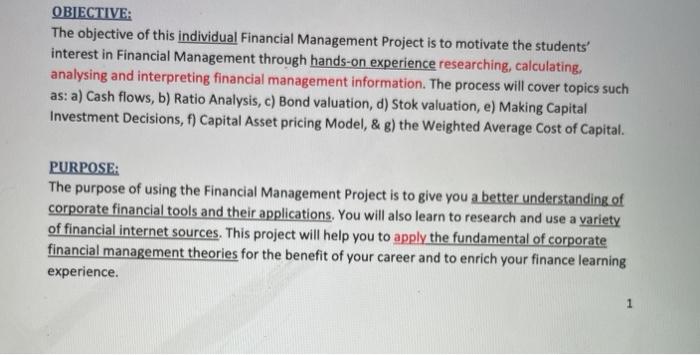

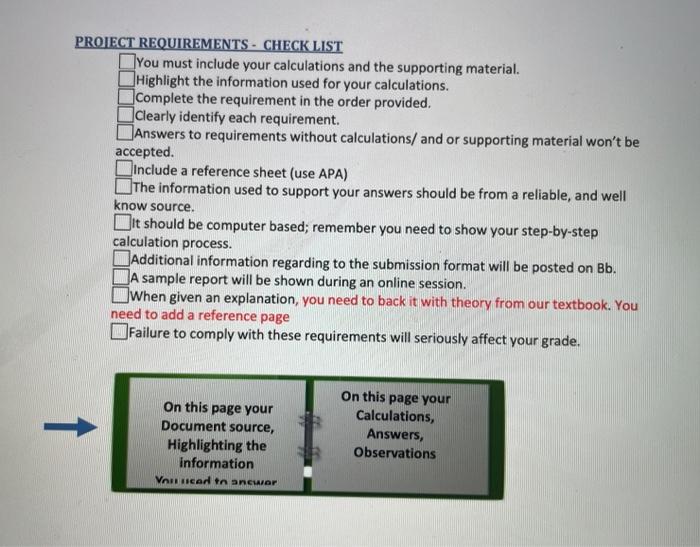

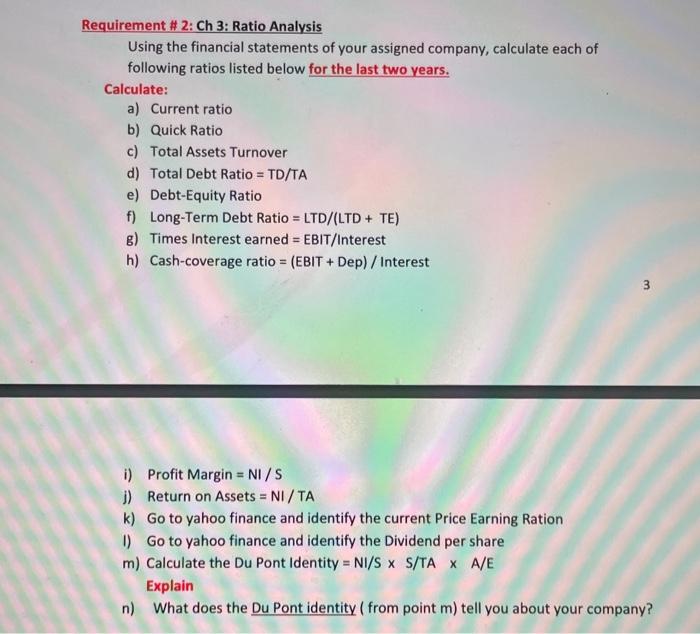

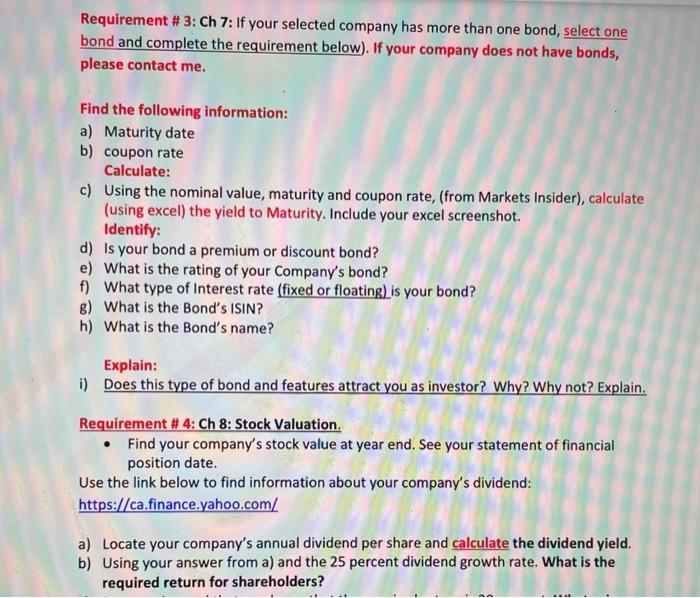

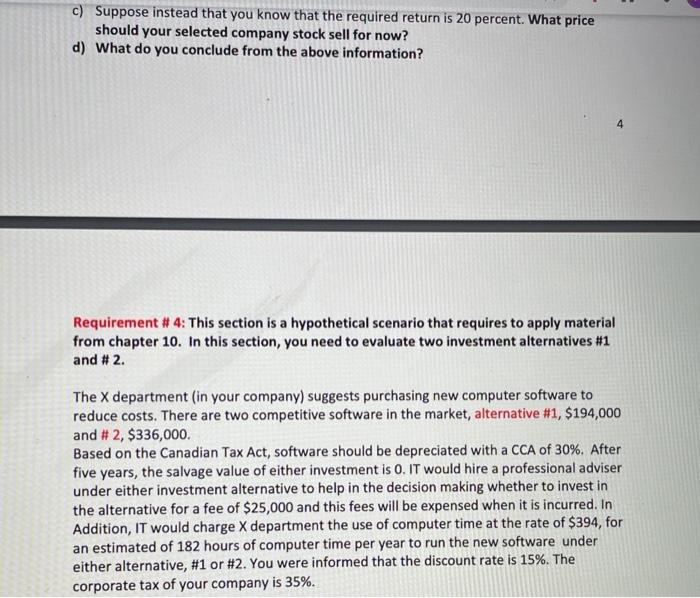

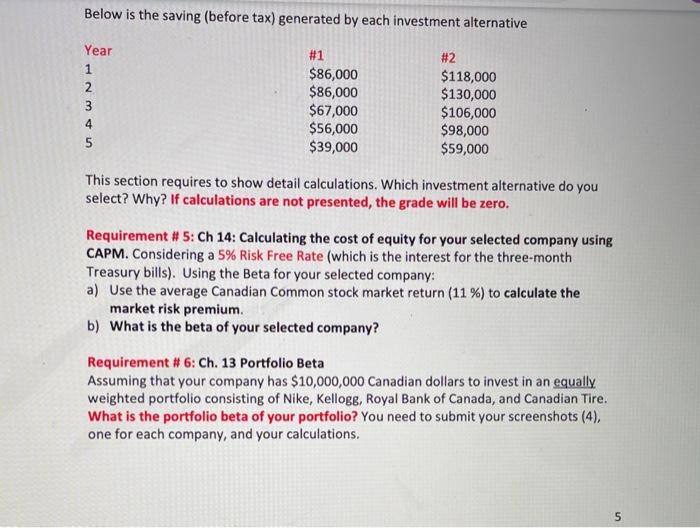

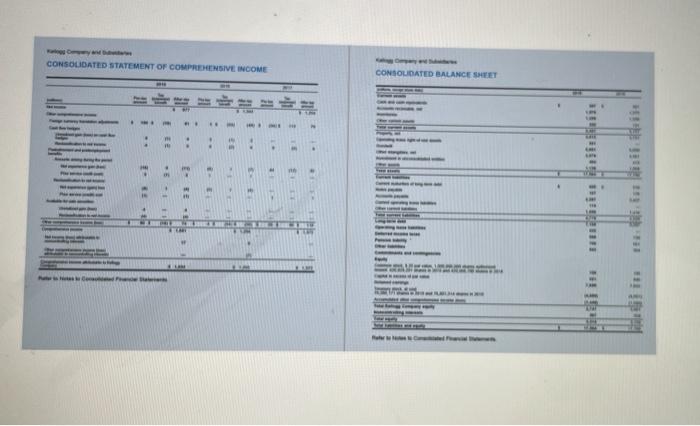

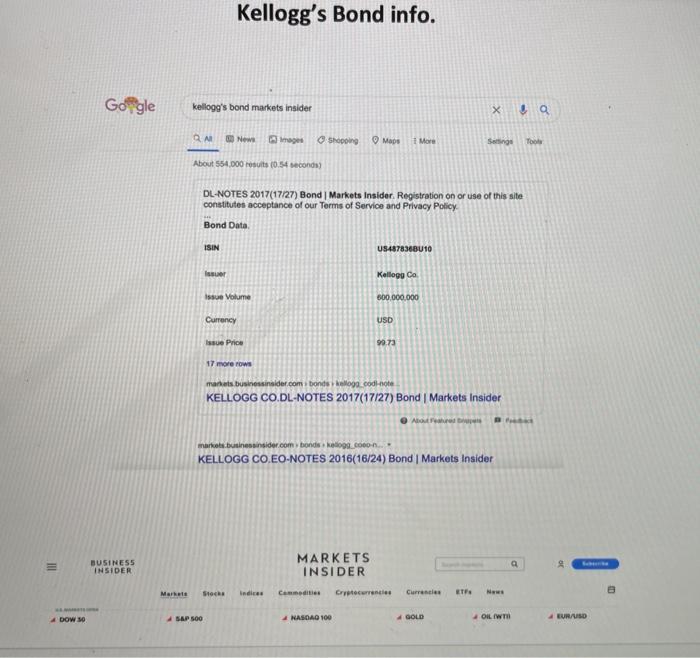

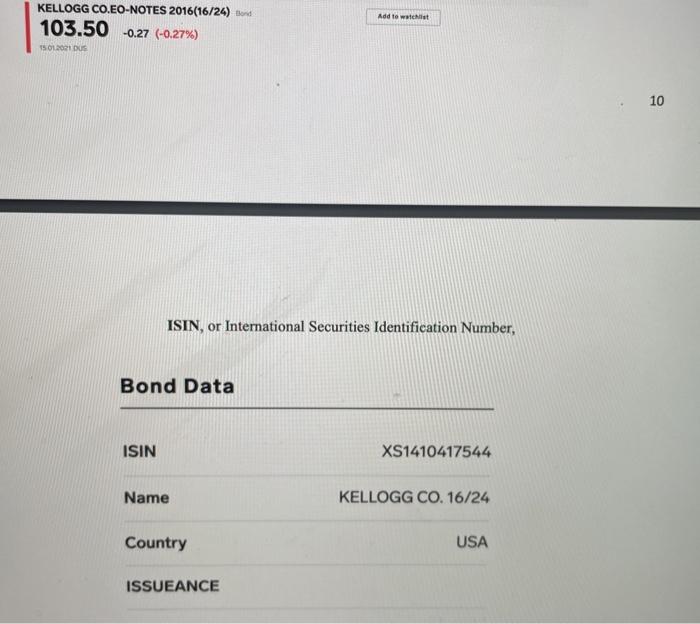

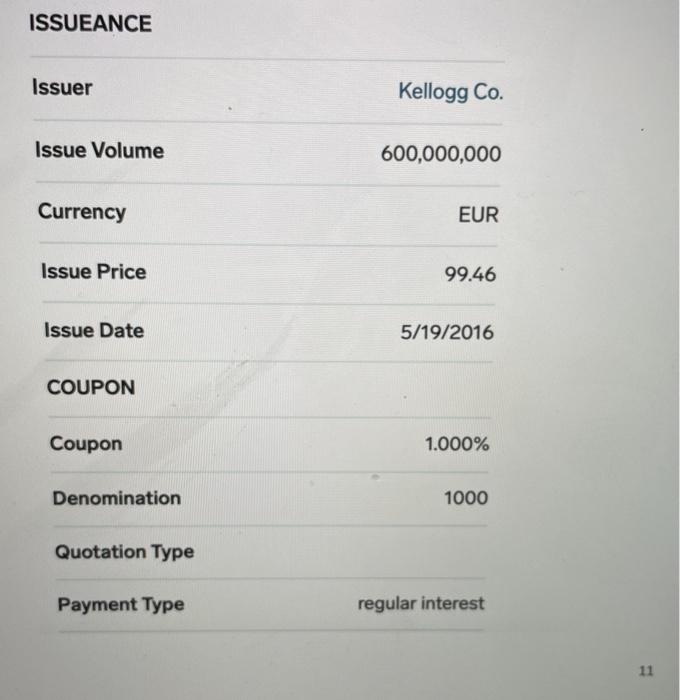

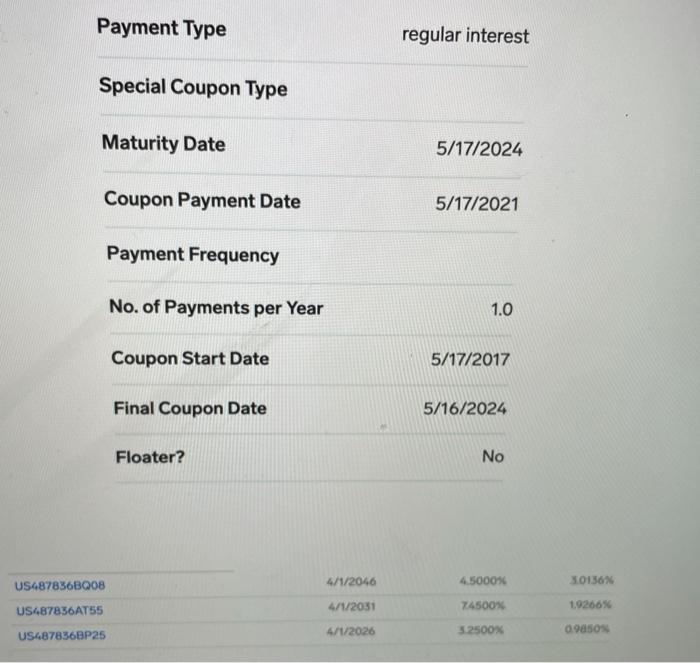

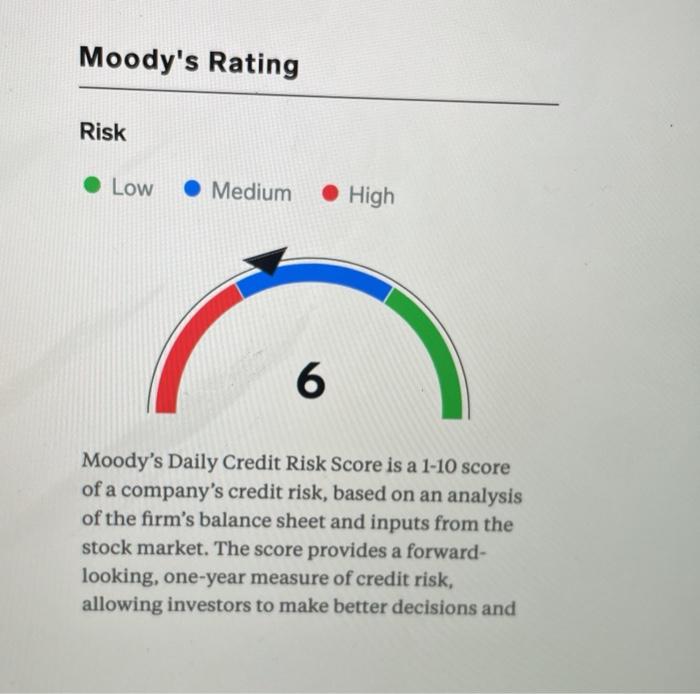

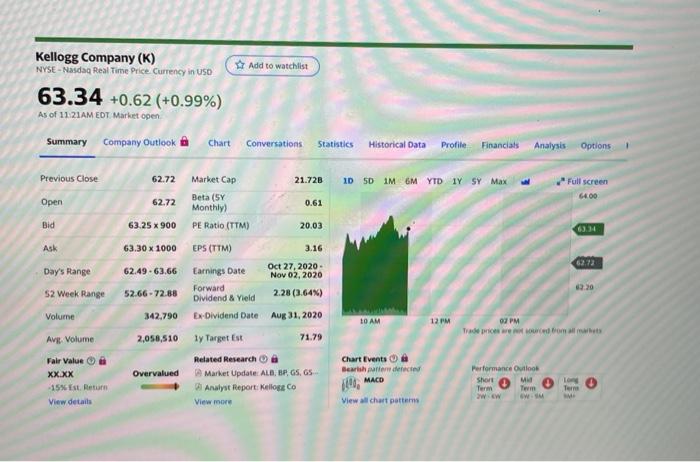

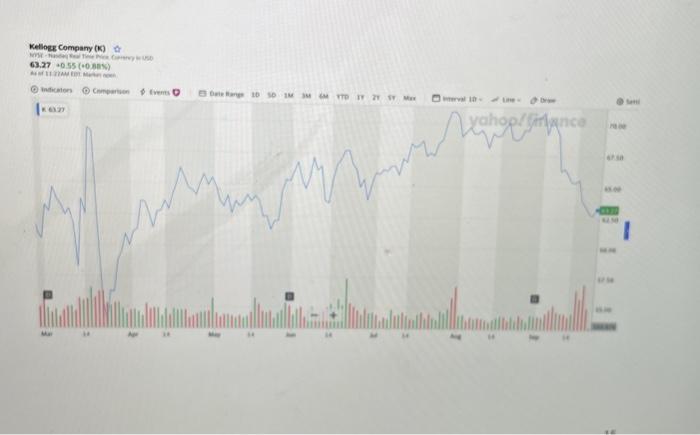

Master budget My company is Kobe Steel ( the company to use) please read the instructuoon OBJECTIVE: The objective of this individual Financial Management Project is to motivate the students' interest in Financial Management through hands-on experience researching, calculating, analysing and interpreting financial management information. The process will cover topics such as: a) Cash flows, b) Ratio Analysis, c) Bond valuation, d) Stok valuation, e) Making Capital Investment Decisions, f) Capital Asset pricing Model, & g) the Weighted Average Cost of Capital. PURPOSE: The purpose of using the Financial Management Project is to give you a better understanding of corporate financial tools and their applications. You will also learn to research and use a variety of financial internet sources. This project will help you to apply the fundamental of corporate financial management theories for the benefit of your career and to enrich your finance learning experience. 1 PROJECT REQUIREMENTS - CHECK LIST You must include your calculations and the supporting material. Highlight the information used for your calculations. Complete the requirement in the order provided. Clearly identify each requirement. Answers to requirements without calculations/ and or supporting material won't be accepted. Include a reference sheet (use APA) The information used to support your answers should be from a reliable, and well know source. Dit should be computer based; remember you need to show your step-by-step calculation process. Additional information regarding to the submission format will be posted on Bb. A sample report will be shown during an online session. When given an explanation, you need to back it with theory from our textbook. You need to add a reference page Failure to comply with these requirements will seriously affect your grade. On this page your Document source, Highlighting the information Voit ticar in ancuar On this page your Calculations, Answers, Observations 2. FINANCIAL MANAGEMENT REQUIREMENTS: In order to complete the following requirements, you need to use the last annual financial report from your company's web site, which includes the financial statements and notes to the financial statement. Only financial statements and its notes from the firm's official site will be accepted. Financial