Answered step by step

Verified Expert Solution

Question

1 Approved Answer

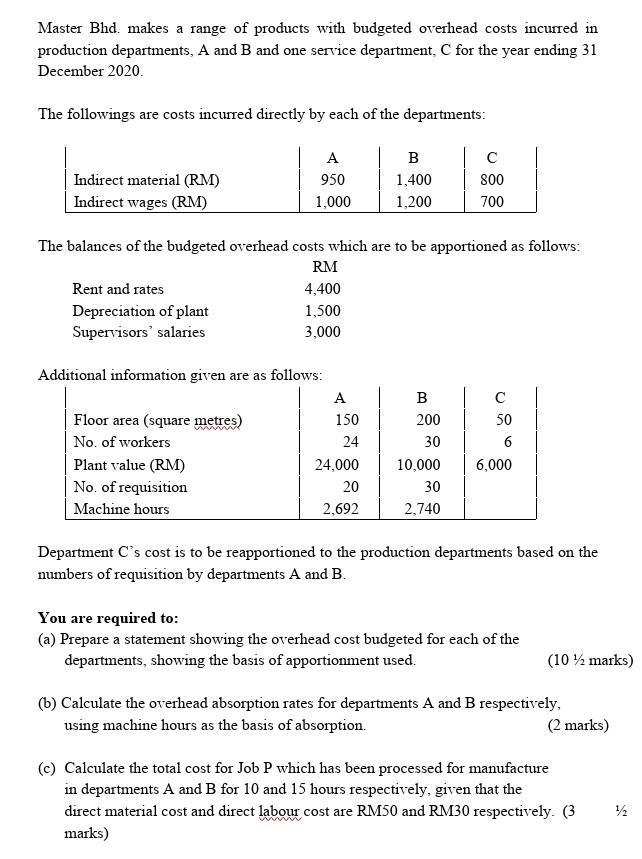

Master Bhd. makes a range of products with budgeted overhead costs incurred in production departments, A and B and one service department, C for

Master Bhd. makes a range of products with budgeted overhead costs incurred in production departments, A and B and one service department, C for the year ending 31 December 2020. The followings are costs incurred directly by each of the departments: Indirect material (RM) Indirect wages (RM) Rent and rates Depreciation of plant Supervisors' salaries A 950 1,000 The balances of the budgeted overhead costs which are to be apportioned as follows: RM 4,400 1,500 3,000 Additional information given are as follows: Floor area (square metres) No. of workers Plant value (RM) No. of requisition Machine hours B 1,400 1,200 A 150 24 24,000 20 2,692 C 800 700 B 200 30 10,000 30 2,740 50 6 6,000 Department C's cost is to be reapportioned to the production departments based on the numbers of requisition by departments A and B. You are required to: (a) Prepare a statement showing the overhead cost budgeted for each of the departments, showing the basis of apportionment used. (10% marks) (b) Calculate the overhead absorption rates for departments A and B respectively, using machine hours as the basis of absorption. (2 marks) (c) Calculate the total cost for Job P which has been processed for manufacture in departments A and B for 10 and 15 hours respectively, given that the direct material cost and direct labour cost are RM50 and RM30 respectively. (3 marks)

Step by Step Solution

★★★★★

3.50 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Solution Allocation of Rent and rate RM 44000 on the basis of Floor ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started