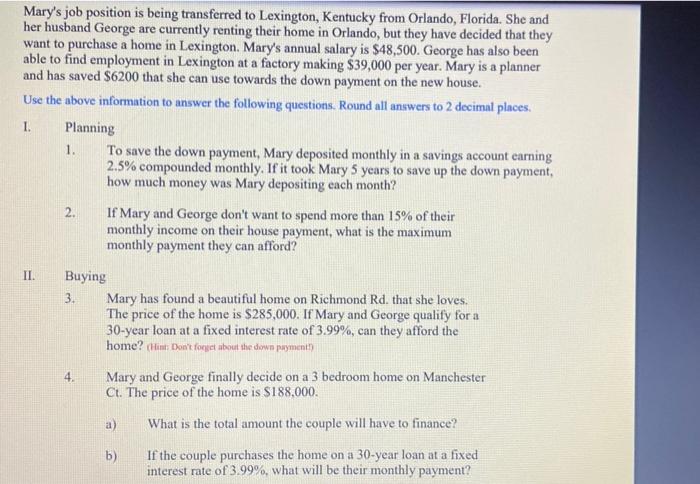

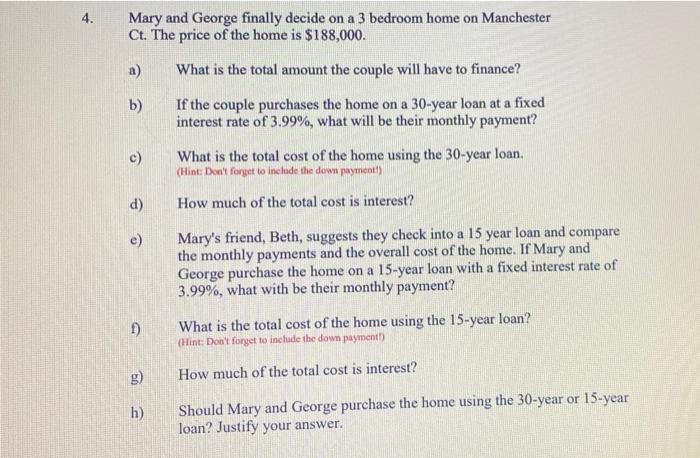

Mary's job position is being transferred to Lexington, Kentucky from Orlando, Florida. She and her husband George are currently renting their home in Orlando, but they have decided that they want to purchase a home in Lexington. Mary's annual salary is $48,500. George has also been able to find employment in Lexington at a factory making $39,000 per year. Mary is a planner and has saved $6200 that she can use towards the down payment on the new house. Use the above information to answer the following questions. Round all answers to 2 decimal places. Planning 1. To save the down payment, Mary deposited monthly in a savings account earning 2.5% compounded monthly. If it took Mary 5 years to save up the down payment, how much money was Mary depositing each month? 1. 2. If Mary and George don't want to spend more than 15% of their monthly income on their house payment, what is the maximum monthly payment they can afford? IL Buying 3. Mary has found a beautiful home on Richmond Rd, that she loves. The price of the home is $285,000. If Mary and George qualify for a 30-year loan at a fixed interest rate of 3.99%, can they afford the home? Don't forget about the down payment 4. Mary and George finally decide on a 3 bedroom home on Manchester Ct. The price of the home is $188,000. a) What is the total amount the couple will have to finance? b) If the couple purchases the home on a 30-year loan at a fixed interest rate of 3.99%, what will be their monthly payment? 4. Mary and George finally decide on a 3 bedroom home on Manchester Ct. The price of the home is $188,000. a) What is the total amount the couple will have to finance? b) If the couple purchases the home on a 30-year loan at a fixed interest rate of 3.99%, what will be their monthly payment? c) What is the total cost of the home using the 30-year loan. (Hint: Don't forget to include the down payment) d) How much of the total cost is interest? e) Mary's friend, Beth, suggests they check into a 15 year loan and compare the monthly payments and the overall cost of the home. If Mary and George purchase the home on a 15-year loan with a fixed interest rate of 3.99%, what with be their monthly payment? f) What is the total cost of the home using the 15-year loan? (Hint: Don't forget to include the down payment g) How much of the total cost is interest? h) Should Mary and George purchase the home using the 30-year or 15-year loan? Justify your