statements from other sources, such as, Yahoo financial, Google financial, etc., won't be accepted. Requirement # 1: Ch 2: Cash Flow Identify: Using the annual balance sheet and the Income Statement, calculate the cash flow identify a) OCF b) NCS c) changes in NWC d) Is the Net working capital negative or positive? e) Does this indicate any potential difficulty for the company? f) CFA g) CFC h) is the Cash Flow to Creditors Negative? i) Explain how this might come about? j) What is the last total dividend pay? - refer to the Statement of Changes in Equity k) Did the company issue new shares? Yes or no. What is the total dollar value? -refer to the Statement of Changes in Equity 1) Did the company repurchase shares? Yes or no. What is the total dollar value? - refer to the Statement of Changes in Equity m) Based on the information above (from point "a" to "l"), what is your opinion in regards to the cash flow of vour company? Requirement #2: Ch 3: Ratio Analysis Using the financial statements of your assigned company, calculate each of following ratios listed below for the last two years. Calculate: a) Current ratio b) Quick Ratio c) Total Assets Turnover d) Total Debt Ratio = TD/TA e) Debt-Equity Ratio f) Long-Term Debt Ratio = LTD/LTD + TE) g) Times Interest earned = EBIT/Interest h) Cash-coverage ratio = (EBIT + Dep) / Interest 3 i) Profit Margin = NI/S 1) Return on Assets = NI/TA k) Go to yahoo finance and identify the current Price Earning Ration 1) Go to yahoo finance and identify the Dividend per share m) Calculate the Du Pont Identity = NI/S x S/TA X A/E Explain n) What does the Du Pont identity (from point m) tell you about your company? Requirement #3: Ch 7: If your selected company has more than one bond, select one bond and complete the requirement below). If your company does not have bonds, please contact me. Find the following information: a) Maturity date b) coupon rate Calculate: c) Using the nominal value, maturity and coupon rate, (from Markets Insider), calculate (using excel) the yield to Maturity. Include your excel screenshot Identify: d) Is your bond a premium or discount bond? e) What is the rating of your Company's bond? f) What type of Interest rate (fixed or floating) is your bond? g) What is the Bond's ISIN? h) What is the Bond's name? Explain: i) Does this type of bond and features attract you as investor? Why? Why not? Explain. Requirement # 4: Ch 8: Stock Valuation. Find your company's stock value at year end. See your statement of financial position date. Use the link below to find information about your company's dividend: https://ca.finance.yahoo.com/ a) Locate your company's annual dividend per share and calculate the dividend yield. b) Using your answer from a) and the 25 percent dividend growth rate. What is the required return for shareholders? c) Suppose instead that you know that the required return is 20 percent. What price should your