Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maryland income tax Would you mind to give me the answer for these questions? Thank you Question 18 of 20. A Maryland resident who is

Maryland income tax Would you mind to give me the answer for these questions? Thank you

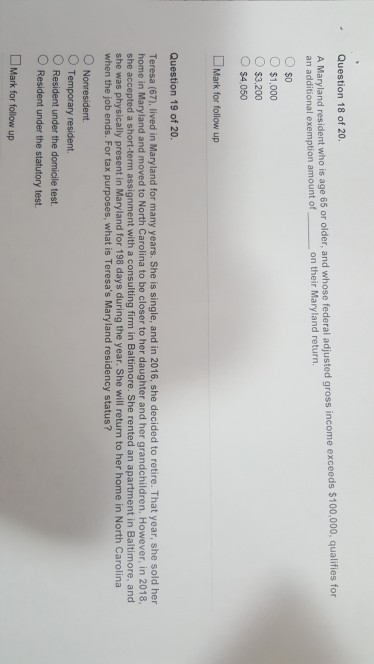

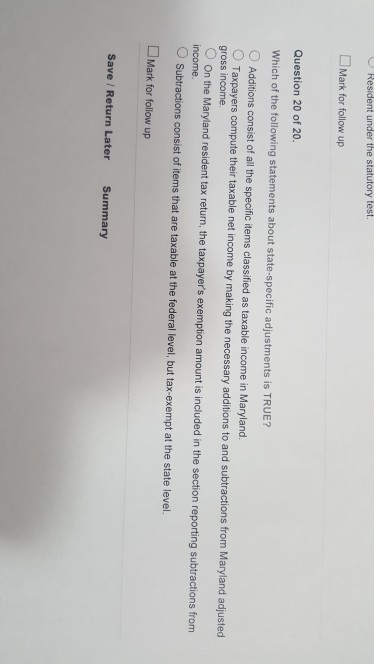

Question 18 of 20. A Maryland resident who is age 65 or older, and whose federal adjusted gross income exceeds $100,000, qualifies for an additional exemption amount of on their Maryland return. $0 O $1,000 O $3,200 $4,050 Mark for follow up Question 19 of 20. Teresa (67), lived in Maryland for many years. She is single, and in 2016, she decided to retire. That year, she sold her home in Maryland and moved to North Carolina to be closer to her daughter and her grandchildren. However, in 2018, she accepted a short-term assignment with a consulting firm in Baltimore. She rented an apartment in Baltimore, and she was physically present in Maryland for 198 days during the year. She will return to her home in North Carolina when the job ends. For tax purposes, what is Teresa's Maryland residency status? Nonresident Temporary resident O Resident under the domicile test. O Resident under the statutory test. Mark for follow up Resident under the statutory test Mark for follow up Question 20 of 20 Which of the following statements about state-specific adjustments is TRUE? Additions consist of all the specific items classified as taxable income in Maryland. Taxpayers compute their taxable net income by making the necessary additions to and subtractions from Maryland adjusted gross income On the Maryland resident tax return, the taxpayer's exemption amount is included in the section reporting subtractions from income Subtractions consist of items that are taxable at the federal level, but tax-exempt at the state level. Mark for follow up Save / Return Later Summary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started