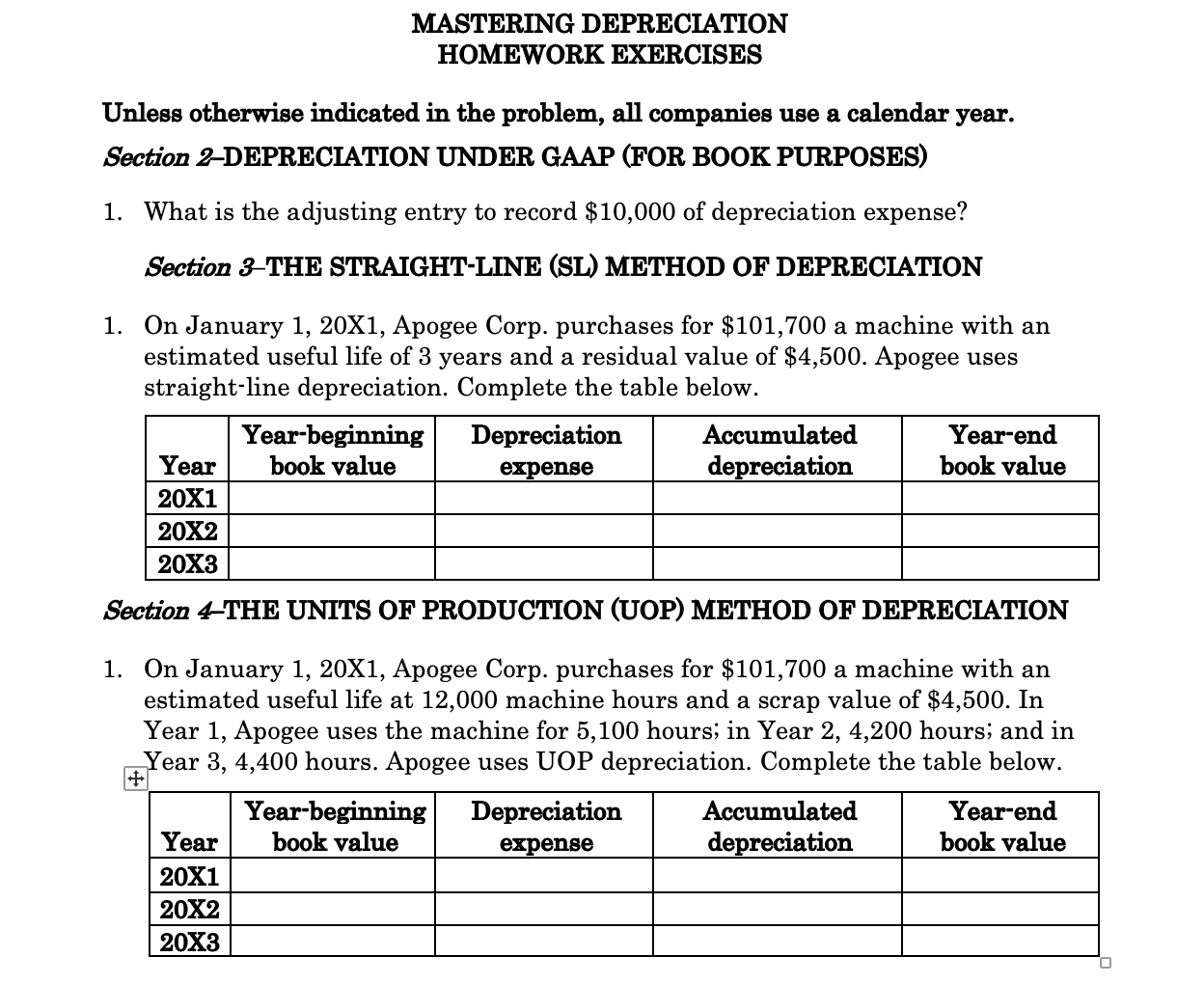

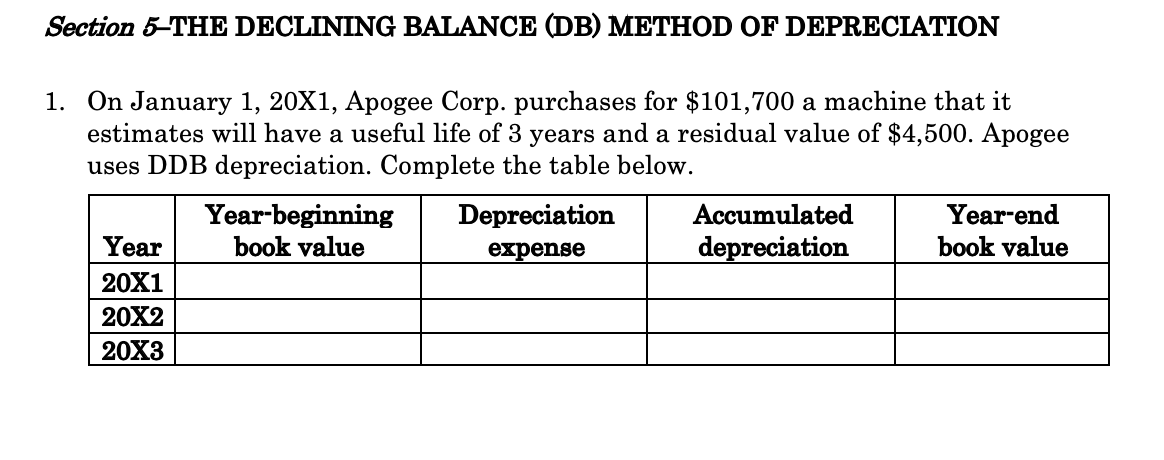

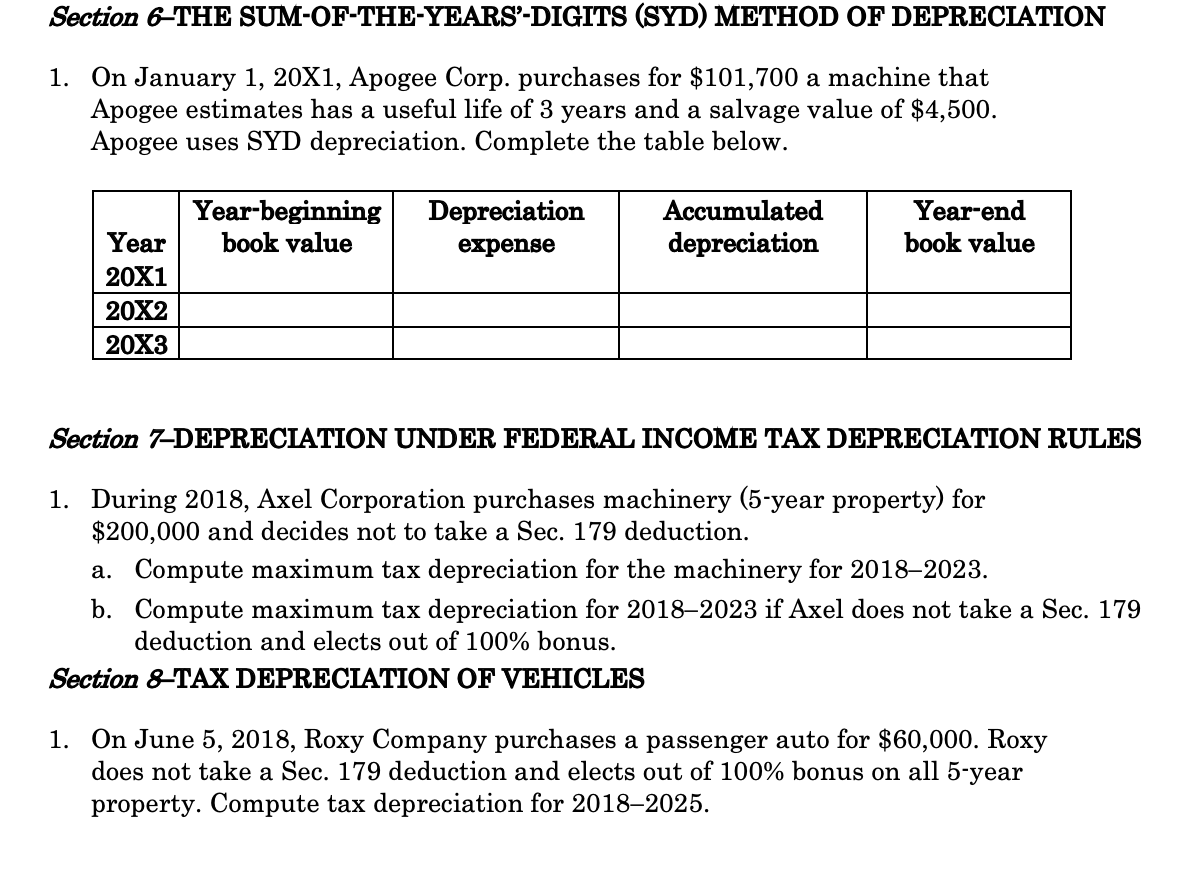

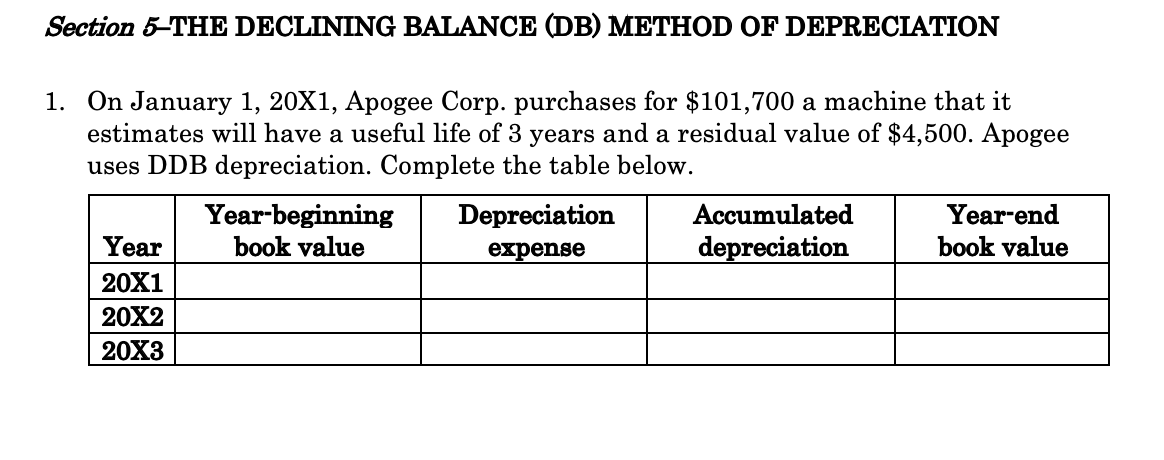

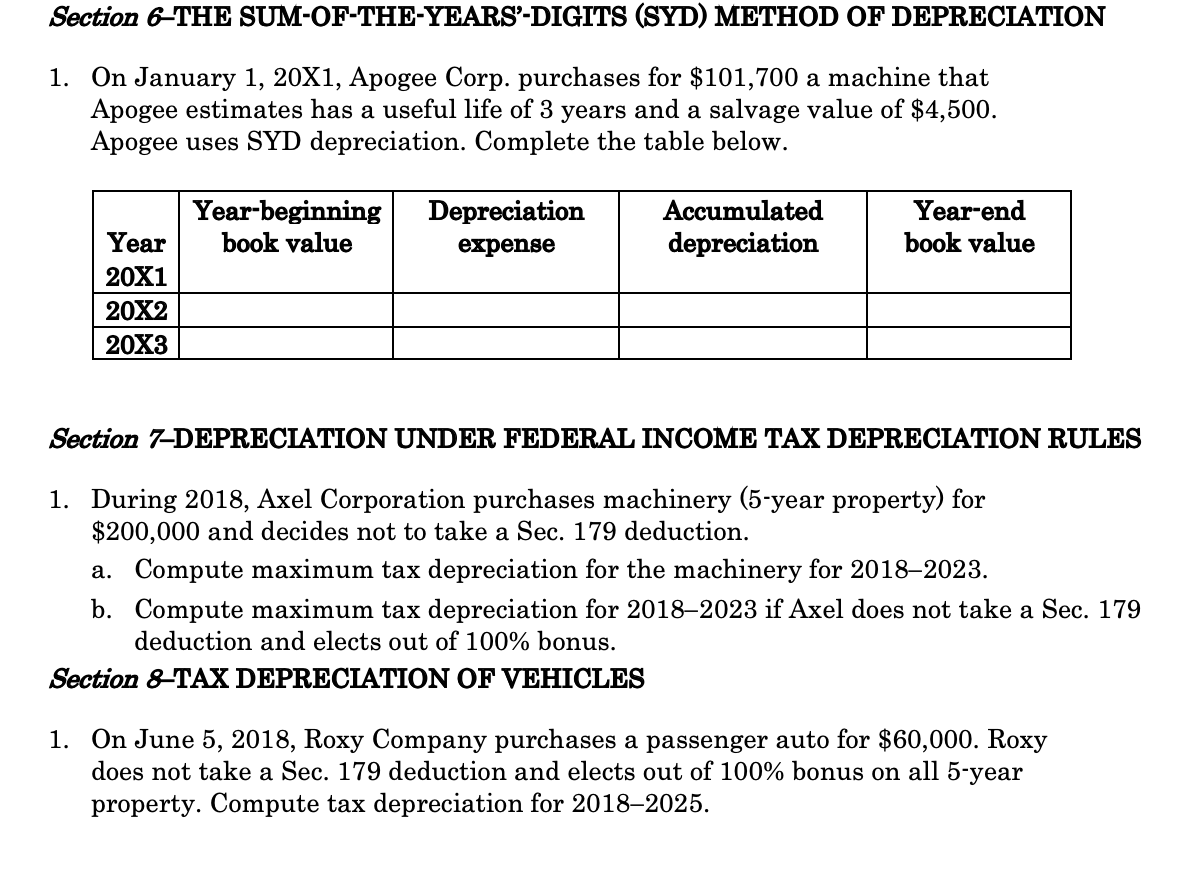

MASTERING DEPRECIATION HOMEWORK EXERCISES Unless otherwise indicated in the problem, all companies use a calendar year. Section 2-DEPRECIATION UNDER GAAP (FOR BOOK PURPOSES) 1. What is the adjusting entry to record $10,000 of depreciation expense? Section 3-THE STRAIGHT-LINE (SL) METHOD OF DEPRECIATION 1. On January 1, 20X1, Apogee Corp. purchases for $101,700 a machine with an estimated useful life of 3 years and a residual value of $4,500. Apogee uses straight-line