selected company stock sell for now? d) What do you conclude from the above information? Requirement #4: This section is a hypothetical scenario that requires to apply material from chapter 10. In this section, you need to evaluate two investment alternatives #1 and #2. The X department (in your company) suggests purchasing new computer software to reduce costs. There are two competitive software in the market, alternative #1, $194,000 and # 2, $336,000 Based on the Canadian Tax Act, software should be depreciated with a CCA of 30%. After five years, the salvage value of either investment is 0. It would hire a professional adviser under either investment alternative to help in the decision making whether to invest in the alternative for a fee of $25,000 and this fees will be expensed when it is incurred. In Addition, IT would charge X department the use of computer time at the rate of $394, for an estimated of 182 hours of computer time per year to run the new software under either alternative, #1 or #2. You were informed that the discount rate is 15%. The corporate tax of your company is 35%. Below is the saving (before tax) generated by each investment alternative Year 1 #1 $86,000 $86,000 $67,000 $56,000 $39,000 #2 $118,000 $130,000 $106,000 $98,000 $59,000 This section requires to show detail calculations. Which investment alternative do you select? Why? If calculations are not presented, the grade will be zero. Requirement #5: Ch 14: Calculating the cost of equity for your selected company using CAPM. Considering a 5% Risk Free Rate (which is the interest for the three-month Treasury bills). Using the Beta for your selected company: a) Use the average Canadian Common stock market return (11%) to calculate the market risk premium. b) What is the beta of your selected company? Requirement #6: Ch. 13 Portfolio Beta Assuming that your company has $10,000,000 Canadian dollars to invest in an equally weighted portfolio consisting of Nike, Kelloge, Royal Bank of Canada, and Canadian Tire. What is the portfolio beta of your portfolio? You need to submit your screenshots (4), one for each company, and your calculations. 5 Requirement #7: Ch 14: Using the Risk Free rate (2 % Risk Free Rate) and assuming a 14 percent market risk premium, a) What is the cost of equity for your selected company using CAPM? b) You now need to calculate the cost of debt (after tax YTM) for your selected company. Use the info from Requirement 3c. c) What is the total market value if this bond (use markets insider to find other bond issues and the related price) Requirement #8 In addition to answer the Financial Management Question (above), this project will include: One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Shareholder. One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Bondholders. One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Senior Management. One page (double space, 