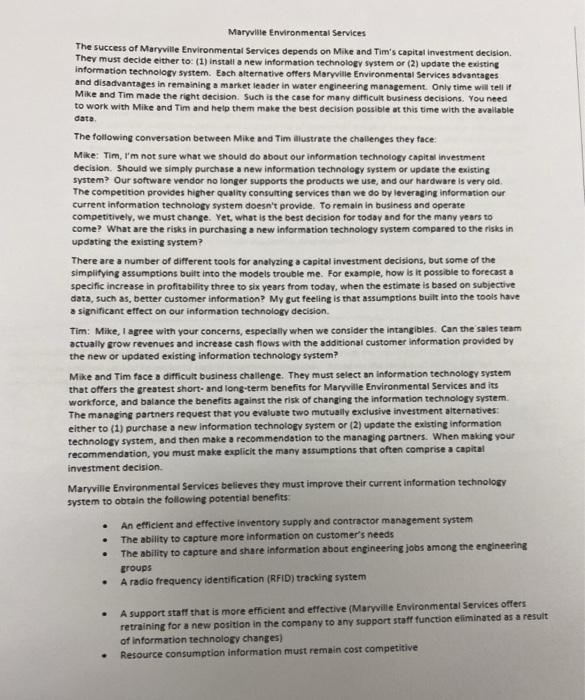

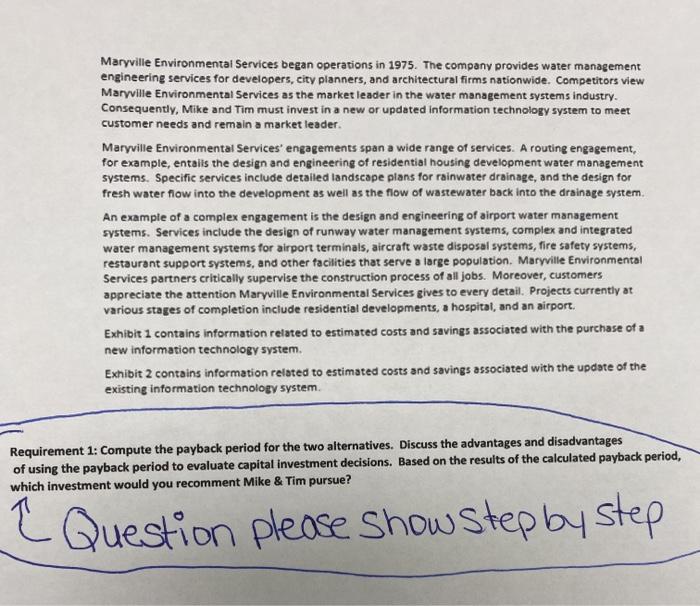

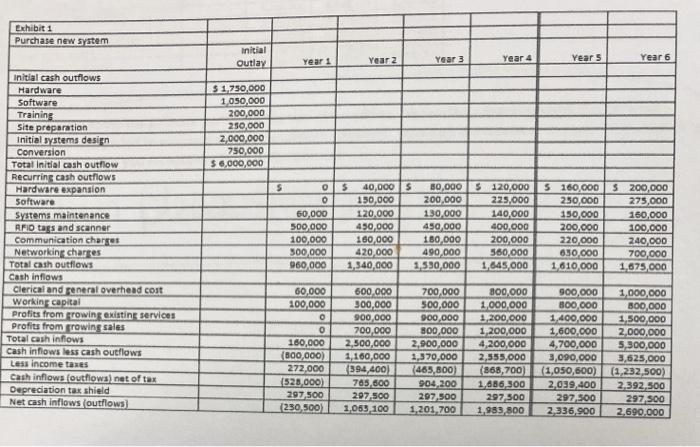

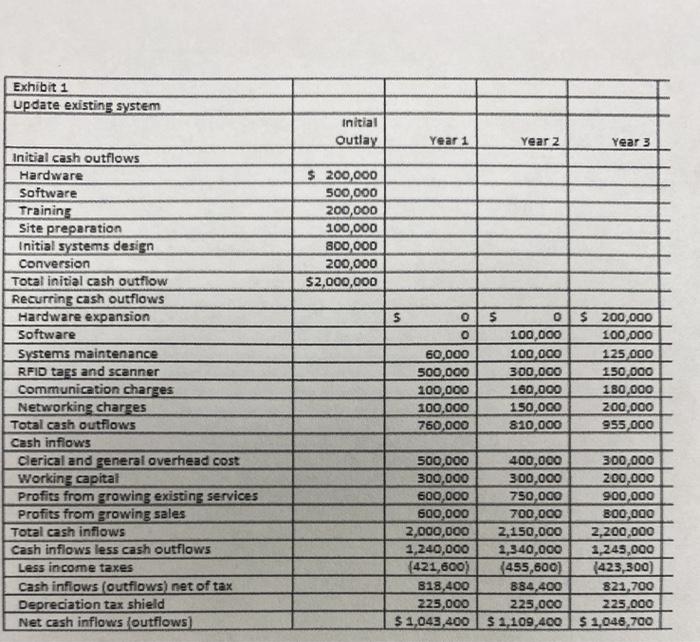

Maryville Environmental Services began operations in 1975. The company provides water management engineering services for developers, city planners, and architectural firms nationwide. Competitors view Maryville Environmental Services as the market leader in the water management systems industry. Consequently, Mike and Tim must invest in a new or updated information technology system to meet customer needs and remain a market leader. Maryville Environmental Services' engagements span a wide range of services. A routing engagement, for example, entails the design and engineering of residential housing development water management systems. Specific services include detailed landscape plans for rainwater drainage, and the design for fresh water flow into the development as well as the flow of wastewater back into the drainage system. An example of a complex engagement is the design and engineering of airport water management systems. Services include the design of runway water management systems, complex and integrated water management systems for airport terminals, aircraft waste disposal systems, fire safety systems, restaurant support systems, and other facilities that serve a large population. Maryville Environmental Services partners critically supervise the construction process of all jobs. Moreover, customers appreciate the attention Maryville Environmental Services gives to every detail. Projects currently at various stages of completion include residential developments, a hospital, and an airport. Exhibit 1 contains information related to estimated costs and savings associated with the purchase of a new information technology system. Exhibit 2 contains information related to estimated costs and savings associated with the update of the existing information technology system, Requirement 1: Compute the payback period for the two alternatives. Discuss the advantages and disadvantages of using the payback period to evaluate capital investment decisions. Based on the results of the calculated payback period, which investment would you recomment Mike & Tim pursue? Question please showstepby step Exhibit 1 Purchase new system Initial Outlay Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 51.750,000 1 050,000 200,000 230,000 2,000,000 750,000 $6,000,000 Initial cash outflows Hardware Software Training Site preparation Initial systems design Conversion Total Initial cash outflow Recurring cash outflows Hardware expansion Software Systems maintenance RFID tags and scanner Communication charges Networking charges Total cash outflows Cash inflows Clerical and general overhead cost Working capital Profits from growing existing services Profits from growing sales Total cash inflows Cash inflows less cash outflows Less income taxes Cash inflows foutflows.net of tax Depreciation tax shield Net cash inflows outflows) s o 60,000 500,000 100,000 300,000 960 000 $ 40,000 $ 80,000 150,000 200,000 120.000 130.000 450,000 450,000 160,000 180,000 420,000 490,000 1,340,000 1,530,000 5 120,000 225,000 140.000 400.000 200,000 560.000 1,845,000 $ 160,000 250,000 350.000 200,000 220,000 