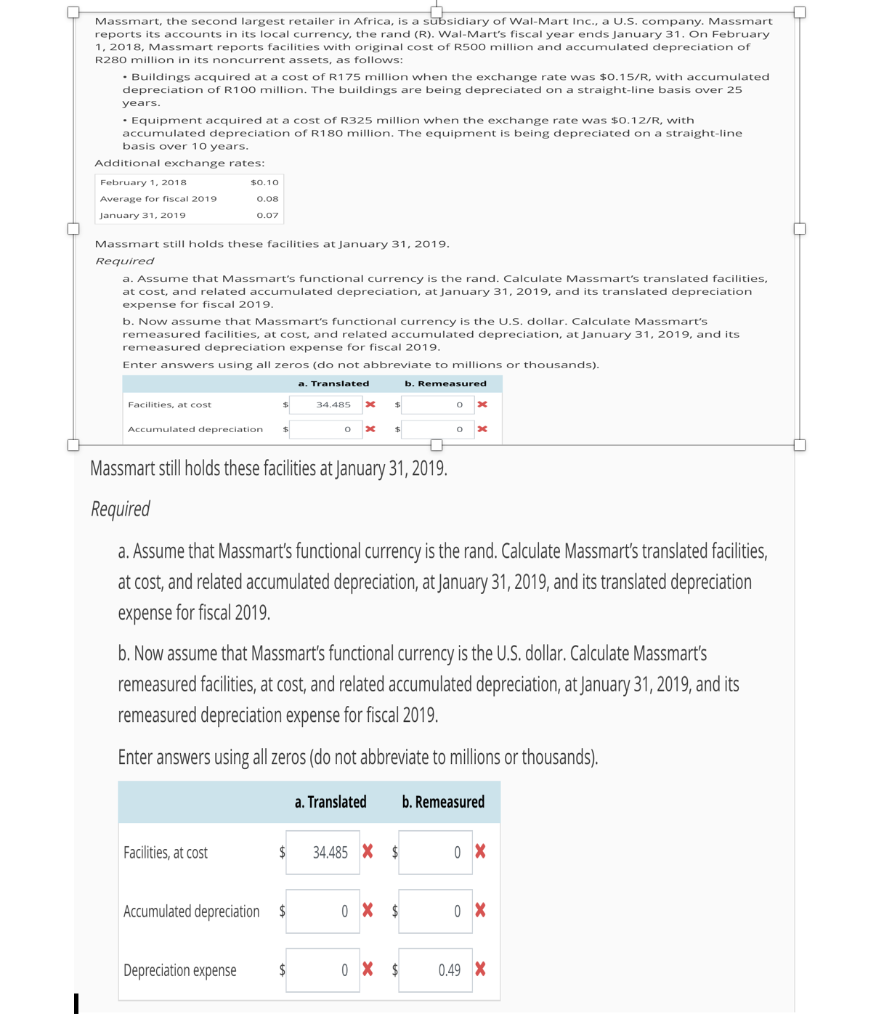

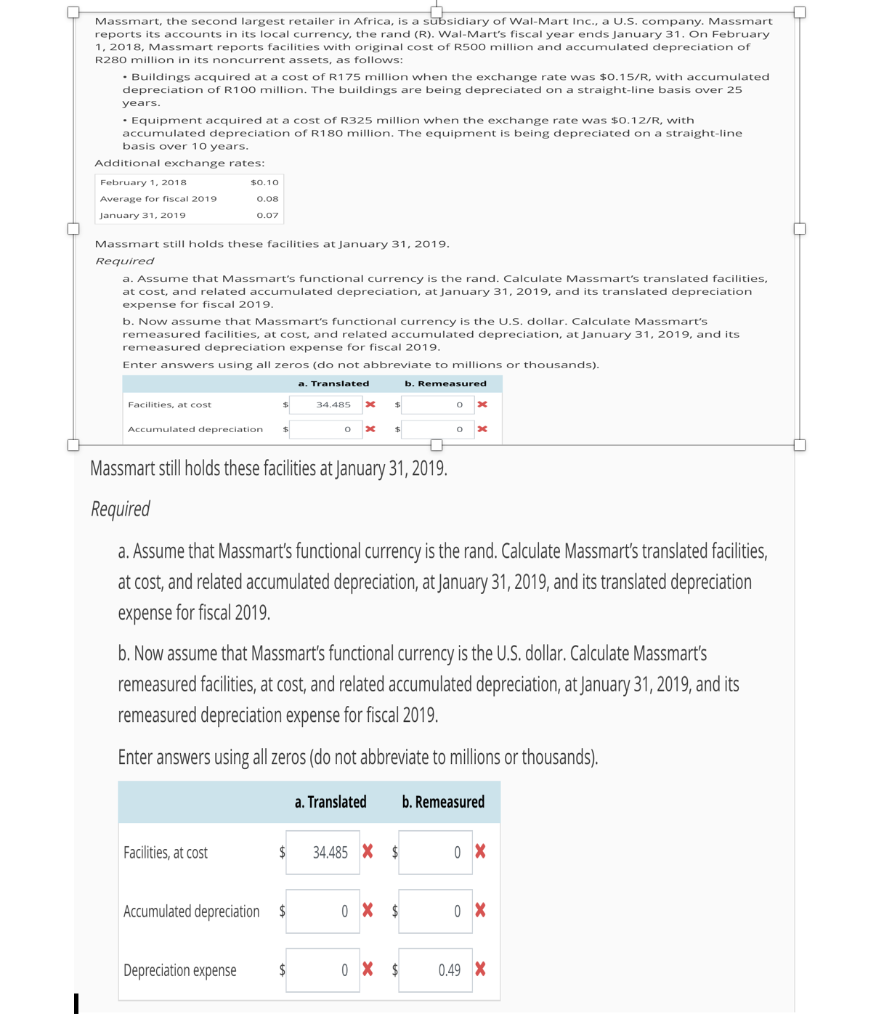

Massmart, the second largest retailer in Africa, is a subsidiary of Wal-Mart Inc., a U.S. company. Massmart reports its accounts in its local currency, the rand (R). Wal-Mart's fiscal year ends January 31. On February 1, 2018, Massmart reports facilities with original cost of R500 million and accumulated depreciation of R280 million in its noncurrent assets, as follows: Buildings acquired at a cost of R175 million when the exchange rate was $0.15/R, with accumulated depreciation of R100 million. The buildings are being depreciated on a straight-line basis over 25 years . Equipment acquired atacost of R325 million when the exchange rate was $0.12/R, with accumulated depreciation of R180 million. The equipment is being depreciated on a straight-line basis over 10 years. Additional exchange rates: February 1, 2018 Average for fiscal 2019 January 31. 2019 $0.10 0.08 0.07 Massmart still holds these facilities at January 31, 2019 Required a. Assume that Massmart's functional currency is the rand. Calculate Massmart's translated facilities, at cost, and related accumulated depreciation, at January 31, 2019, and its translated depreciation expense for fiscal 2019 b. Now assume that Massmart's functional currency is the U.S. dollar. Calculate Massmart's remeasured facilities, at cost, and related accumulated depreciation, at January 31, 2019, and its remeasured depreciation expense for fiscal 2019 Enter answers using all zeros (do not abbreviate to millions or thousands) a. Translated 34,485 x Facilities, at cost Massmart stil holds these facilities at january 31, 2019 Required a. Assume that Massmart's functional currency is the rand. Calculate Massmart's translated facilities at cost, and related accumulated depreciation, at January 31,2019, and its translated depreciation expense for fiscal 2019 b. Now assume that Massmart's functional currency is the U.S. dollar. Calculate Massmart's remeasured facilities, at cost, and related accumulated depreciation, at January 31, 2019, and its remeasured depreciation expense for fiscal 2019 Enter answers using all zeros (do not abbreviate to millions or thousands) a. Translated b. Remeasured 34.485 X $ Facilities,at cost Accumulated depreciation $ 0 X S0.49X Depreciation expense