12 font): What are the Financial Management Strengths and Weaknesses of the firm? One page (double space, 12 font): clearly state your Financial Management Recommendations to improve your selected company's financial position. Reference (APA style) . . Kellogg's Kellogg Company 2019 Annual Report SEC Form 10-K and Supplemental Information Fiscal Year End: December 28, 2019 / 128 60 UN Find balance shoot DOCTO balance sheet (44) Kellogg's Add to watch KELLOGG CO.EO-NOTES 2016(16/24) lond 103.50 -0.27 (-0.27%) 15012021 10 ISIN, or International Securities Identification Number, Bond Data ISIN XS1410417544 Name KELLOGG CO. 16/24 Country USA ISSUEANCE ISSUEANCE Issuer Kellogg Co. Issue Volume 600,000,000 Currency EUR Issue Price 99.46 Issue Date 5/19/2016 COUPON Coupon 1.000% Denomination 1000 Quotation Type Payment Type regular interest 11 Payment Type regular interest Special Coupon Type Maturity Date 5/17/2024 Coupon Payment Date 5/17/2021 Payment Frequency No. of Payments per Year 1.0 Coupon Start Date 5/17/2017 Final Coupon Date 5/16/2024 Floater? No US487836BQ08 4/1/2046 4.5000% 3.0136% US487836AT55 4/1/2031 74500% 1.9206% US487836BP25 4/1/2026 3.2500X 09850s Moody's Rating Risk Low Medium High 6 Moody's Daily Credit Risk Score is a 1-10 score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. The score provides a forward- looking, one-year measure of credit risk, allowing investors to make better decisions and Kellogg's Dividend Info. Gogle kellogg's yahoo finance Q Alle New Shopping Images Videos More Settings Tools About 137,000 results (0.50 seconds) finance yahoo.com quote Kellogg Company (K) - Yahoo Finance Find the latest Kellogg Company (K) stock quote, history, news and other vital information to help you with your lock wading and vesting You visited this page on 10/04/20 Kellogg Company (K) Stock Forum & Discussion Find the latest Kellogo Company Find the latest Kellogo Company (K) stock quote, history, news stock discussion in Yahoo Kellogg Company (K) Chart Discover historical prices for Interactive Chart for Kaloog stock on Yahoo Fiance View Company (1) anwyse althe Historical Data Kellogg Company C). NYSE - NYSE Delayed Price More results from yahoo.com Kellogg Company (K) NYSE - Nasdaq Real Time Price Currency in USO Add to watchlist 63.34 +0.62 (+0.99%) As of 11 21AM EDT Market open Summary Company Outlook chart Conversations Statistics Historical Data Profile Financials Analysis Options Previous Close 62.72 21.728 10 50 1MM YTD IY SY Max Full screen 6400 Open 62.72 Market Cap Beta (SY Monthly) PE Ratio (TTM) 0.61 Bid 63.25 x 900 20.03 Ask 62.72 Day's Range 02:20 52 Week Range Volume 63.30 x 1000 EPS (TTM) 3.16 62.49.63.66 Oct 27, 2020 Earnings Date Nov 02, 2020 52.66 - 72.88 Forward Dividend & Yield 2.28 (3.64%) 342.790 Ex-Dividend Date Aug 31, 2020 2,058,510 ly Target ut 71.79 Related Research Overvalued Market Update ALD, BP, GS, GS Analyst Report