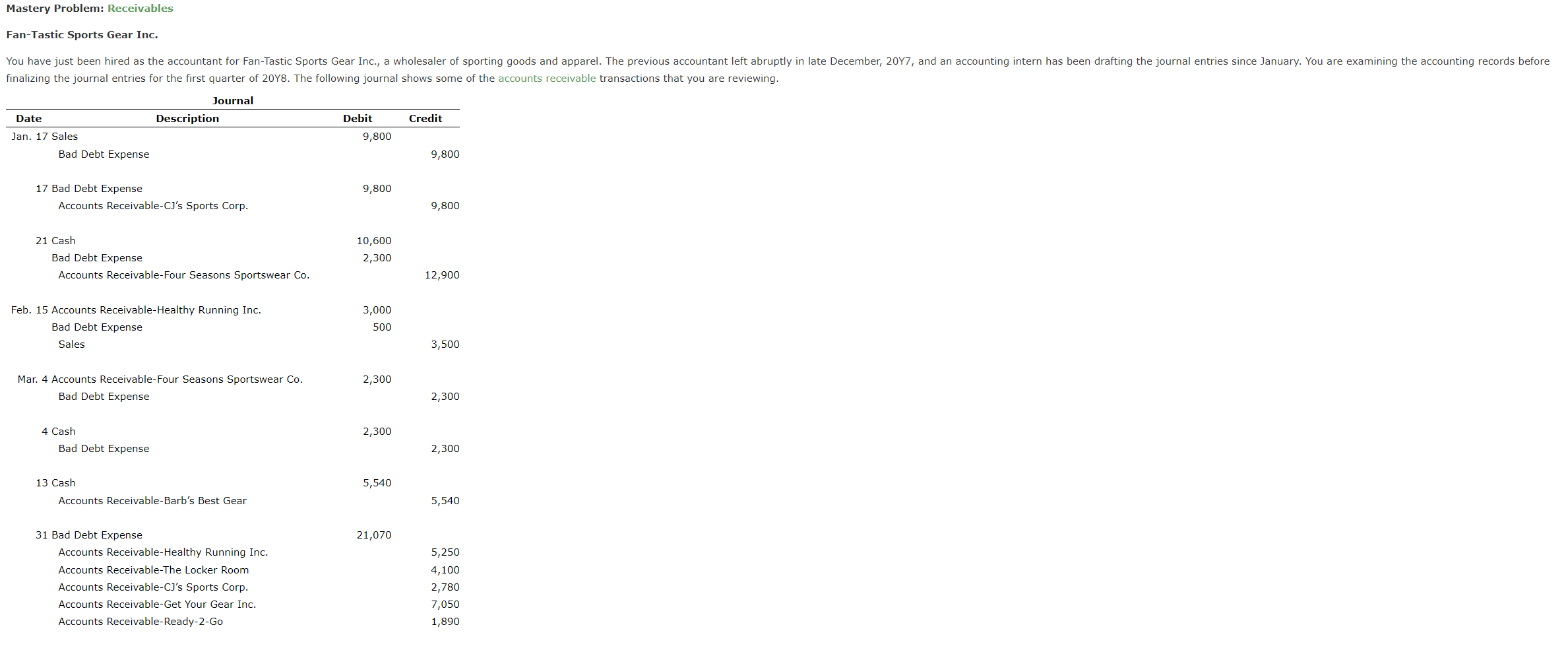

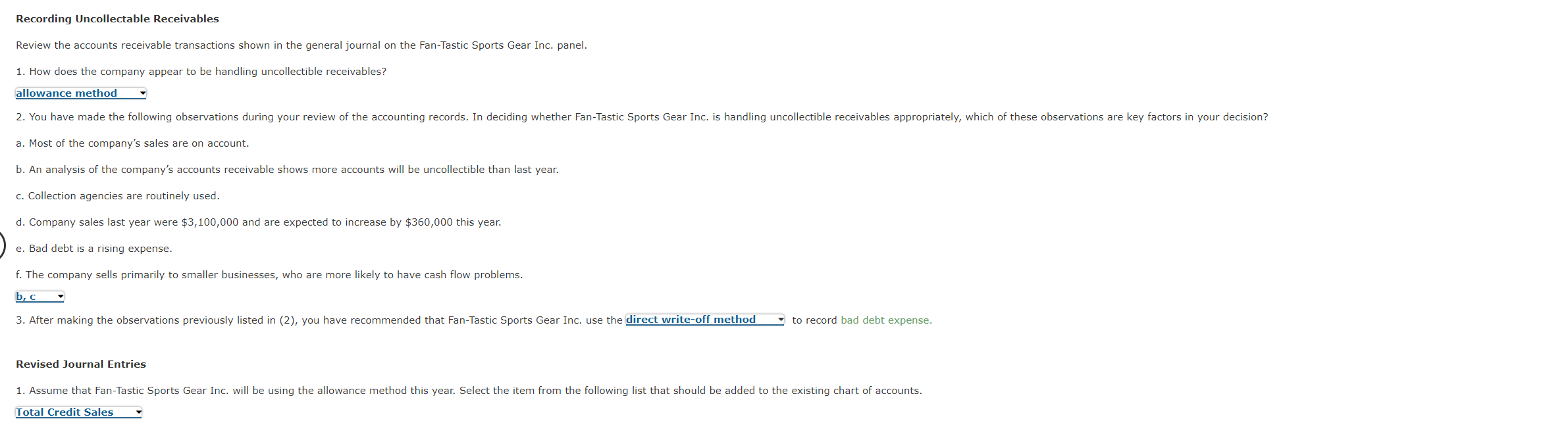

