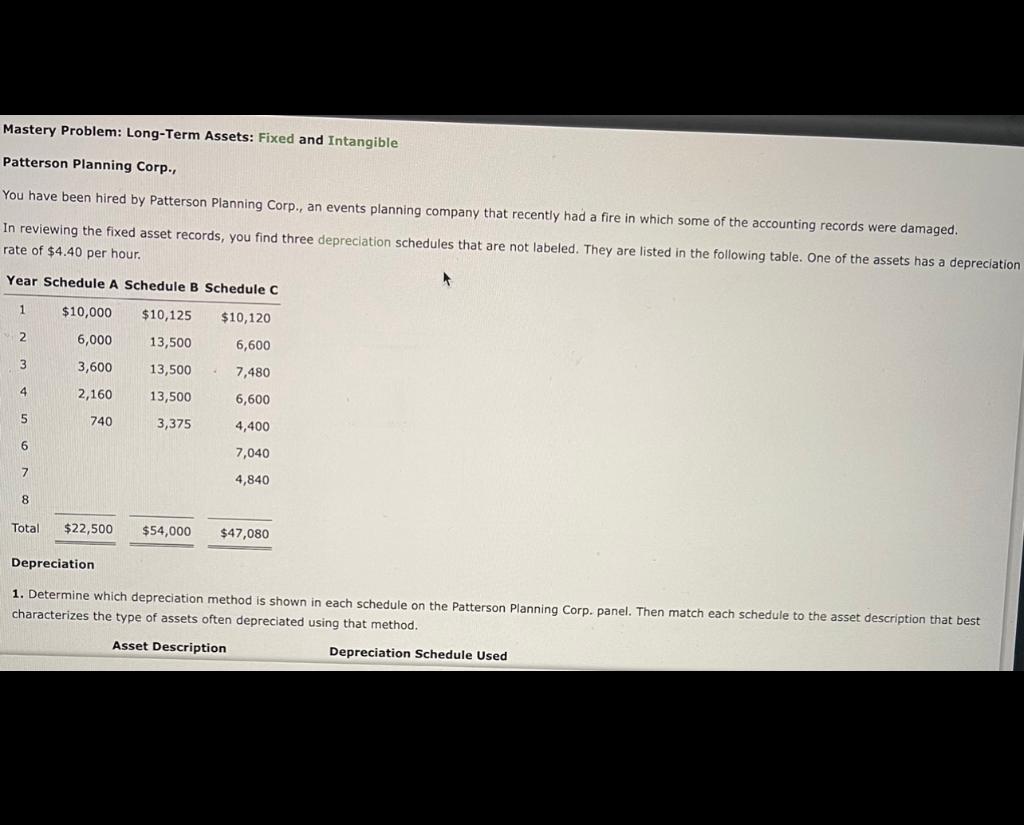

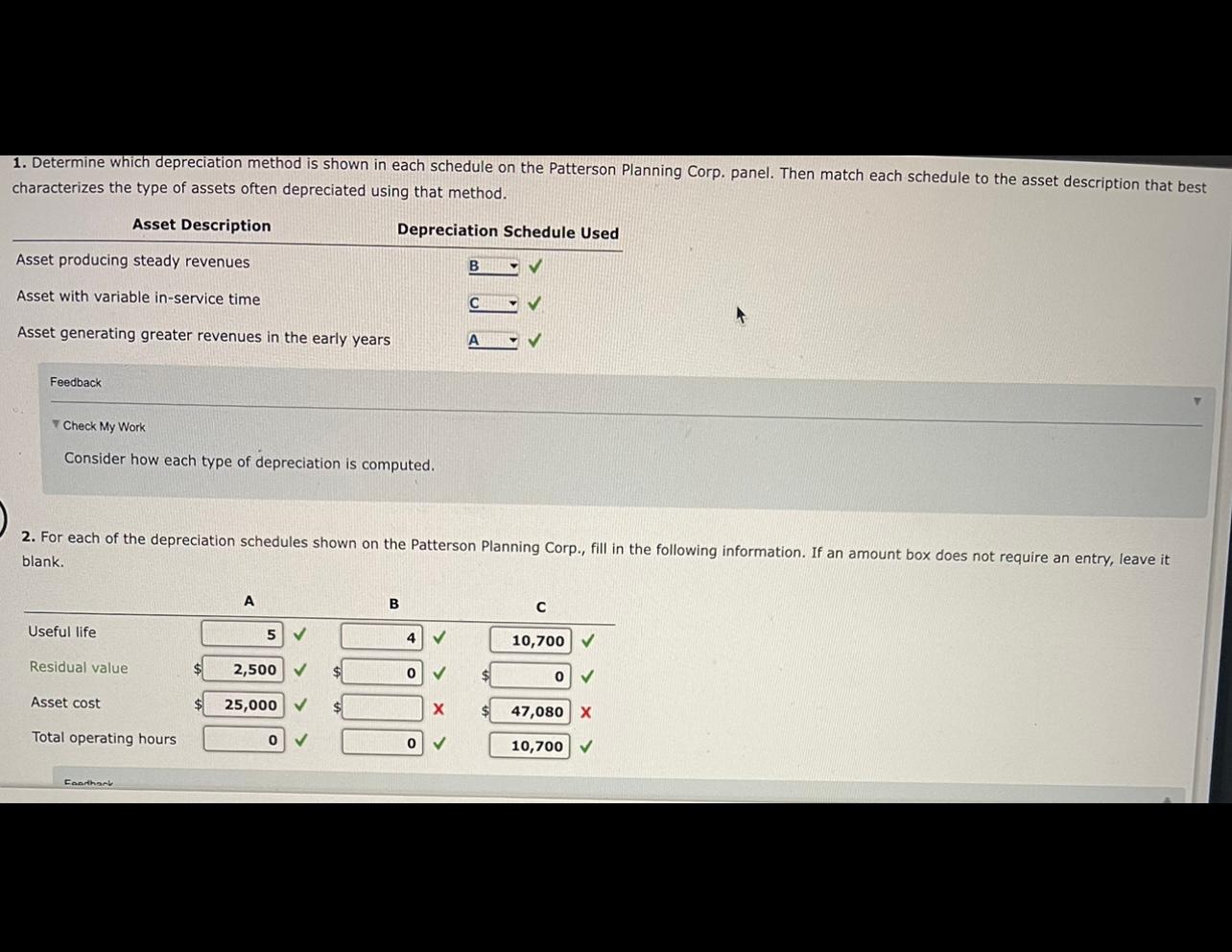

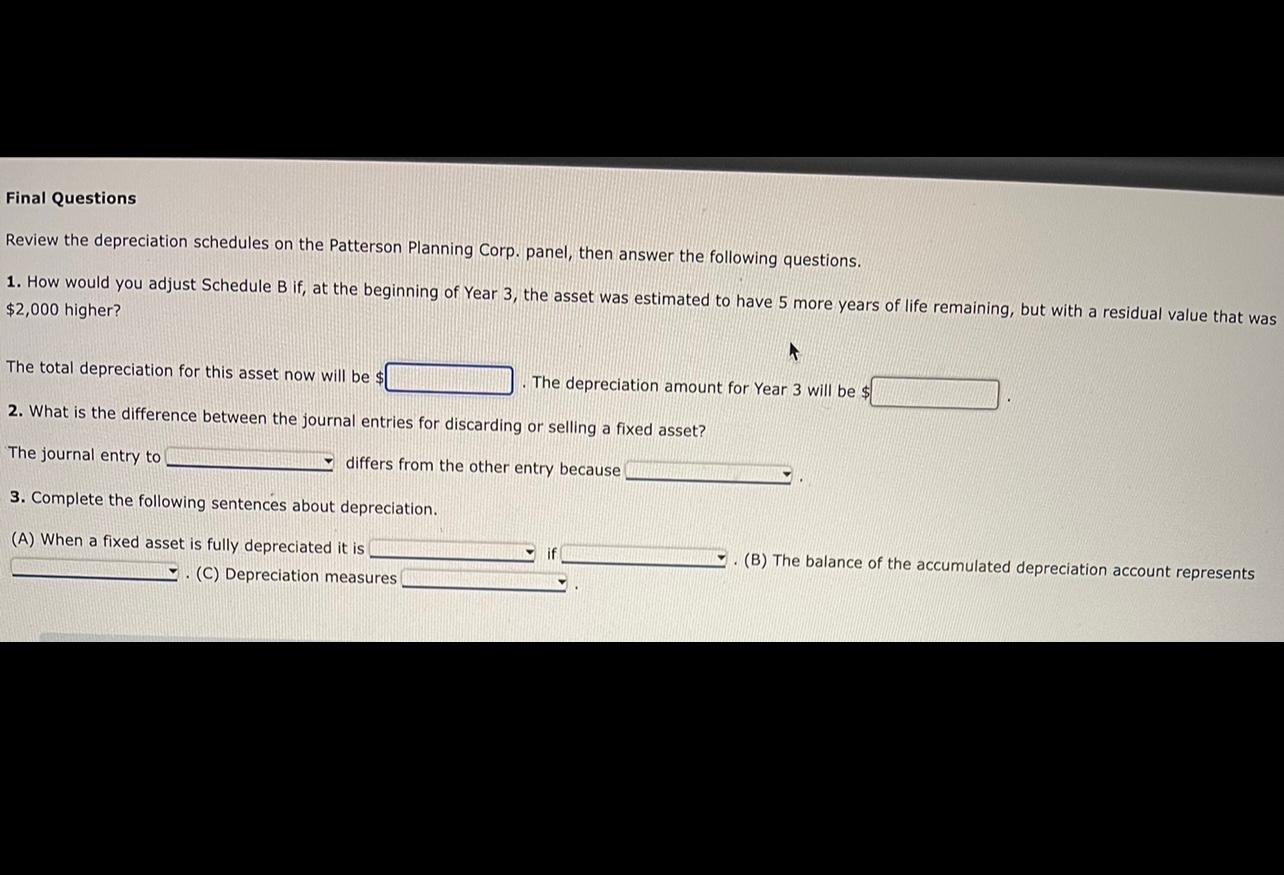

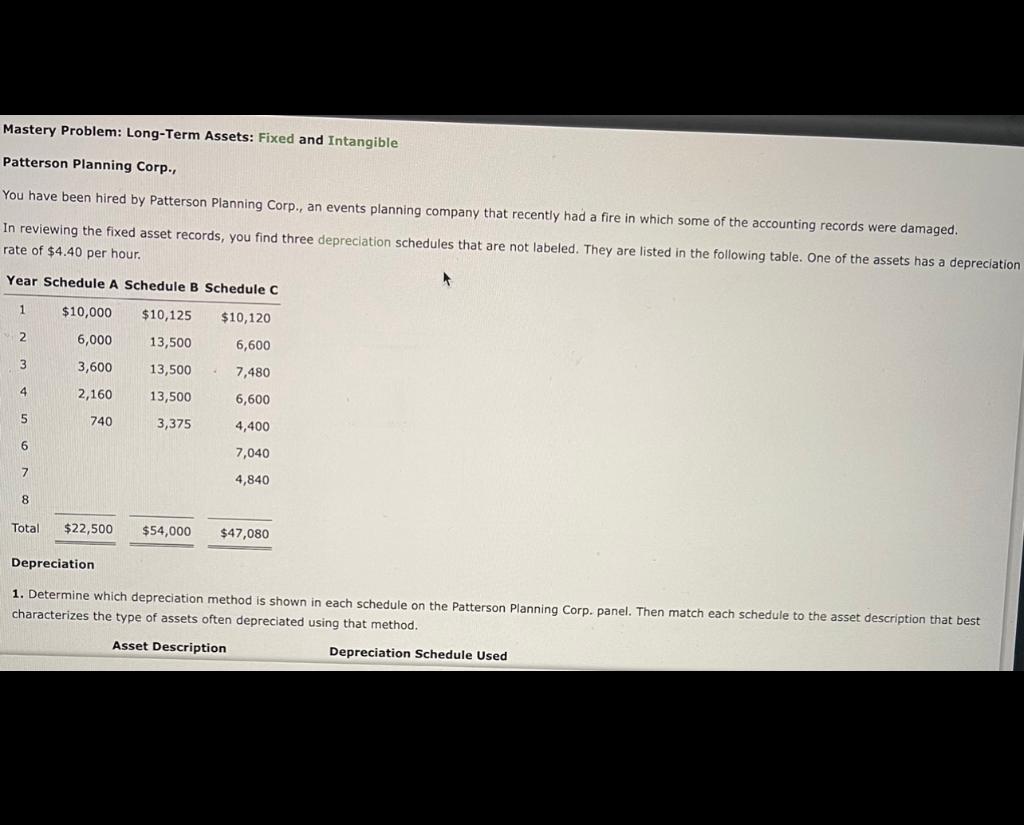

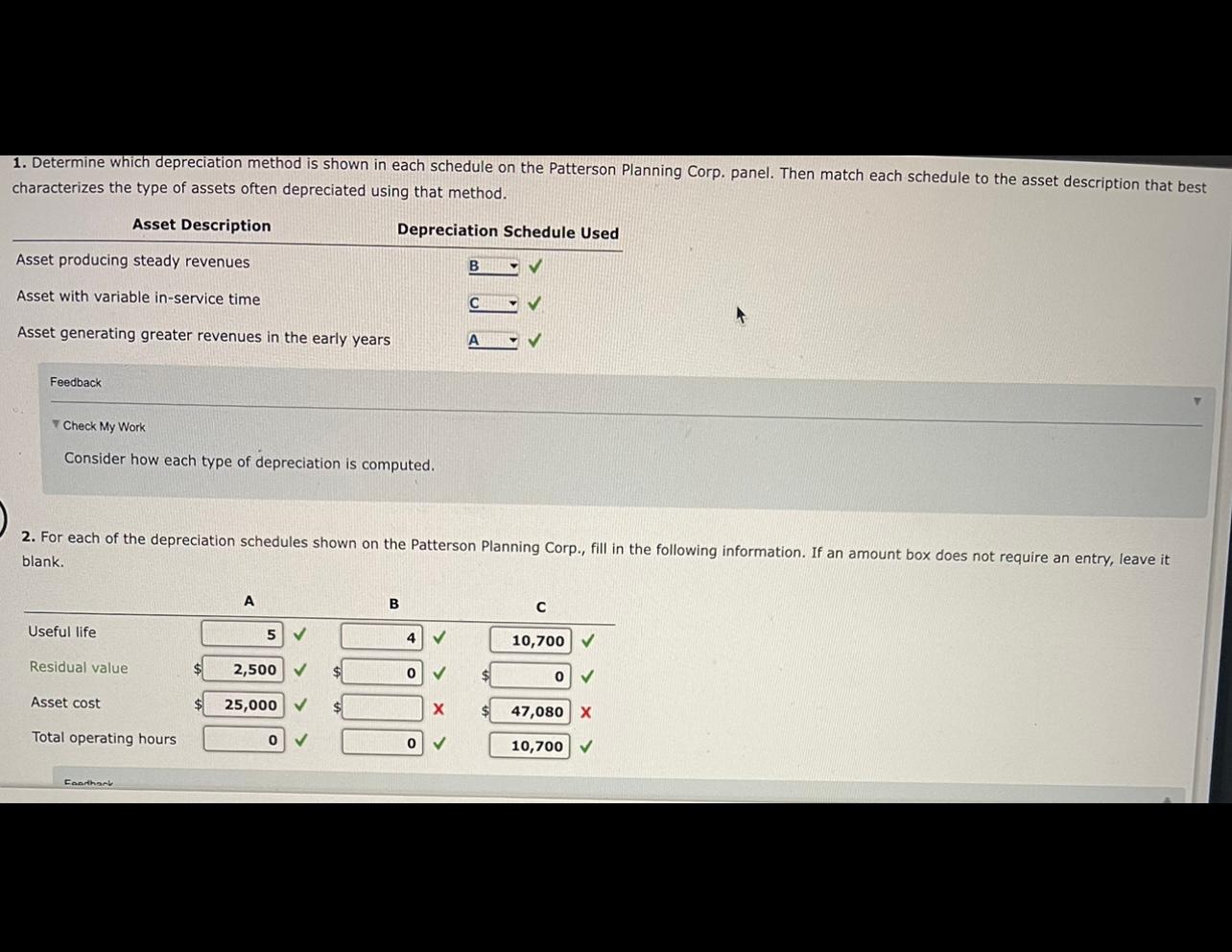

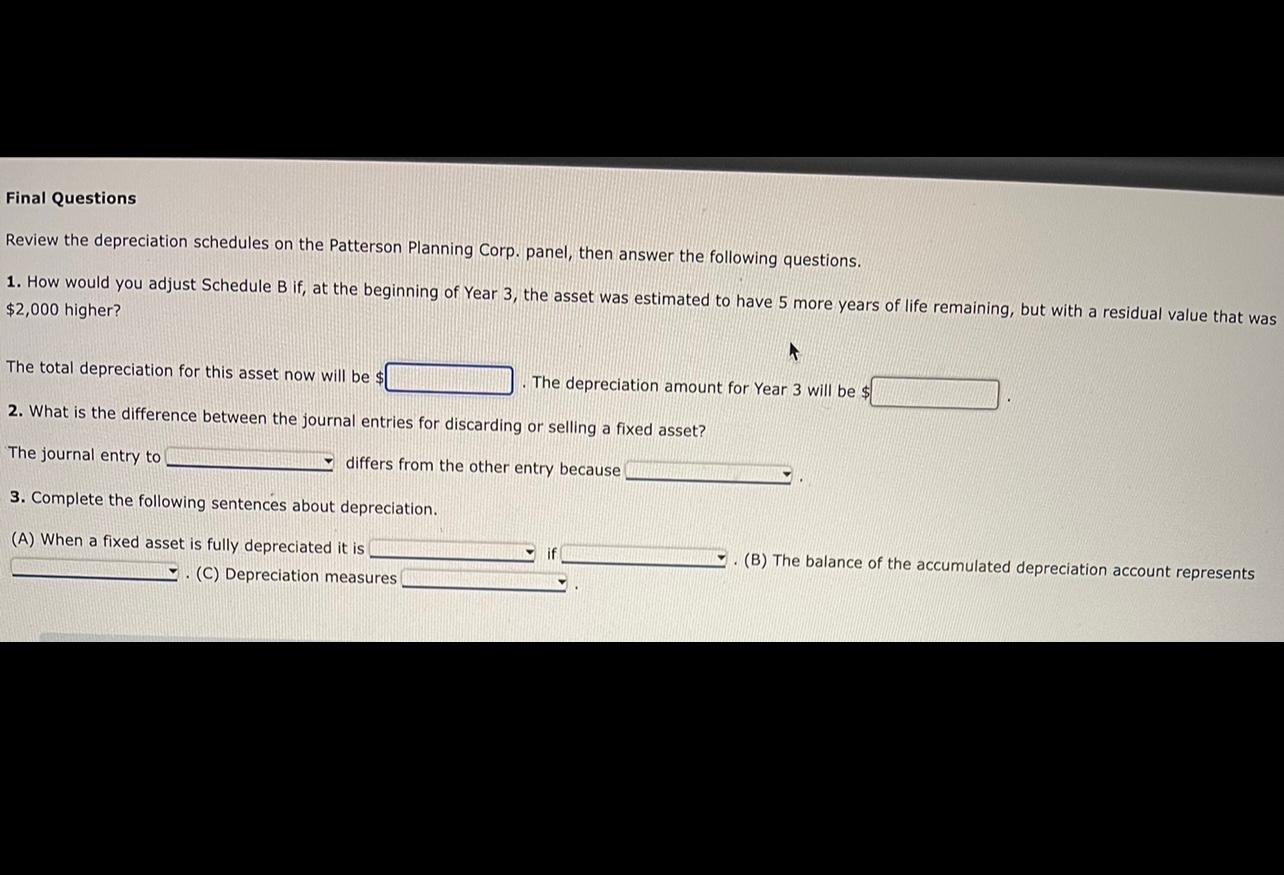

Mastery Problem: Long-Term Assets: Fixed and Intangible Patterson Planning Corp., You have been hired by Patterson Planning Corp., an events planning company that recently had a fire in which some of the accounting records were damaged. In reviewing the fixed asset records, you find three depreciation schedules that are not labeled. They are listed in the following table. One of the assets has a depreciation rate of $4.40 per hour. Year Schedule A Schedule B Schedule C 1 $10,000 $10,125 $10,120 2 6,000 13,500 6,600 3 3,600 13,500 7,480 4 2,160 13,500 6,600 5 740 3,375 4,400 6 