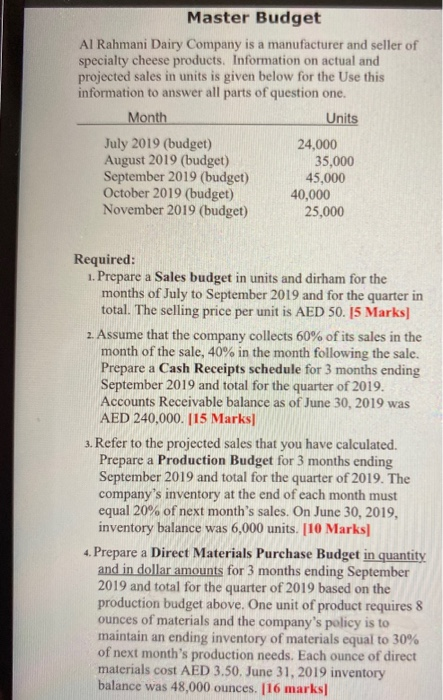

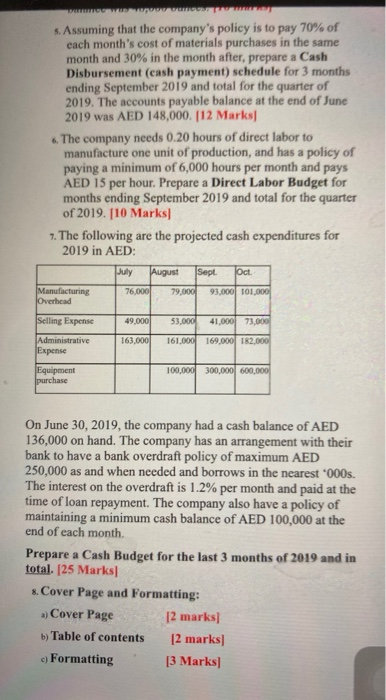

Master Budget Al Rahmani Dairy Company is a manufacturer and seller of specialty cheese products. Information on actual and projected sales in units is given below for the Use this information to answer all parts of question one. Month Units July 2019 (budget) 24,000 August 2019 (budget) 35,000 September 2019 (budget) 45,000 October 2019 (budget) 40,000 November 2019 (budget) 25,000 Required: 1. Prepare a Sales budget in units and dirham for the months of July to September 2019 and for the quarter in total. The selling price per unit is AED 50.15 Marks] 2. Assume that the company collects 60% of its sales in the month of the sale, 40% in the month following the sale. Prepare a Cash Receipts schedule for 3 months ending September 2019 and total for the quarter of 2019. Accounts Receivable balance as of June 30, 2019 was AED 240,000.115 Marks] 3. Refer to the projected sales that you have calculated. Prepare a Production Budget for 3 months ending September 2019 and total for the quarter of 2019. The company's inventory at the end of each month must equal 20% of next month's sales. On June 30, 2019, inventory balance was 6,000 units. [10 Marks 4. Prepare a Direct Materials Purchase Budget in quantity and in dollar amounts for 3 months ending September 2019 and total for the quarter of 2019 based on the production budget above. One unit of product requires 8 ounces of materials and the company's policy is to maintain an ending inventory of materials equal to 30% of next month's production needs. Each ounce of direct materials cost AED 3.50. June 31, 2019 inventory balance was 48,000 ounces. 116 marks] Novo 5. Assuming that the company's policy is to pay 70% of each month's cost of materials purchases in the same month and 30% in the month after, prepare a Cash Disbursement (cash payment) schedule for 3 months ending September 2019 and total for the quarter of 2019. The accounts payable balance at the end of June 2019 was AED 148,000. [12 Marks 6. The company needs 0.20 hours of direct labor to manufacture one unit of production, and has a policy of paying a minimum of 6,000 hours per month and pays AED 15 per hour. Prepare a Direct Labor Budget for months ending September 2019 and total for the quarter of 2019. [10 Marks 7. The following are the projected cash expenditures for 2019 in AED: July August Sept. oct. Manufacturing 76,000 79.000 93,000 101.000 Overhead Selling Expense 49,000 53.000 41.000 73,000 163.000 Administrative Expense 161,000 169.000 182.000 Equipment 100,000 300.000 600,000 purchase On June 30, 2019, the company had a cash balance of AED 136,000 on hand. The company has an arrangement with their bank to have a bank overdraft policy of maximum AED 250,000 as and when needed and borrows in the nearest *000s. The interest on the overdraft is 1.2% per month and paid at the time of loan repayment. The company also have a policy of maintaining a minimum cash balance of AED 100,000 at the end of each month Prepare a Cash Budget for the last 3 months of 2019 and in total. (25 Marks 8. Cover Page and Formatting: a) Cover Page [2 marks] b) Table of contents [2 marks] c) Formatting [3 Marks]