Answered step by step

Verified Expert Solution

Question

1 Approved Answer

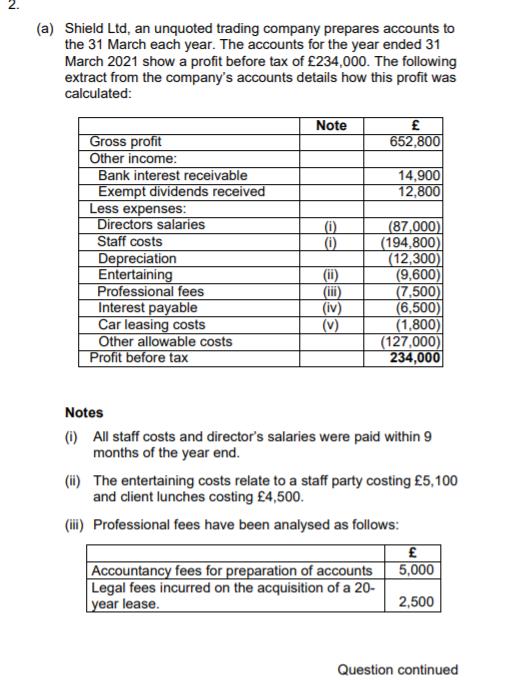

N (a) Shield Ltd, an unquoted trading company prepares accounts to the 31 March each year. The accounts for the year ended 31 March

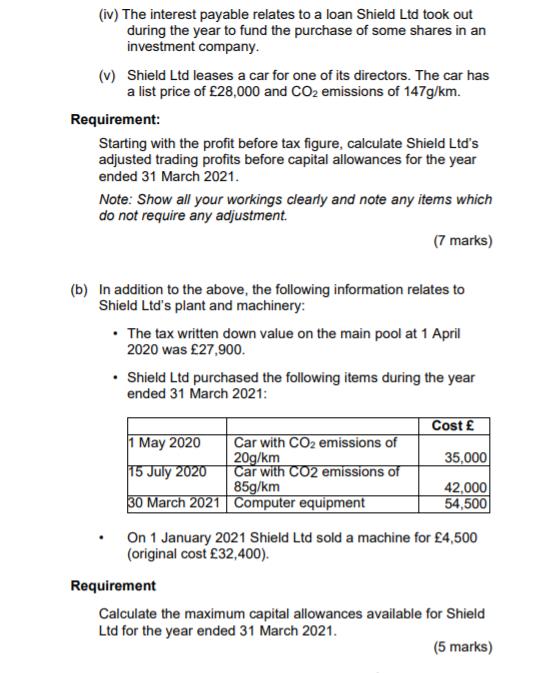

N (a) Shield Ltd, an unquoted trading company prepares accounts to the 31 March each year. The accounts for the year ended 31 March 2021 show a profit before tax of 234,000. The following extract from the company's accounts details how this profit was calculated: Gross profit Other income: Bank interest receivable Exempt dividends received Less expenses: Directors salaries Staff costs Depreciation Entertaining Professional fees Interest payable Car leasing costs Other allowable costs Profit before tax Note (i) (1) (ii) (iv) (v) 652,800 14,900 12,800 Accountancy fees for preparation of accounts Legal fees incurred on the acquisition of a 20- year lease. (87,000) (194,800) (12,300) (9,600) (7,500) (6,500) (1,800) (127,000) 234,000 Notes (i) All staff costs and director's salaries were paid within 9 months of the year end. (ii) The entertaining costs relate to a staff party costing 5,100 and client lunches costing 4,500. (iii) Professional fees have been analysed as follows: 5,000 2,500 Question continued (iv) The interest payable relates to a loan Shield Ltd took out during the year to fund the purchase of some shares in an investment company. (v) Shield Ltd leases a car for one of its directors. The car has a list price of 28,000 and CO emissions of 147g/km. Requirement: Starting with the profit before tax figure, calculate Shield Ltd's adjusted trading profits before capital allowances for the year ended 31 March 2021. Note: Show all your workings clearly and note any items which do not require any adjustment. (7 marks) (b) In addition to the above, the following information relates to Shield Ltd's plant and machinery: The tax written down value on the main pool at 1 April 2020 was 27,900. Shield Ltd purchased the following items during the year ended 31 March 2021: 1 May 2020 15 July 2020 30 March 2021 Car with CO2 emissions of 20g/km Car with CO2 emissions of 85g/km Computer equipment Cost 35,000 42,000 54,500 On 1 January 2021 Shield Ltd sold a machine for 4,500 (original cost 32,400). Requirement Calculate the maximum capital allowances available for Shield Ltd for the year ended 31 March 2021. (5 marks)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate Shield Ltds adjusted trading profits before capital allowances for the year ended 31 March 2021 we need to adjust the profit before tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started