Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MASTER BUDGET CASE STUDY RICE PRODUCTS PTY LIMITED Rice Products Pty. Ltd. is a local firm that produces two moulded plastic products: kickboards and

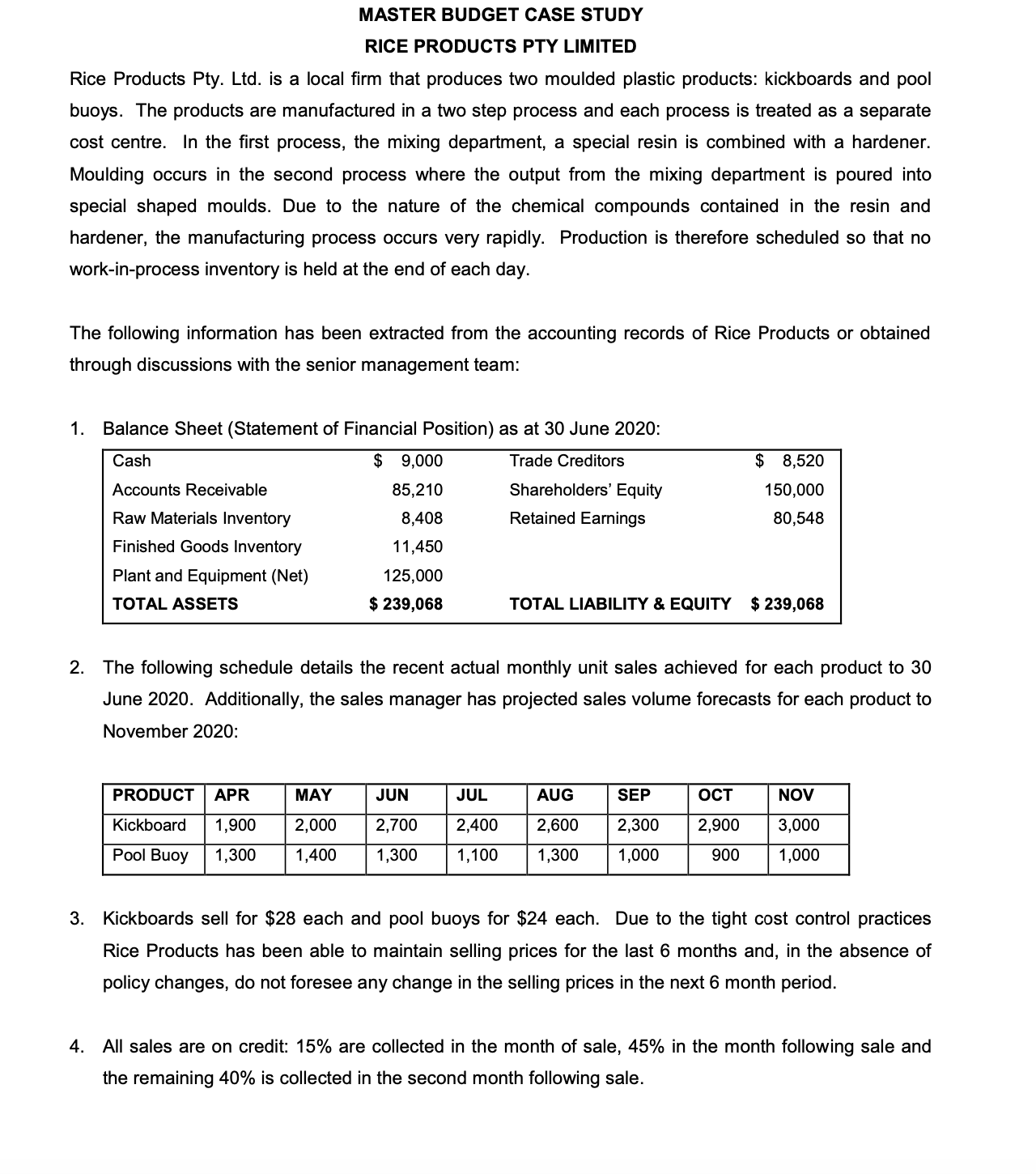

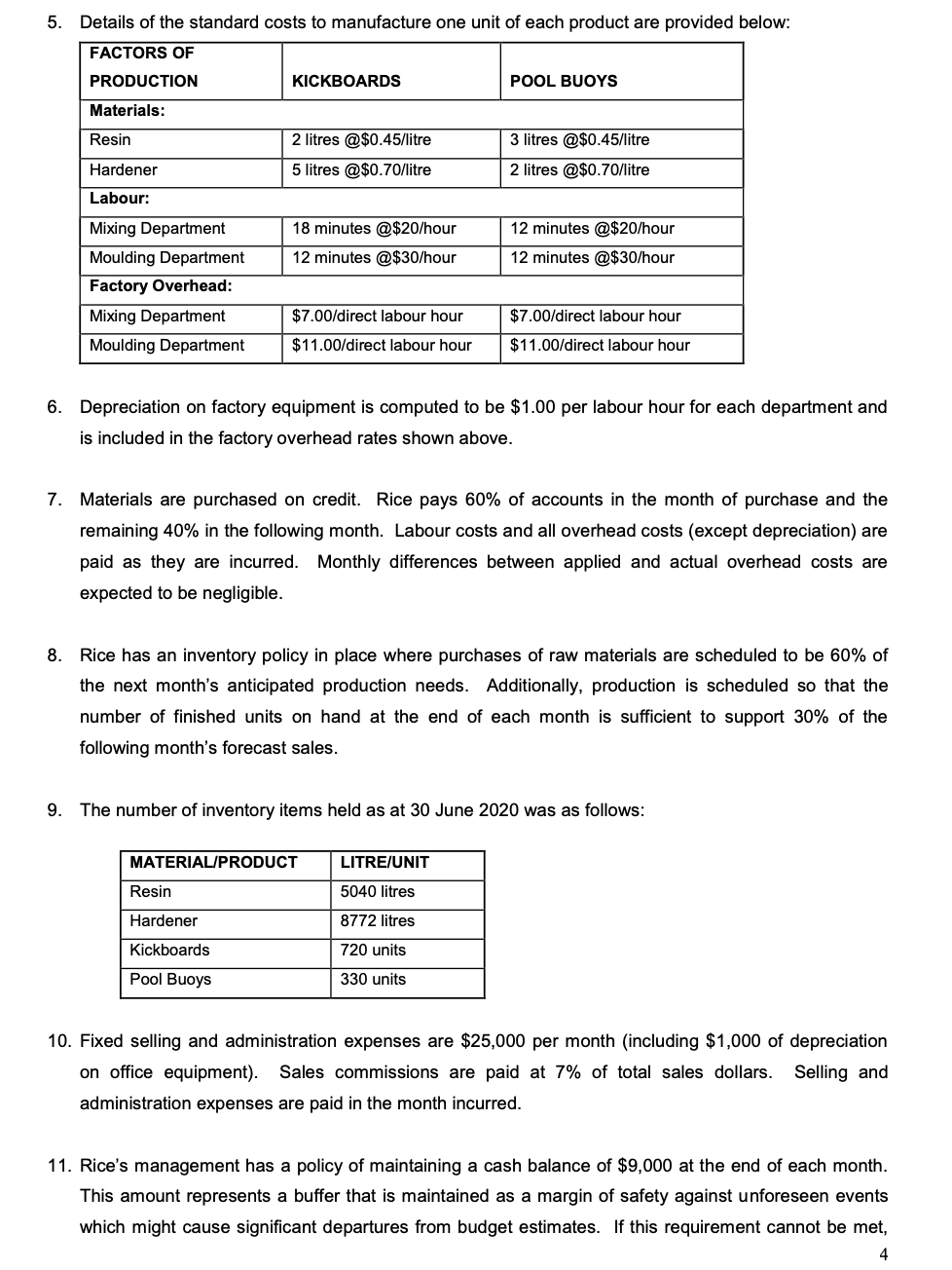

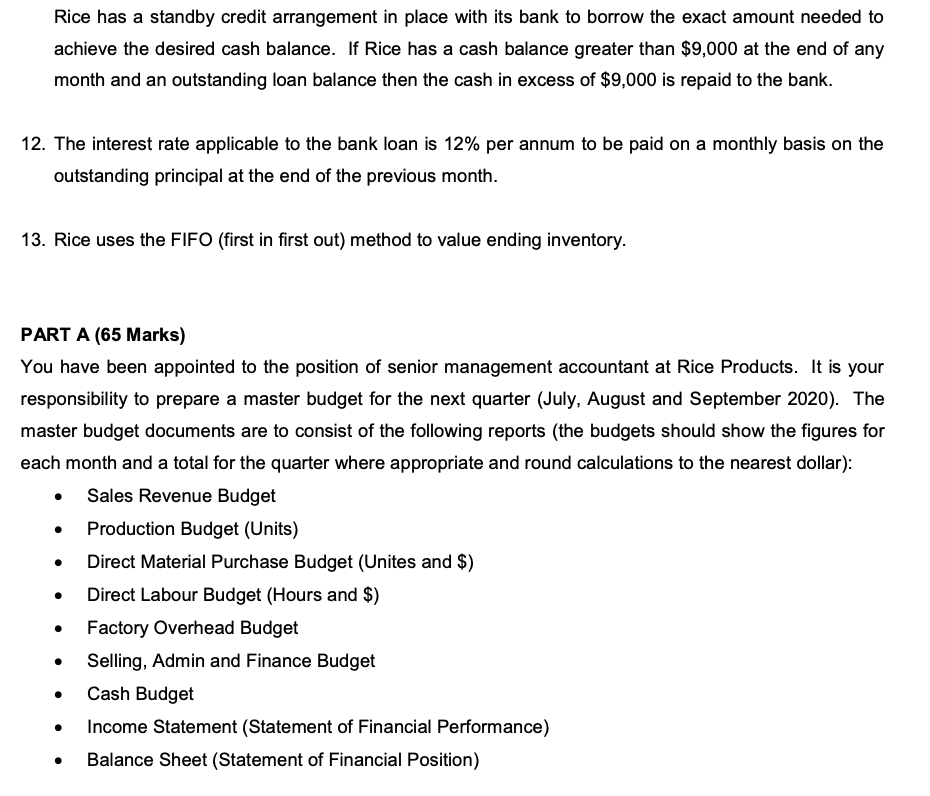

MASTER BUDGET CASE STUDY RICE PRODUCTS PTY LIMITED Rice Products Pty. Ltd. is a local firm that produces two moulded plastic products: kickboards and pool buoys. The products are manufactured in a two step process and each process is treated as a separate cost centre. In the first process, the mixing department, a special resin is combined with a hardener. Moulding occurs in the second process where the output from the mixing department is poured into special shaped moulds. Due to the nature of the chemical compounds contained in the resin and hardener, the manufacturing process occurs very rapidly. Production is therefore scheduled so that no work-in-process inventory is held at the end of each day. The following information has been extracted from the accounting records of Rice Products or obtained through discussions with the senior management team: 1. Balance Sheet (Statement of Financial Position) as at 30 June 2020: Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Plant and Equipment (Net) TOTAL ASSETS $ 9,000 Trade Creditors $ 8,520 85,210 8,408 Shareholders' Equity Retained Earnings 150,000 80,548 11,450 125,000 $ 239,068 TOTAL LIABILITY & EQUITY $239,068 2. The following schedule details the recent actual monthly unit sales achieved for each product to 30 June 2020. Additionally, the sales manager has projected sales volume forecasts for each product to November 2020: PRODUCT APR Kickboard 1,900 MAY 2,000 JUN JUL AUG SEP OCT NOV 2,700 2,400 2,600 2,300 2,900 3,000 Pool Buoy 1,300 1,400 1,300 1,100 1,300 1,000 900 1,000 3. Kickboards sell for $28 each and pool buoys for $24 each. Due to the tight cost control practices Rice Products has been able to maintain selling prices for the last 6 months and, in the absence of policy changes, do not foresee any change in the selling prices in the next 6 month period. 