Question

Mason Company makes sales on which an 6% sales tax is assessed. The following summary transactions were made during 2015: a. b. C. Cash

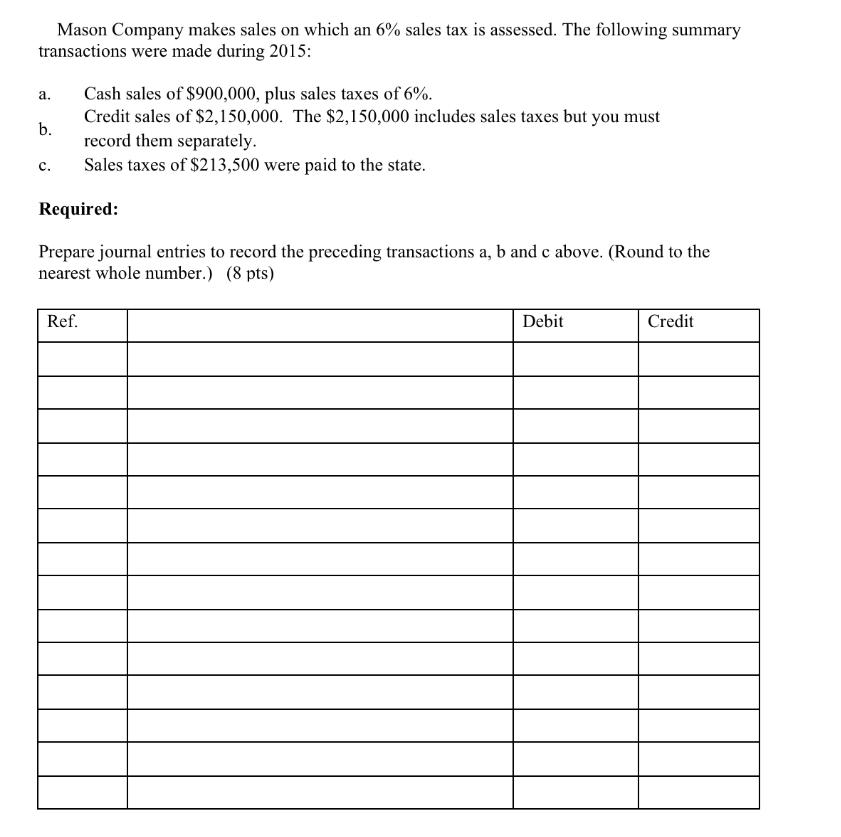

Mason Company makes sales on which an 6% sales tax is assessed. The following summary transactions were made during 2015: a. b. C. Cash sales of $900,000, plus sales taxes of 6%. Credit sales of $2,150,000. The $2,150,000 includes sales taxes but you must record them separately. Sales taxes of $213,500 were paid to the state. Required: Prepare journal entries to record the preceding transactions a, b and c above. (Round to the nearest whole number.) (8 pts) Ref. Debit Credit

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

NO General Journal Debit Credit 1 Cash Account 9540...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones

10th Edition

324300980, 978-0324300987

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App