depreciation. Complete the table below. Year-beginning Depreciation Accumulated Year-end Year book value expense depreciation book value 20X1 20X2 20X3 Section 4-THE UNITS OF PRODUCTION (UOP) METHOD OF DEPRECIATION 1. On January 1, 20X1, Apogee Corp. purchases for $101,700 a machine with an estimated useful life at 12,000 machine hours and a scrap value of $4,500. In Year 1, Apogee uses the machine for 5,100 hours; in Year 2, 4,200 hours; and in Year 3, 4,400 hours. Apogee uses UOP depreciation. Complete the table below. + Year-beginning book value Depreciation expense Accumulated depreciation Year-end book value Year 20X1 20X2 20X3 Section 5-THE DECLINING BALANCE (DB) METHOD OF DEPRECIATION 1. On January 1, 20X1, Apogee Corp. purchases for $101,700 a machine that it estimates will have a useful life of 3 years and a residual value of $4,500. Apogee uses DDB depreciation. Complete the table below. Year-beginning Depreciation Accumulated Year-end Year book value expense depreciation book value 20X1 20X2 20X3 Section 6-THE SUM-OF-THE-YEARS-DIGITS (SYD) METHOD OF DEPRECIATION 1. On January 1, 20X1, Apogee Corp. purchases for $101,700 a machine that Apogee estimates has a useful life of 3 years and a salvage value of $4,500. Apogee uses SYD depreciation. Complete the table below. Year-beginning book value Depreciation expense Accumulated depreciation Year-end book value Year 20X1 20X2 20X3 Section 7-DEPRECIATION UNDER FEDERAL INCOME TAX DEPRECIATION RULES 1. During 2018, Axel Corporation purchases machinery (5-year property) for $200,000 and decides not to take a Sec. 179 deduction. a. Compute maximum tax depreciation for the machinery for 20182023. b. Compute maximum tax depreciation for 20182023 if Axel does not take a Sec. 179 deduction and elects out of 100% bonus. Section & TAX DEPRECIATION OF VEHICLES 1. On June 5, 2018, Roxy Company purchases a passenger auto for $60,000. Roxy does not take a Sec. 179 deduction and elects out of 100% bonus on all 5-year property. Compute tax depreciation for 20182025