4. All sales are on credit: 15% are collected in the month of sale, 45% in the month following sale and the remaining 40% is collected in the second month following sale. 5. Details of the standard costs to manufacture one unit of each product are provided below: FACTORS OF PRODUCTION KICKBOARDS POOL BUOYS Materials: Resin Hardener Labour: Mixing Department Moulding Department Factory Overhead: Mixing Department Moulding Department 2 litres @$0.45/litre 5 litres @$0.70/litre 3 litres @$0.45/litre 2 litres @$0.70/litre 18 minutes @$20/hour 12 minutes @$30/hour 12 minutes @$20/hour 12 minutes @$30/hour $7.00/direct labour hour $11.00/direct labour hour $7.00/direct labour hour $11.00/direct labour hour 6. Depreciation on factory equipment is computed to be $1.00 per labour hour for each department and is included in the factory overhead rates shown above. 7. Materials are purchased on credit. Rice pays 60% of accounts in the month of purchase and the remaining 40% in the following month. Labour costs and all overhead costs (except depreciation) are paid as they are incurred. Monthly differences between applied and actual overhead costs are expected to be negligible. 8. Rice has an inventory policy in place where purchases of raw materials are scheduled to be 60% of the next month's anticipated production needs. Additionally, production is scheduled so that the number of finished units on hand at the end of each month is sufficient to support 30% of the following month's forecast sales. 