Kellose Co View more 10 AM 12 PM 0 PM Trprised oma mets Av Volume Chart Events Berishendetected Fair Value XX.XX -15% Est. Return View details Performance Outlook Short Mia Term Term www ww Terre ME View all chart portem Kelloge Company) 63.27 0.55 (0.3) to move 3 100MMOTYWY ang pengamananca Master budget My company is Kobe Steel ( the company to use) please read the instructuoon OBJECTIVE: The objective of this individual Financial Management Project is to motivate the students' interest in Financial Management through hands-on experience researching, calculating, analysing and interpreting financial management information. The process will cover topics such as: a) Cash flows, b) Ratio Analysis, c) Bond valuation, d) Stok valuation, e) Making Capital Investment Decisions, f) Capital Asset pricing Model, & g) the Weighted Average Cost of Capital. PURPOSE: The purpose of using the Financial Management Project is to give you a better understanding of corporate financial tools and their applications. You will also learn to research and use a variety of financial internet sources. This project will help you to apply the fundamental of corporate financial management theories for the benefit of your career and to enrich your finance learning experience. 1 PROJECT REQUIREMENTS - CHECK LIST You must include your calculations and the supporting material. Highlight the information used for your calculations. Complete the requirement in the order provided. Clearly identify each requirement. Answers to requirements without calculations/ and or supporting material won't be accepted. Include a reference sheet (use APA) The information used to support your answers should be from a reliable, and well know source. Dit should be computer based; remember you need to show your step-by-step calculation process. Additional information regarding to the submission format will be posted on Bb. A sample report will be shown during an online session. When given an explanation, you need to back it with theory from our textbook. You need to add a reference page Failure to comply with these requirements will seriously affect your grade. On this page your Document source, Highlighting the information Voit ticar in ancuar On this page your Calculations, Answers, Observations 2. FINANCIAL MANAGEMENT REQUIREMENTS: In order to complete the following requirements, you need to use the last annual financial report from your company's web site, which includes the financial statements and notes to the financial statement. Only financial statements and its notes from the firm's official site will be accepted. Financial statements from other sources, such as, Yahoo financial, Google financial, etc., won't be accepted. Requirement # 1: Ch 2: Cash Flow Identify: Using the annual balance sheet and the Income Statement, calculate the cash flow identify a) OCF b) NCS c) changes in NWC d) Is the Net working capital