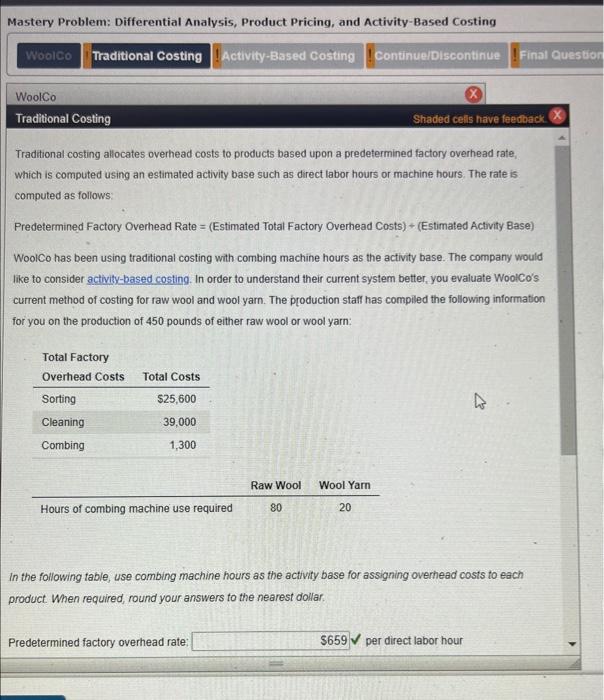

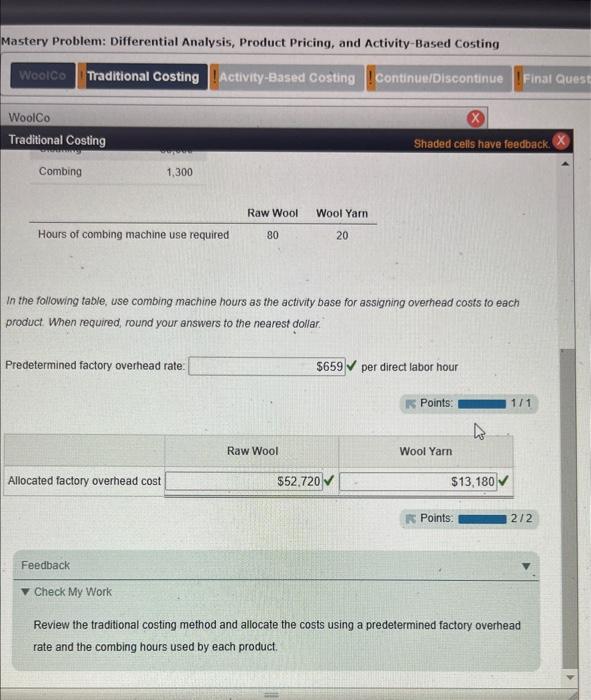

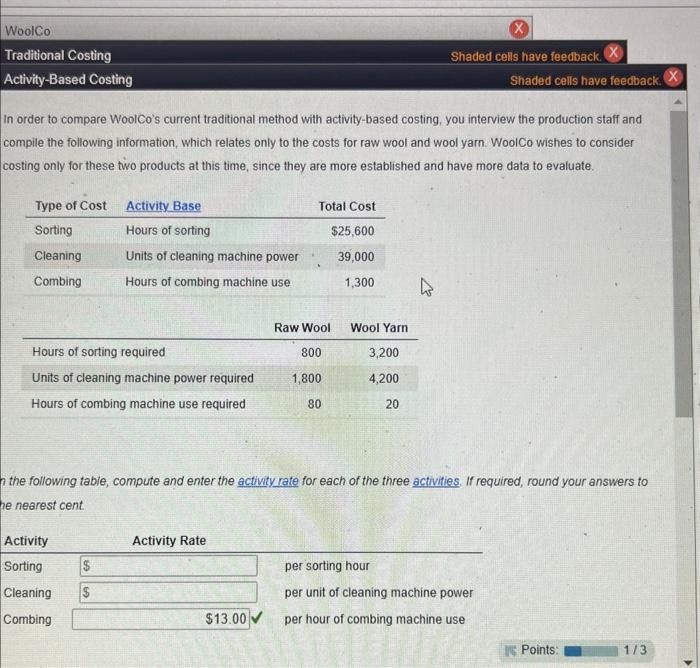

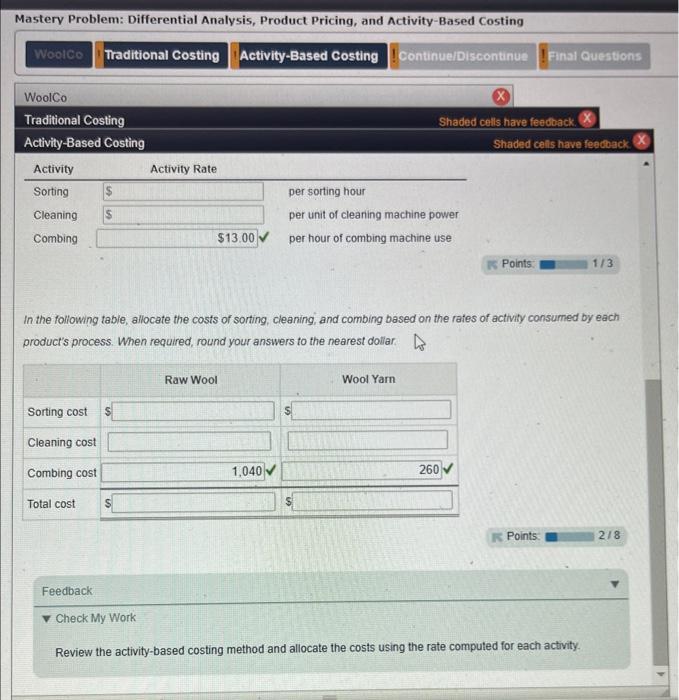

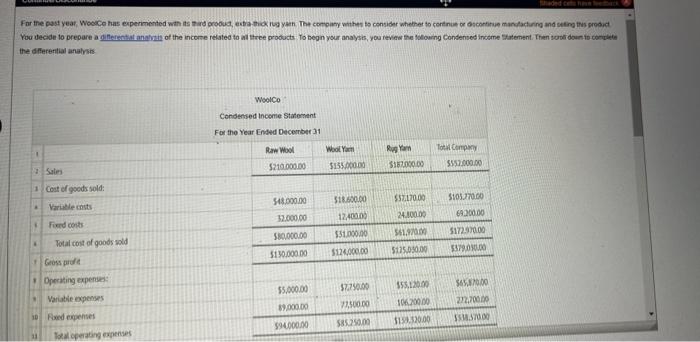

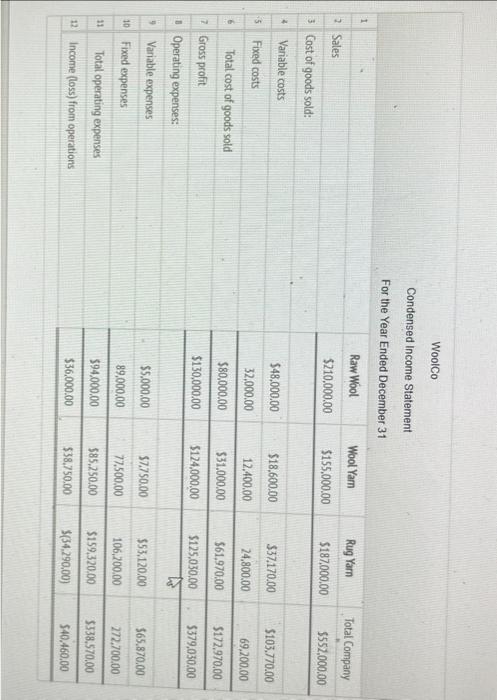

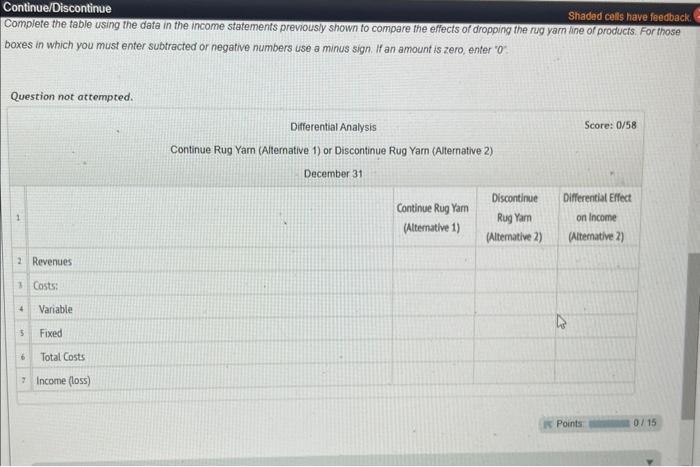

Mastery Problem: Differential Analysis, Product Pricing, and Activity-Based Costing WoolCo WoolCo buys sheep's wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning overhead to products. You've just been hired as a production manager at WoolCo Currently WoolCo makes three products: (1) raw, clean wool to be used as stuffing or insulation; (2) wool yarn for use in the textile industry, and (3) extra-thick yarn for use in rugs. The company would like you to evaluate its costing methods for its raw wool and wool yarn. Upper management would also like your recommendations regardihg a production decision regarding their current and proposed product lines. Mastery Problem: Differential Analysis, Product Pricing, and Activity-Based Costing WoolCo Traditional Costing Shaded cells have feedback. Traditional costing allocates overhead costs to products based upon a predetermined factory overhead rate. which is computed using an estimated activity base such as direct labor hours or machine hours. The rate is computed as follows: Predetermined Factory Overhead Rate =( Estimated Total Factory Overhead Costs )+( Estimated Activity Base ) WoolCo has been using traditional costing with combing machine hours as the activity base. The company would like to consider activity-based costing. In order to understand their current system better, you evaluate WoolCo's current method of costing for raw wool and wool yarn. The production staff has compiled the following information for you on the production of 450 pounds of either raw wool or wool yarn: In the following table, use combing machine hours as the activity base for assigning overhead costs to each product. When required, round your answers to the nearest dollar. Predetermined factory overhead rate: per direct labor hour In the following table, use combing machine hours as the activity base for assigning overhead costs to each oroduct. When required, round your answers to the nearest dollar. Predetermined factory overhead rate: per direct labor