9. The number of inventory items held as at 30 June 2020 was as follows: LITRE/UNIT 5040 litres 8772 litres 720 units 330 units MATERIAL/PRODUCT Resin Hardener Kickboards Pool Buoys 10. Fixed selling and administration expenses are $25,000 per month (including $1,000 of depreciation on office equipment). Sales commissions are paid at 7% of total sales dollars. Selling and administration expenses are paid in the month incurred. 11. Rice's management has a policy of maintaining a cash balance of $9,000 at the end of each month. This amount represents a buffer that is maintained as a margin of safety against unforeseen events which might cause significant departures from budget estimates. If this requirement cannot be met, 4 Rice has a standby credit arrangement in place with its bank to borrow the exact amount needed to achieve the desired cash balance. If Rice has a cash balance greater than $9,000 at the end of any month and an outstanding loan balance then the cash in excess of $9,000 is repaid to the bank. 12. The interest rate applicable to the bank loan is 12% per annum to be paid on a monthly basis on the outstanding principal at the end of the previous month. 13. Rice uses the FIFO (first in first out) method to value ending inventory. PART A (65 Marks) You have been appointed to the position of senior management accountant at Rice Products. It is your responsibility to prepare a master budget for the next quarter (July, August and September 2020). The master budget documents are to consist of the following reports (the budgets should show the figures for each month and a total for the quarter where appropriate and round calculations to the nearest dollar): Sales Revenue Budget Production Budget (Units) Direct Material Purchase Budget (Unites and $) Direct Labour Budget (Hours and $) Factory Overhead Budget Selling, Admin and Finance Budget Cash Budget Income Statement (Statement of Financial Performance) Balance Sheet (Statement of Financial Position)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started