Question

Marysa Corp. issued a 10-year, 5 percent semiannual bond 4 years ago. The bond currently sells for 94 percent of its face value. The

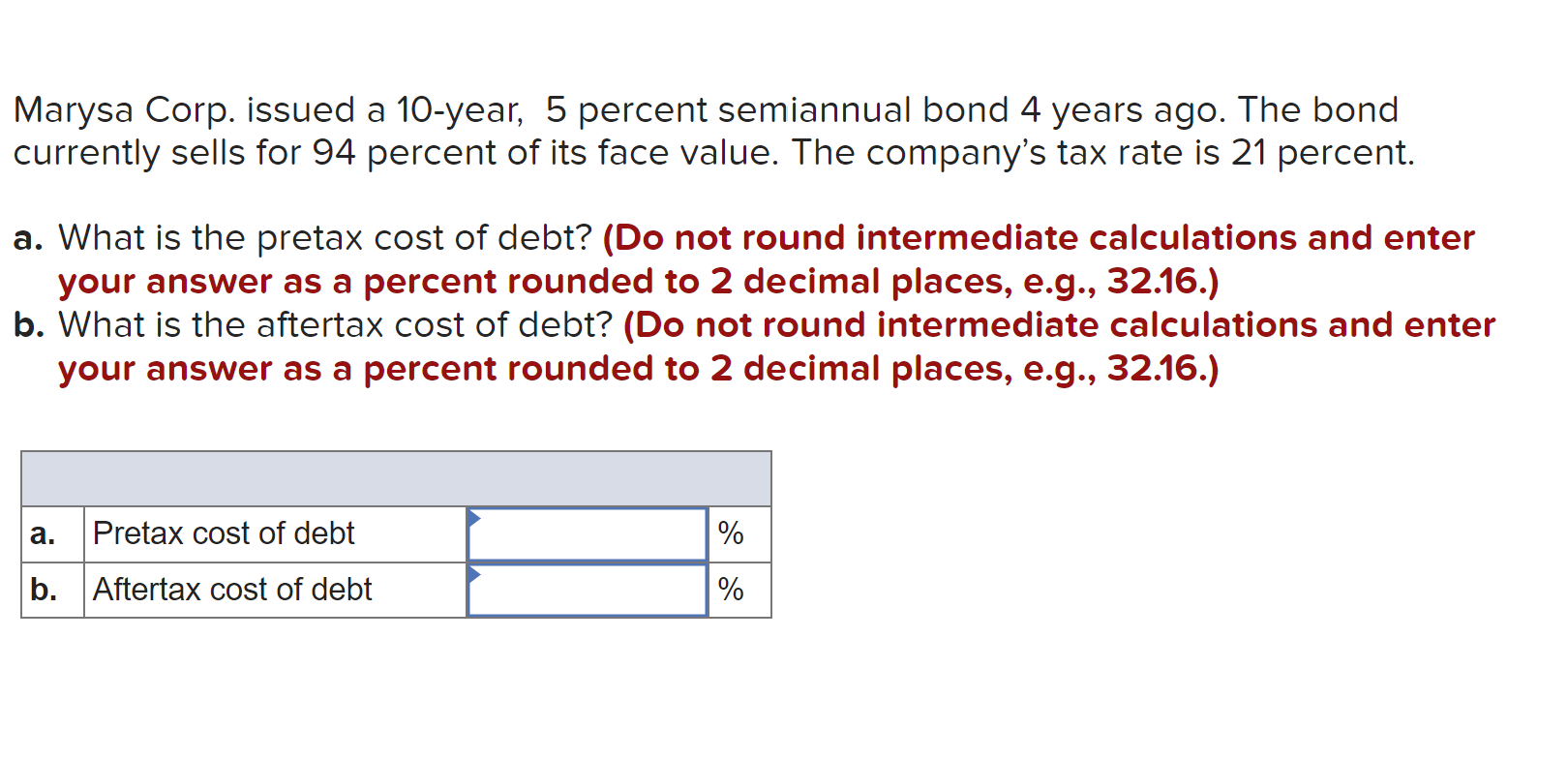

Marysa Corp. issued a 10-year, 5 percent semiannual bond 4 years ago. The bond currently sells for 94 percent of its face value. The company's tax rate is 21 percent. a. What is the pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Pretax cost of debt % b. Aftertax cost of debt %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials of Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

8th edition

78034752, 978-0078034756

Students also viewed these Algorithms questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App