7,040 7 4,840 8 Total $22,500 $54,000 $47,080 Depreciation 1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp. panel. Then match each schedule to the asset description that best characterizes the type of assets often depreciated using that method. Asset Description Depreciation Schedule Used 1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp. panel. Then match each schedule to the asset description that best characterizes the type of assets often depreciated using that method. Asset Description Depreciation Schedule Used Asset producing steady revenues B V Asset with variable in-service time Asset generating greater revenues in the early years A Feedback Check My Work Consider how each type of depreciation is computed. 2. For each of the depreciation schedules shown on the Patterson Planning Corp., fill in the following information. If an amount box does not require an entry, leave it blank. A B Useful life 5 4 10,700 Residual value 2,500 0 0 Asset cost 25,000 47,080 X Total operating hours 0 0 10,700 Caarthart Final Questions Review the depreciation schedules on the Patterson Planning Corp. panel, then answer the following questions. 1. How would you adjust Schedule B if, at the beginning of Year 3, the asset was estimated to have 5 more years of life remaining, but with a residual value that was $2,000 higher? The total depreciation for this asset now will be $ The depreciation amount for Year 3 will be $ 2. What is the difference between the journal entries for discarding or selling a fixed asset? The journal entry to differs from the other entry because 3. Complete the following sentences about depreciation. (A) When a fixed