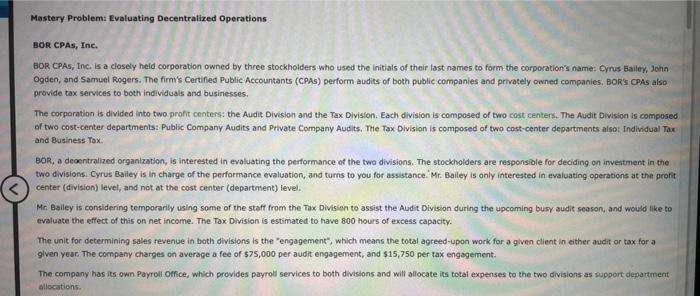

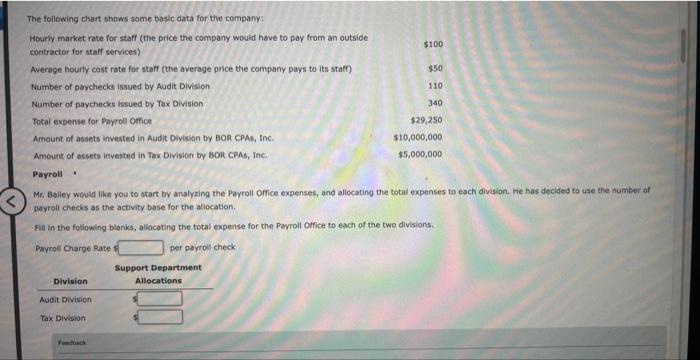

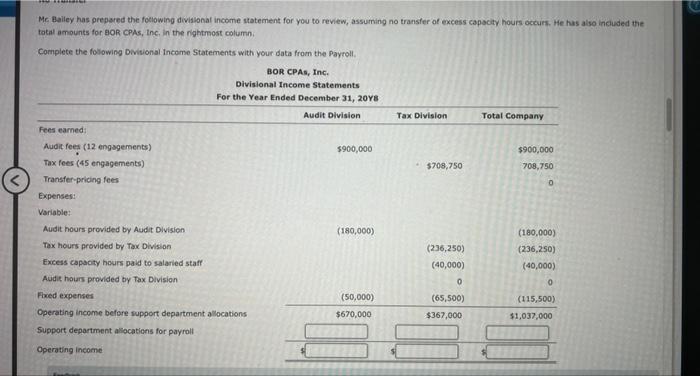

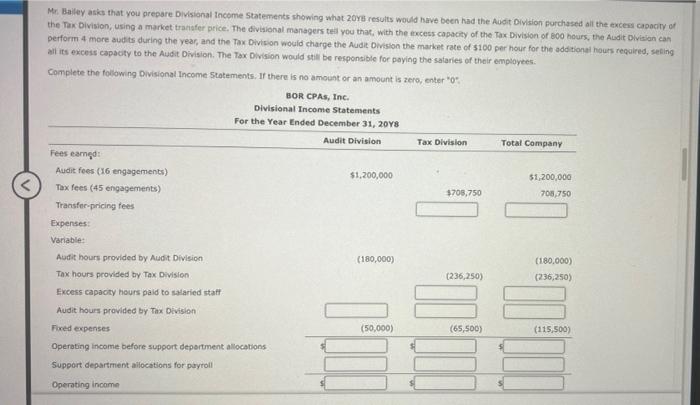

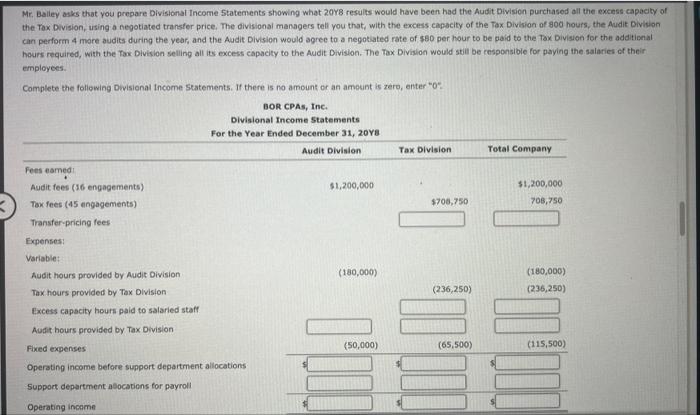

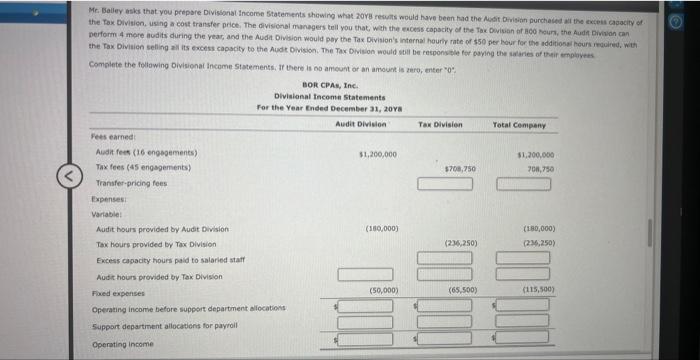

Mastery Problem: Evaluating Decentralized Operations BOR CPAs, Inc. BOR, CPAS, Inc. is a closely held corporation owned by three stockholders who used the initials of their last names to form the corporation's name: Cyrus Bailey, 3ohn Ogden, and Samuel Rogers. The firm's Certified Public Accountants (CPAs) perform audits of both public companies and privately owned companies, BOR's CPAs also provide tax services to both individuals and businesses. The corporation is divided into two profit centers: the Audit Division and the Tax Division. Each division is composed of two cost centers. The Audit Division is composed of two cost-center departments: Public Company Audits and Private Company Audits. The Tax Division is composed of two cost-center departments also: Individual Tax and Business Tox. BOR, a deoentralized organization, is interested in evaluating the performance of the two divisions. The stockholders are responsiole for deciding on invertment in the two divisions. Cyrus Bailey is in charge of the performance evaluation, and turns to you for assistance. Mr. Bailey is only interested in evaluating operations at the profit center (division) level, and not at the cost center (department) level. Mr. Bailey is considering temporarly using some of the staft from the Tax Division to assist the Audit Division during the upcoming busy audit season, and would like to evaluate the effect of this on net income. The Tax.Division is estimated to have 800 hours of excess capacity. The unit for determining sales fevenue in both divisions is the "engagement", which means the total agreed-upon work for a given client in either audit or tax for a glven year. The company charges on average a fee of $75,000 per audit engagement, and $15,750 per tax engagement. The company has its own Payroll office, which provides payroll services to both divisions and will allocate its total expenses to the two divisions as support department Allocations. Mr. Bsiley would like you to start by analyzing the Payroll orfice expenses, and allocating the total expenses to each division. He