mind to answer these questions? Thank you Question 1 of 20. Marlon (53) is a Maryland resident who received military

Maryland income tax. Would you mind to answer these questions? Thank you

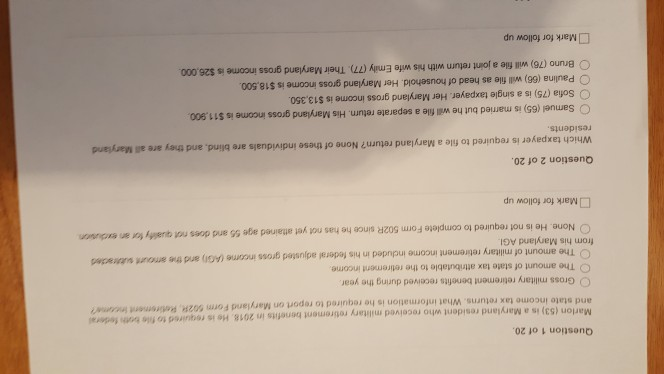

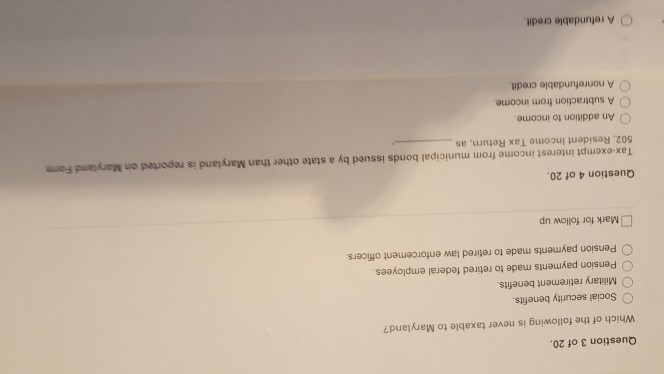

Question 1 of 20. Marlon (53) is a Maryland resident who received military retirement benefits in 2018. He is required to file both federal and state income tax returns. What information is he required to report on Maryland Form 502R Retirement income? Gross military retirement benefits received during the year The amount of state tax attributable to the retirement income The amount of military retirement income included in his federal adjusted gross income (AGI) and the amount strated from his Maryland AGI None. He is not required to complete Form 502R since he has not yet attained age 55 and does not quality for an exclusion Mark for follow up Question 2 of 20. Which taxpayer is required to file a Maryland return? None of these individuals are blind, and they are all Maryland residents Samuel (65) is married but he will file a separate return. His Maryland gross income is $11.900 Sofia (75) is a single taxpayer. Her Maryland gross income is $13,350 Paulina (66) will file as head of household. Her Maryland gross income is $18,500 Bruno (76) will file a joint return with his wife Emily (77). Their Maryland gross income is $26.000 Mark for follow up Question 3 of 20. Which of the following is never taxable to Maryland? Social security benefits. Military retirement benefits. Pension payments made to retired federal employees Pension payments made to retired law enforcement officers. Mark for follow up Question 4 of 20. Tax-exempt interest income from municipal bonds issued by a state other than Maryland is reported on Maryland Form 502, Resident Income Tax Return, as An addition to income A subtraction from income A nonrefundable credit O A refundable credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started