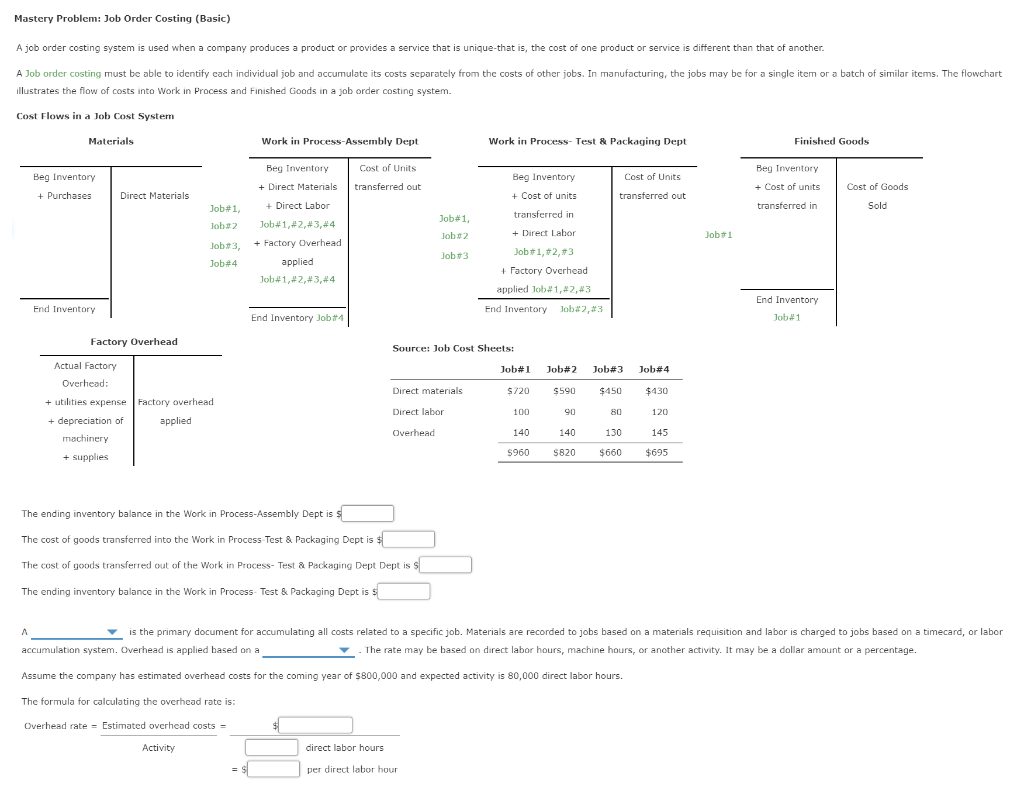

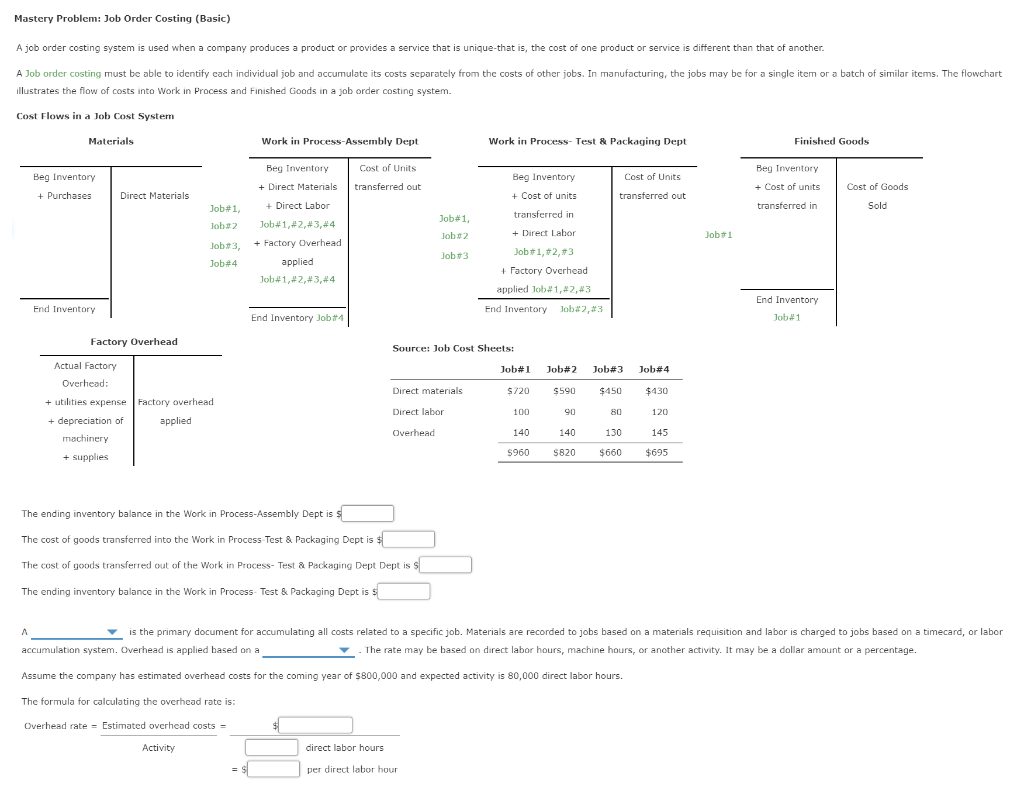

Mastery Problem: Job Order Costing (Basic) A job order costing system is used when a company produces a product or provides a service that is unique that is, the cost of one product or service is different than that of another. A Job order costing must be able to identify each individual job and accumulate its costs separately from the costs of other jobs. In manufacturing, the jobs may be for a single item or a batch of similar items. The flowchart illustrates the flow of costs into Work in Process and Finished Goods in a job order costing system. Cost Flows in a Job Cost System Materials Work in Process-Assembly Dept Work in Process- Test & Packaging Dept Finished Goods Beg Inventory Cost of Units transferred out Beg Inventory Beg Inventory + Purchases Cost of Units + Cost of units Direct Materials transferred out Cost of Goods Sold transferred in Job#1, Job#2 Job3 Job#4 Beg Inventory + Direct Materials + Direct Labor Job#1, #2, #3,#4 + Factory Overhead applied Job+1,#2, #3,#4 Job#1, Job2 Jobti Job3 + Cost of units transferred in + Direct Labor Job#1, #2, #3 + Factory Overhead applied Job#1, #2,43 End Inventory Job#2 #3 End Inventory End Inventory End Inventory Job#4 Job#1 Factory Overhead Source: Job Cost Sheets: Job#1 Job#2 Job#3 Job#4 Direct materials Factory overhead Actual Factory Overhead: + utilities expense + depreciation of machinery + supplies Direct labor applied $720 100 140 $960 $590 90 140 $820 $450 80 130 $660 $430 120 145 $695 Overhead The ending inventory balance in the Work in Process Assembly Dept is s The cost of goods transferred into the Work in Process Test & Packaging Dept is $ The cost of goods transferred out of the Work in Process- Test & Packaging Dept Dept is s The ending inventory balance in the Work in Process- Test & Packaging Dept is s is the primary document for accumulating all costs related to a specific job. Materials are recorded to jobs based on a materials requisition and labor is charged to jobs based on a timecard, or labor accumulation system. Overhead is applied based on a - The rate may be based on direct labor hours, machine hours, or another activity. It may be a dollar amount or a percentage. Assume the company has estimated overhead costs for the coming year of $800,000 and expected activity is 80,000 direct labor hours. The formula for calculating the overhead rate is: Overhead rate - Estimated overhead costs = $ Activity direct labor hours per direct labor hour