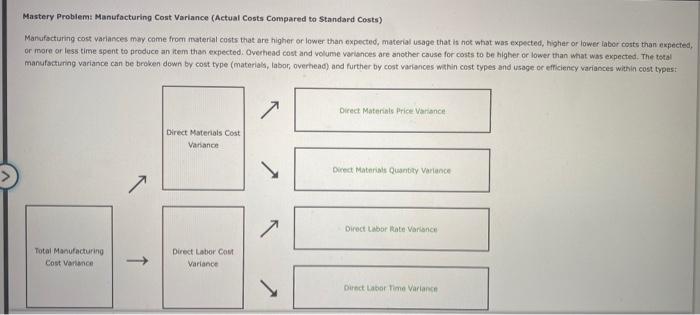

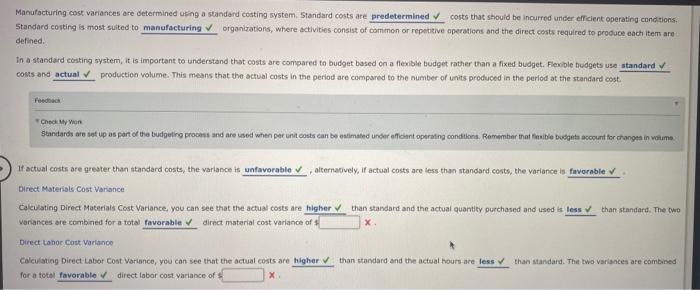

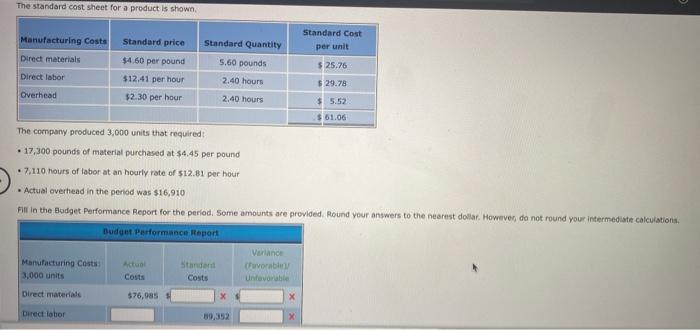

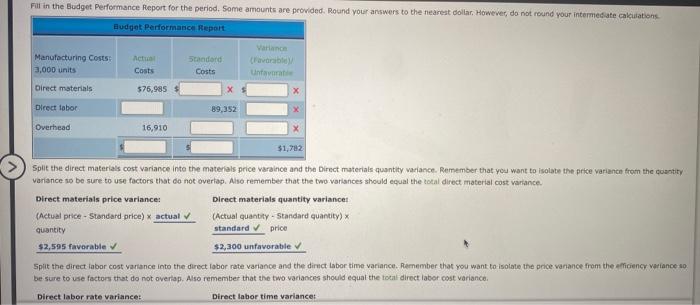

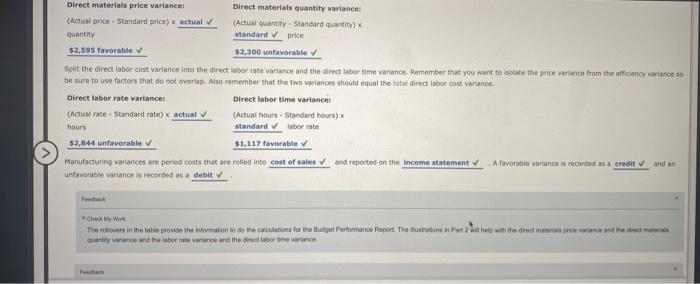

Mastery Problem: Manufacturing Cost Variance (Actual Costs Compared to Standard Costs) Manufacturing cost variances may come from material costs that are higher or lower than expected, material usage that is not what was expected, higher or lower labor costs than expected, or more or less time spent to produce an item than expected. Overhead cost and volume variances are another cause for costs to be higher or lower than what was expected. The total manufacturing variance can be broken down by cout type (material, labor, overhead) and further by cost variances within cost types and usage of efficiency variances within cost typust Direct Material Price Variance Direct Materials Cost Variance Direct Materials Quantity Variance 7 Direct Labor Rate Variance Total Manufacturing Cost Variance Direct Labor Com Variance Direct Labor Time Variance Manufacturing cost variances are determined using a standard costing system. Standard costs are predetermined costs that should be incurred under efficient operating conditions. Standard costing is most suited to manufacturing organizations, where activities consist of common or repetitive operations and the direct costs required to produce each item are defined In a standard costing system, it is important to understand that costs are compared to budget based on a flexible budget rather than a fixed budget. Flexible hudgets use standard costs and actual production volume. This means that the actual costs in the period are compared to the number of units produced in the period at the standard cost. Check My on Standards are set up as part of the budgeting rooms and are used when per unit costs can be estimated under eficient operating conditions. Remember that flexible boots account for changes in volume 1 actual costs are greater than standard costs, the varlance is unfavorable alternatively, if actual costs are less than standard costs, the variance in favorable v Direct Materials Cost Variance Calevating Direct Materials Cost Variance, you can see that the actual costs are higher than standard and the actual quantity purchased and used is less than standard. The two Variances are combined for a total favorable direct material cost varlance of sL Direct Labor Cost Variance Calculating Direct Labor Cost Variance, you can see that the actual costs are higher than standard and the actual hours are less than standard. The two variances are combined for a total favorable direct labor cost variance of The standard cost sheet for a product is shown Standard Cost Manufacturing Costs Standard Quantity per unit 5.60 pounds Direct materials Direct labor $ 25.76 Standard price $4,60 per pound $12.41 per hour $2.30 per hour 2.40 hours $29.78 Overhead 2.40 hours $5.52 $161.06 . The company produced 3,000 units that required 17,300 pounds of material purchased at $4.45 per pound 7.110 hours of labor at an hourly rate of $12.81 per hour Actual overhead in the period was $16,910 Pill in the Budget Performance Report for the period. Some amounts are provided. Round your answers to the nearest dollar. However, do not round your intermediate calculations Budget Performance Report Verano Manufacturing Costs Standard Puvorable 3.000 units Costs Costs Unfavorable Direct materials $76,985 X Direct labor X Fill in the Budget Performance Report for the period. Some amounts are provided. Round your answers to the nearest dollar. However, do not round your intermediate calculations Budget Performance Report Vartanon Manufacturing Costs 3,000 units Actu Costs Standard Costs Untara Direct materials 576,985 X X Direct labor 89,352 Overhead 16,910 $1,782 Split the direct materials cost variance into the materials price Varance and the Direct materials quantity variance. Remember that you want to isolate the price variance from the quantity variance so be sure to use factors that do not overlap. Also remember that the two variances should equal the total direct material cost variance Direct materials price variance: Direct materials quantity variancet (Actual price - Standard price) actual (Actual quantity - Standard quantity) quantity standard price $2,595 favorable $2,300 unfavorable Split the direct labor cost variance into the direct labor rate variance and the direct labor time variance. Remember that you want to isolate the price variance from the efficiency variance so be sure to use factors that do not overlap. Also remember that the two variances should equal the total direct labor cost variance Direct labor rate variance: Direct labor time variance Direct materials price variance Direct materials quantity variance (Actual price - Standard price) * actual (Actualquantity Standard quantity) quantity standard price $2.595 favorable $2,300 unfavorable sont the direct labor cost variance into the direct laborate variance and the direct aber time varianon. Remember that you want to isolate the price variance from the efficiency valance 10 be sure to use factors that do not overlap. Also remember that the two variants should equat the total director cost variance Direct labor rate variance Direct labor time variance (Actual rate - Standard rate) actual (Actual hours - Standard hours) hours standard laborate $2,144 unfavorable $1,117 favorable Manufacturing variances are period costs that are rolled into cost of sales and reported on the Income statement A favorable variance is recorded a credit and on unfavorable variance is recorded as a debit The rowers in the title provide the nortation to do the saloons for the Budget Performance Report. The Hortons Part 2 We he will the art materias prie vartos are the street te quality and the laborate and the direct labore