Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mason made the following disposals in 2021-22: 1. 20 September 2021: sold a painting to his brother, Peter, for 25,000 despite it being worth

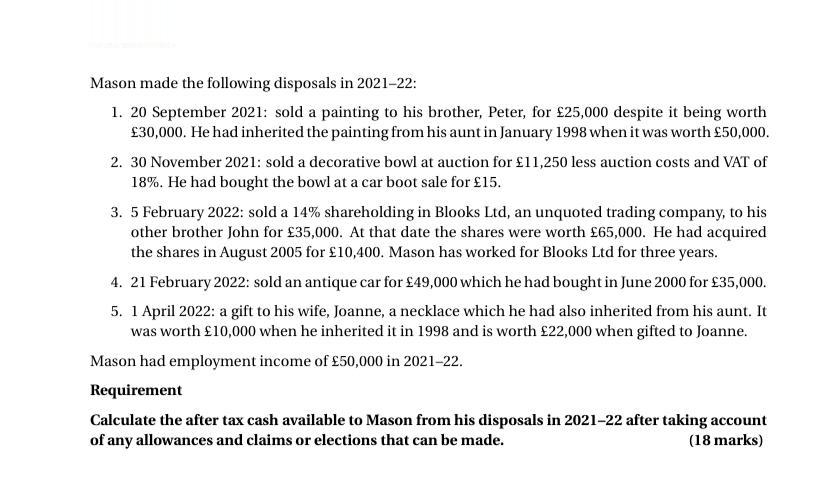

Mason made the following disposals in 2021-22: 1. 20 September 2021: sold a painting to his brother, Peter, for 25,000 despite it being worth 30,000. He had inherited the painting from his aunt in January 1998 when it was worth 50,000. 2. 30 November 2021: sold a decorative bowl at auction for 11,250 less auction costs and VAT of 18%. He had bought the bowl at a car boot sale for 15. 3. 5 February 2022: sold a 14% shareholding in Blooks Ltd, an unquoted trading company, to his other brother John for 35,000. At that date the shares were worth 65,000. He had acquired the shares in August 2005 for 10,400. Mason has worked for Blooks Ltd for three years. 4. 21 February 2022: sold an antique car for 49,000 which he had bought in June 2000 for 35,000. 5. 1 April 2022: a gift to his wife, Joanne, a necklace which he had also inherited from his aunt. It was worth 10,000 when he inherited it in 1998 and is worth 22,000 when gifted to Joanne. Mason had employment income of 50,000 in 2021-22. Requirement Calculate the after tax cash available to Mason from his disposals in 2021-22 after taking account of any allowances and claims or elections that can be made. (18 marks)

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer Masons aftertax cash available from disposals in 202122 is 109937 Calculation 1 Disposal of painting Gain on sale 25000 50000 25000 CGT allowan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started