negative or positive? e) Does this indicate any potential difficulty for the company? f) CFA g) CFC h) is the Cash Flow to Creditors Negative? i) Explain how this might come about? j) What is the last total dividend pay? - refer to the Statement of Changes in Equity k) Did the company issue new shares? Yes or no. What is the total dollar value? -refer to the Statement of Changes in Equity 1) Did the company repurchase shares? Yes or no. What is the total dollar value? - refer to the Statement of Changes in Equity m) Based on the information above (from point "a" to "l"), what is your opinion in regards to the cash flow of vour company? Requirement #2: Ch 3: Ratio Analysis Using the financial statements of your assigned company, calculate each of following ratios listed below for the last two years. Calculate: a) Current ratio b) Quick Ratio c) Total Assets Turnover d) Total Debt Ratio = TD/TA e) Debt-Equity Ratio f) Long-Term Debt Ratio = LTD/LTD + TE) g) Times Interest earned = EBIT/Interest h) Cash-coverage ratio = (EBIT + Dep) / Interest 3 i) Profit Margin = NI/S 1) Return on Assets = NI/TA k) Go to yahoo finance and identify the current Price Earning Ration 1) Go to yahoo finance and identify the Dividend per share m) Calculate the Du Pont Identity = NI/S x S/TA X A/E Explain n) What does the Du Pont identity (from point m) tell you about your company? Requirement #3: Ch 7: If your selected company has more than one bond, select one bond and complete the requirement below). If your company does not have bonds, please contact me. Find the following information: a) Maturity date b) coupon rate Calculate: c) Using the nominal value, maturity and coupon rate, (from Markets Insider), calculate (using excel) the yield to Maturity. Include your excel screenshot Identify: d) Is your bond a premium or discount bond? e) What is the rating of your Company's bond? f) What type of Interest rate (fixed or floating) is your bond? g) What is the Bond's ISIN? h) What is the Bond's name? Explain: i) Does this type of bond and features attract you as investor? Why? Why not? Explain. Requirement # 4: Ch 8: Stock Valuation. Find your company's stock value at year end. See your statement of financial position date. Use the link below to find information about your company's dividend: https://ca.finance.yahoo.com/ a) Locate your company's annual dividend per share and calculate the dividend yield. b) Using your answer from a) and the 25 percent dividend growth rate. What is the required return for shareholders? c) Suppose instead that you know that the required return is 20 percent. What price should your selected company stock sell for now? d) What do you conclude from the above information? Requirement #4: This section is a hypothetical scenario that requires to apply material from chapter 10. In this section, you need to evaluate two investment alternatives #1 and #2. The X department (in