630.000 1.810,000 $ 200,000 275,000 160,000 100.000 240,000 700,000 1,675,000 60,000 100,000 O 0 160,000 (B00,000) 272,000 528,000) 297,500 (230.500) 600.000 300,000 900,000 700,000 2,500,000 1,160,000 394,400) 765,600 297.500 1,053, 100 700.000 500,000 900,000 300,000 2,900,000 1,370,000 (465,800) 904,200 297,300 1,201,700 800,000 1.000.000 1,200,000 1,200,000 4,200,000 2,555,000 (868,700) 1.686,300 297, 300 1.983,800 900,000 B00,000 1,400,000 1.600.000 4,700,000 3,090,000 (1,050,600) 2,039,400 297,500 2,336,900 1,000,000 BOO,000 1,500,000 2,000,000 5,300,000 3.625,000 (1,232,500) 2,392,500 297,500 2,690,000 Exhibit 1 update existing system Initial Outlay Year 1 Year 2 Year 3 $ 200,000 500,000 200,000 100,000 800,000 200,000 $2,000,000 $ $ 0 Initial cash outflows Hardware Software Training Site preparation Initial systems design Conversion Total initial cash outflow Recurring cash outflows Hardware expansion Software Systems maintenance RFID tags and scanner Communication charges Networking charges Total cash outflows Cash inflows Clerical and general overhead cost Working capital Profits from growing existing services Profits from growing sales Total cash inflows Cash inflows less cash outflows Less income taxes Cash inflows foutfiows) net of tax Depreciation tax shield Net cash inflows foutflows 60.000 500,000 100,000 100,000 760,000 5 0 100,000 100,000 300,000 160,000 150.000 810,000 $ 200,000 100,000 125,000 150,000 180,000 200,000 955,000 500,000 400,000 300,000 300,000 300,000 200.000 600,000 750,000 900,000 600,000 700,000 800,000 2,000,000 2,150,000 2,200,000 1,240,000 2,340,000 2,245,000 (421,600) (455,600) 1423,300) 818.400 884,400 821,700 225,000 225,000 225.000 $ 1,043,400 $2,109,400 $ 1,046,700 Maryville Environmental Services began operations in 1975. The company provides water management engineering services for developers, city planners, and architectural firms nationwide. Competitors view Maryville Environmental Services as the market leader in the water management systems industry. Consequently, Mike and Tim must invest in a new or updated information technology system to meet customer needs and remain a market leader. Maryville Environmental Services' engagements span a wide range of services. A routing engagement, for example, entails the design and engineering of residential housing development water management systems. Specific services include detailed landscape plans for rainwater drainage, and the design for fresh water flow into the development as well as the flow of wastewater back into the drainage system. An example of a complex engagement is the design and engineering of airport water management systems. Services include the design of runway water management systems, complex and integrated water management systems for airport terminals, aircraft waste disposal systems, fire safety systems, restaurant support systems, and other facilities that serve a large population. Maryville Environmental Services partners critically supervise the construction process of all jobs. Moreover, customers appreciate the attention Maryville Environmental Services gives to every detail. Projects currently at various stages of completion include residential developments, a hospital, and an airport. Exhibit 1 contains information related