hour Feedback Check My Work Review the traditional costing method and allocate the costs using a predetermined factory overhead rate and the combing hours used by each product. In order to compare WoolCo's current traditional method with activity-based costing, you interview the production staff and compile the following information, which relates only to the costs for raw wool and wool yam. WoolCo wishes to consider costing only for these two products at this time, since they are more established and have more data to evaluate. the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to e nearest cent. In the following table, allocate the costs of sorting, cleaning, and combing based on the rates of activity consumed by each product's process. When required, round your answers to the nearest dollar. Feedback Check My Work Review the activity-based costing method and allocate the costs using the rate computed for each activity. You decide to prepare the dfereritial aratrsis WoolCo Condensed Income Statement For the Year Ended December 31 Complete the table using the data in the income statements previousiy shown fo compare the effects of dropping the rug yam line of products. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If an amount is zero, enter " 0 ". Question not attempted. Mastery Problem: Differential Analysis, Product Pricing, and Activity-Based Costing WoolCo WoolCo buys sheep's wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning overhead to products. You've just been hired as a production manager at WoolCo Currently WoolCo makes three products: (1) raw, clean wool to be used as stuffing or insulation; (2) wool yarn for use in the textile industry, and (3) extra-thick yarn for use in rugs. The company would like you to evaluate its costing methods for its raw wool and wool yarn. Upper management would also like your recommendations regardihg a production decision regarding their current and proposed product lines. Mastery Problem: Differential Analysis, Product Pricing, and Activity-Based Costing WoolCo Traditional Costing Shaded cells have feedback. Traditional costing allocates overhead costs to products based upon a predetermined factory overhead rate. which is computed using an estimated activity base such as direct labor hours or machine hours. The