your company) suggests purchasing new computer software to reduce costs. There are two competitive software in the market, alternative #1, $194,000 and # 2, $336,000 Based on the Canadian Tax Act, software should be depreciated with a CCA of 30%. After five years, the salvage value of either investment is 0. It would hire a professional adviser under either investment alternative to help in the decision making whether to invest in the alternative for a fee of $25,000 and this fees will be expensed when it is incurred. In Addition, IT would charge X department the use of computer time at the rate of $394, for an estimated of 182 hours of computer time per year to run the new software under either alternative, #1 or #2. You were informed that the discount rate is 15%. The corporate tax of your company is 35%. Below is the saving (before tax) generated by each investment alternative Year 1 #1 $86,000 $86,000 $67,000 $56,000 $39,000 #2 $118,000 $130,000 $106,000 $98,000 $59,000 This section requires to show detail calculations. Which investment alternative do you select? Why? If calculations are not presented, the grade will be zero. Requirement #5: Ch 14: Calculating the cost of equity for your selected company using CAPM. Considering a 5% Risk Free Rate (which is the interest for the three-month Treasury bills). Using the Beta for your selected company: a) Use the average Canadian Common stock market return (11%) to calculate the market risk premium. b) What is the beta of your selected company? Requirement #6: Ch. 13 Portfolio Beta Assuming that your company has $10,000,000 Canadian dollars to invest in an equally weighted portfolio consisting of Nike, Kelloge, Royal Bank of Canada, and Canadian Tire. What is the portfolio beta of your portfolio? You need to submit your screenshots (4), one for each company, and your calculations. 5 Requirement #7: Ch 14: Using the Risk Free rate (2 % Risk Free Rate) and assuming a 14 percent market risk premium, a) What is the cost of equity for your selected company using CAPM? b) You now need to calculate the cost of debt (after tax YTM) for your selected company. Use the info from Requirement 3c. c) What is the total market value if this bond (use markets insider to find other bond issues and the related price) Requirement #8 In addition to answer the Financial Management Question (above), this project will include: One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Shareholder. One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Bondholders. One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Senior Management. One page (double space, 12 font): What are the Financial Management Strengths and Weaknesses of the firm? One page (double space, 12 font): clearly state your Financial Management Recommendations to improve your selected company's financial position. Reference (APA style) . . Kellogg's Kellogg Company 2019 Annual