to estimated costs and savings associated with the purchase of a new information technology system. Exhibit 2 contains information related to estimated costs and savings associated with the update of the existing information technology system, Requirement 1: Compute the payback period for the two alternatives. Discuss the advantages and disadvantages of using the payback period to evaluate capital investment decisions. Based on the results of the calculated payback period, which investment would you recomment Mike & Tim pursue? Question please showstepby step Exhibit 1 Purchase new system Initial Outlay Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 51.750,000 1 050,000 200,000 230,000 2,000,000 750,000 $6,000,000 Initial cash outflows Hardware Software Training Site preparation Initial systems design Conversion Total Initial cash outflow Recurring cash outflows Hardware expansion Software Systems maintenance RFID tags and scanner Communication charges Networking charges Total cash outflows Cash inflows Clerical and general overhead cost Working capital Profits from growing existing services Profits from growing sales Total cash inflows Cash inflows less cash outflows Less income taxes Cash inflows foutflows.net of tax Depreciation tax shield Net cash inflows outflows) s o 60,000 500,000 100,000 300,000 960 000 $ 40,000 $ 80,000 150,000 200,000 120.000 130.000 450,000 450,000 160,000 180,000 420,000 490,000 1,340,000 1,530,000 5 120,000 225,000 140.000 400.000 200,000 560.000 1,845,000 $ 160,000 250,000 350.000 200,000 220,000 630.000 1.810,000 $ 200,000 275,000 160,000 100.000 240,000 700,000 1,675,000 60,000 100,000 O 0 160,000 (B00,000) 272,000 528,000) 297,500 (230.500) 600.000 300,000 900,000 700,000 2,500,000 1,160,000 394,400) 765,600 297.500 1,053, 100 700.000 500,000 900,000 300,000 2,900,000 1,370,000 (465,800) 904,200 297,300 1,201,700 800,000 1.000.000 1,200,000 1,200,000 4,200,000 2,555,000 (868,700) 1.686,300 297, 300 1.983,800 900,000 B00,000 1,400,000 1.600.000 4,700,000 3,090,000 (1,050,600) 2,039,400 297,500 2,336,900 1,000,000 BOO,000 1,500,000 2,000,000 5,300,000 3.625,000 (1,232,500) 2,392,500 297,500 2,690,000 Exhibit 1 update existing system Initial Outlay Year 1 Year 2 Year 3 $ 200,000 500,000 200,000 100,000 800,000 200,000 $2,000,000 $ $ 0 Initial cash outflows Hardware Software Training Site preparation Initial systems design Conversion Total initial cash outflow Recurring cash outflows Hardware expansion Software Systems maintenance RFID tags and scanner Communication charges Networking charges Total cash outflows Cash inflows Clerical and general overhead cost Working capital Profits from growing existing services Profits from growing sales Total cash inflows Cash inflows less cash outflows Less income taxes Cash inflows foutfiows) net of tax Depreciation tax shield Net cash inflows foutflows 60.000 500,000 100,000 100,000 760,000 5 0 100,000 100,000 300,000 160,000 150.000 810,000 $ 200,000 100,000 125,000 150,000 180,000 200,000 955,000 500,000 400,000 300,000 300,000 300,000 200.000 600,000 750,000 900,000 600,000 700,000 800,000 2,000,000 2,150,000 2,200,000 1,240,000 2,340,000 2,245,000 (421,600) (455,600) 1423,300) 818.400 884,400 821,700 225,000 225,000 225.000 $ 1,043,400 $2,109,400 $ 1,046,700