rate is computed as follows: Predetermined Factory Overhead Rate =( Estimated Total Factory Overhead Costs )+( Estimated Activity Base ) WoolCo has been using traditional costing with combing machine hours as the activity base. The company would like to consider activity-based costing. In order to understand their current system better, you evaluate WoolCo's current method of costing for raw wool and wool yarn. The production staff has compiled the following information for you on the production of 450 pounds of either raw wool or wool yarn: In the following table, use combing machine hours as the activity base for assigning overhead costs to each product. When required, round your answers to the nearest dollar. Predetermined factory overhead rate: per direct labor hour In the following table, use combing machine hours as the activity base for assigning overhead costs to each oroduct. When required, round your answers to the nearest dollar. Predetermined factory overhead rate: per direct labor hour Feedback Check My Work Review the traditional costing method and allocate the costs using a predetermined factory overhead rate and the combing hours used by each product. In order to compare WoolCo's current traditional method with activity-based costing, you interview the production staff and compile the following information, which relates only to the costs for raw wool and wool yam. WoolCo wishes to consider costing only for these two products at this time, since they are more established and have more data to evaluate. the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to e nearest cent. In the following table, allocate the costs of sorting, cleaning, and combing based on the rates of activity consumed by each product's process. When required, round your answers to the nearest dollar. Feedback Check My Work Review the activity-based costing method and allocate the costs using the rate computed for each activity. You decide to prepare the dfereritial aratrsis WoolCo Condensed Income Statement For the Year Ended December 31 Complete the table using the data in the income statements previousiy shown fo compare the effects of dropping the rug yam line of products. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If an amount is zero, enter " 0 ". Question not attempted