asset is fully depreciated it is (C) Depreciation measures . (B) The balance of the accumulated depreciation account represents Mastery Problem: Long-Term Assets: Fixed and Intangible Patterson Planning Corp., You have been hired by Patterson Planning Corp., an events planning company that recently had a fire in which some of the accounting records were damaged. In reviewing the fixed asset records, you find three depreciation schedules that are not labeled. They are listed in the following table. One of the assets has a depreciation rate of $4.40 per hour. Year Schedule A Schedule B Schedule C 1 $10,000 $10,125 $10,120 2 6,000 13,500 6,600 3 3,600 13,500 7,480 4 2,160 13,500 6,600 5 740 3,375 4,400 6 7,040 7 4,840 8 Total $22,500 $54,000 $47,080 Depreciation 1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp. panel. Then match each schedule to the asset description that best characterizes the type of assets often depreciated using that method. Asset Description Depreciation Schedule Used 1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp. panel. Then match each schedule to the asset description that best characterizes the type of assets often depreciated using that method. Asset Description Depreciation Schedule Used Asset producing steady revenues B V Asset with variable in-service time Asset generating greater revenues in the early years A Feedback Check My Work Consider how each type of depreciation is computed. 2. For each of the depreciation schedules shown on the Patterson Planning Corp., fill in the following information. If an amount box does not require an entry, leave it blank. A B Useful life 5 4 10,700 Residual value 2,500 0 0 Asset cost 25,000 47,080 X Total operating hours 0 0 10,700 Caarthart Final Questions Review the depreciation schedules on the Patterson Planning Corp. panel, then answer the following questions. 1. How would you adjust Schedule B if, at the beginning of Year 3, the asset was estimated to have 5 more years of life remaining, but with a residual value that was $2,000 higher? The total depreciation for this asset now will be $ The depreciation amount for Year 3 will be $ 2. What is the difference between the journal entries for discarding or selling a fixed asset? The journal entry to differs from the other entry because 3. Complete the following sentences about depreciation. (A) When a fixed asset is fully depreciated it is (C) Depreciation measures . (B) The balance of the accumulated depreciation account represents