Report SEC Form 10-K and Supplemental Information Fiscal Year End: December 28, 2019 / 128 60 UN Find balance shoot DOCTO balance sheet (44) Kellogg's Add to watch KELLOGG CO.EO-NOTES 2016(16/24) lond 103.50 -0.27 (-0.27%) 15012021 10 ISIN, or International Securities Identification Number, Bond Data ISIN XS1410417544 Name KELLOGG CO. 16/24 Country USA ISSUEANCE ISSUEANCE Issuer Kellogg Co. Issue Volume 600,000,000 Currency EUR Issue Price 99.46 Issue Date 5/19/2016 COUPON Coupon 1.000% Denomination 1000 Quotation Type Payment Type regular interest 11 Payment Type regular interest Special Coupon Type Maturity Date 5/17/2024 Coupon Payment Date 5/17/2021 Payment Frequency No. of Payments per Year 1.0 Coupon Start Date 5/17/2017 Final Coupon Date 5/16/2024 Floater? No US487836BQ08 4/1/2046 4.5000% 3.0136% US487836AT55 4/1/2031 74500% 1.9206% US487836BP25 4/1/2026 3.2500X 09850s Moody's Rating Risk Low Medium High 6 Moody's Daily Credit Risk Score is a 1-10 score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. The score provides a forward- looking, one-year measure of credit risk, allowing investors to make better decisions and Kellogg's Dividend Info. Gogle kellogg's yahoo finance Q Alle New Shopping Images Videos More Settings Tools About 137,000 results (0.50 seconds) finance yahoo.com quote Kellogg Company (K) - Yahoo Finance Find the latest Kellogg Company (K) stock quote, history, news and other vital information to help you with your lock wading and vesting You visited this page on 10/04/20 Kellogg Company (K) Stock Forum & Discussion Find the latest Kellogo Company Find the latest Kellogo Company (K) stock quote, history, news stock discussion in Yahoo Kellogg Company (K) Chart Discover historical prices for Interactive Chart for Kaloog stock on Yahoo Fiance View Company (1) anwyse althe Historical Data Kellogg Company C). NYSE - NYSE Delayed Price More results from yahoo.com Kellogg Company (K) NYSE - Nasdaq Real Time Price Currency in USO Add to watchlist 63.34 +0.62 (+0.99%) As of 11 21AM EDT Market open Summary Company Outlook chart Conversations Statistics Historical Data Profile Financials Analysis Options Previous Close 62.72 21.728 10 50 1MM YTD IY SY Max Full screen 6400 Open 62.72 Market Cap Beta (SY Monthly) PE Ratio (TTM) 0.61 Bid 63.25 x 900 20.03 Ask 62.72 Day's Range 02:20 52 Week Range Volume 63.30 x 1000 EPS (TTM) 3.16 62.49.63.66 Oct 27, 2020 Earnings Date Nov 02, 2020 52.66 - 72.88 Forward Dividend & Yield 2.28 (3.64%) 342.790 Ex-Dividend Date Aug 31, 2020 2,058,510 ly Target ut 71.79 Related Research Overvalued Market Update ALD, BP, GS, GS Analyst Report Kellose Co View more 10 AM 12 PM 0 PM Trprised oma mets Av Volume Chart Events Berishendetected Fair Value XX.XX -15% Est. Return View details Performance Outlook Short Mia Term Term www ww Terre ME View all chart portem Kelloge Company) 63.27 0.55 (0.3) to move 3 100MMOTYWY ang pengamananca