has decided to use the number of payroll checks as the activity base for the aliocation. Fill in the following blenks, allocating the total expense for the Payroll Oifice to each of the two divisions. Payroll Charge Rate? per payroll check Me Bailey has prepsred the foclowing divislonal income statement for you to review, assuming no transfer of excess capscity hours occurs. He has also inciuded the total amounts for GOR CPAs, Inc, in the rightmost column. Complete the following DNisional income Statements with your data from the Payroll. Mr. Bailey asks that you prepare Divisional income Statements showing what 20 orb results would have been had the Audit Oiylsion purchased ait the excess capaciry of the Tax Bivision; using a market tranafer price. The divisional mantgers teil you that, with the excess capacity of the Tax Division of 80o hours, the Audit Divisian can perform 4 more audits during the year, and the Tax Oivision would charge the Audit Division the market rate of s1oo per hour for the add tional hours required, sebing ait its excess capacty to the Audit Division. The Tax Division would still be respontible for paying the sataries of their employees: Complete the following Divisional Income Stotements, If there is no amount or an amount is zero, enter "0* Mr. Baliey asks that you prepare Divisional Income Statements showing what 20 B results would have been had the Audit Division purchased all the excess capaeity of the Tax Division, using a negotiated transter price. The divisional managers tell you that; with the excess capacity of the Tax Division of goo hours, the Audit Division can perform 4 mare audits during the vear, and the Audit Division would agree to a negotiated rate of sb0 per hour to be paid to the Tox Division for the additional hours required, with the Tax Division selling all its excess eapacity to the Audit Division. The Tox Division would still be responsibie for paying the salaries of their employees. Complete the foliowing Dwisional Income Statements. If there is no amount or an amount is zero, enter "0". Mr. Balley asks that you prepore Divissonat Incoroe Statements showing what zorg results would have bean had the Must Drision purcheied ait the exceit cadacity of Comniete the folbwing Divisionat Income Ststements, If there is 00 amount or an amount is anro, enter "0