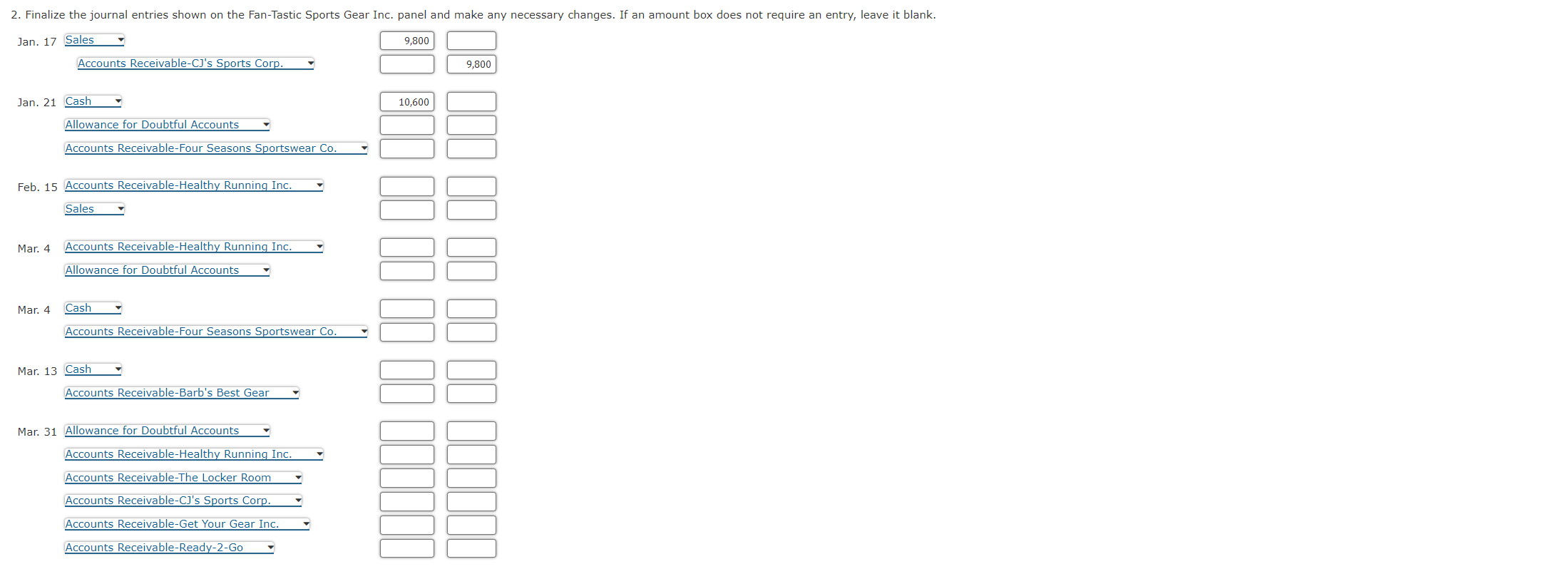

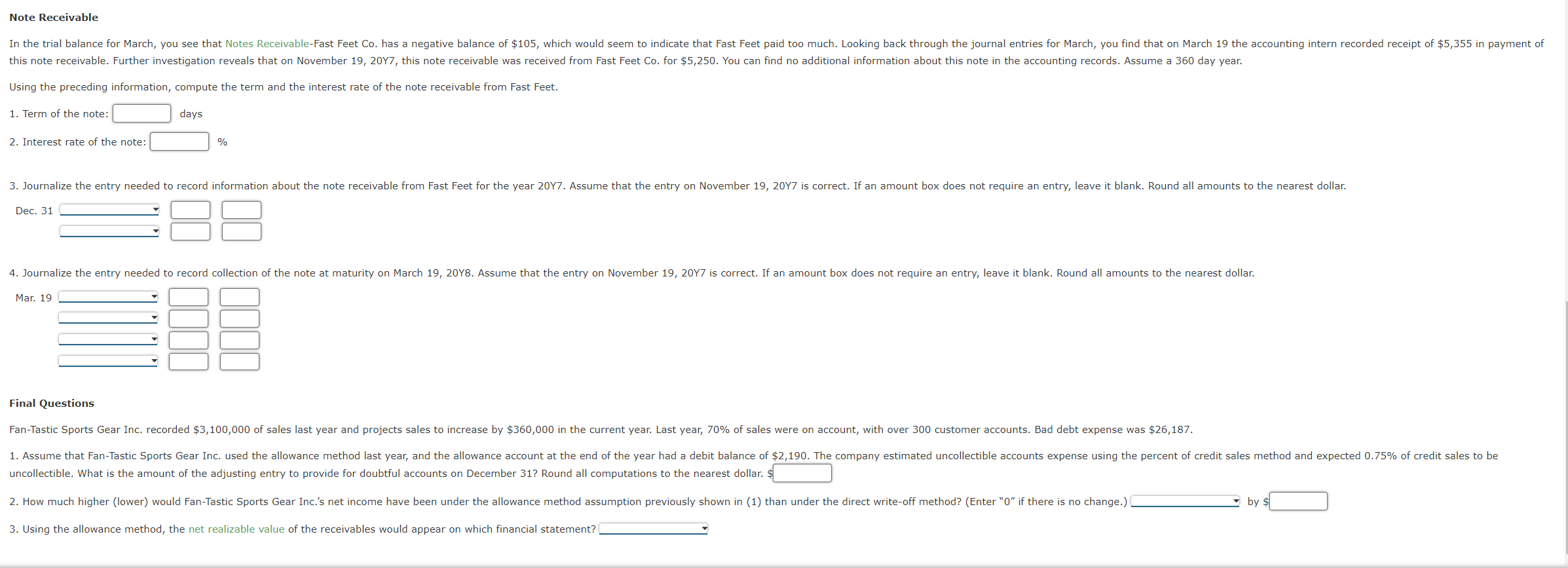

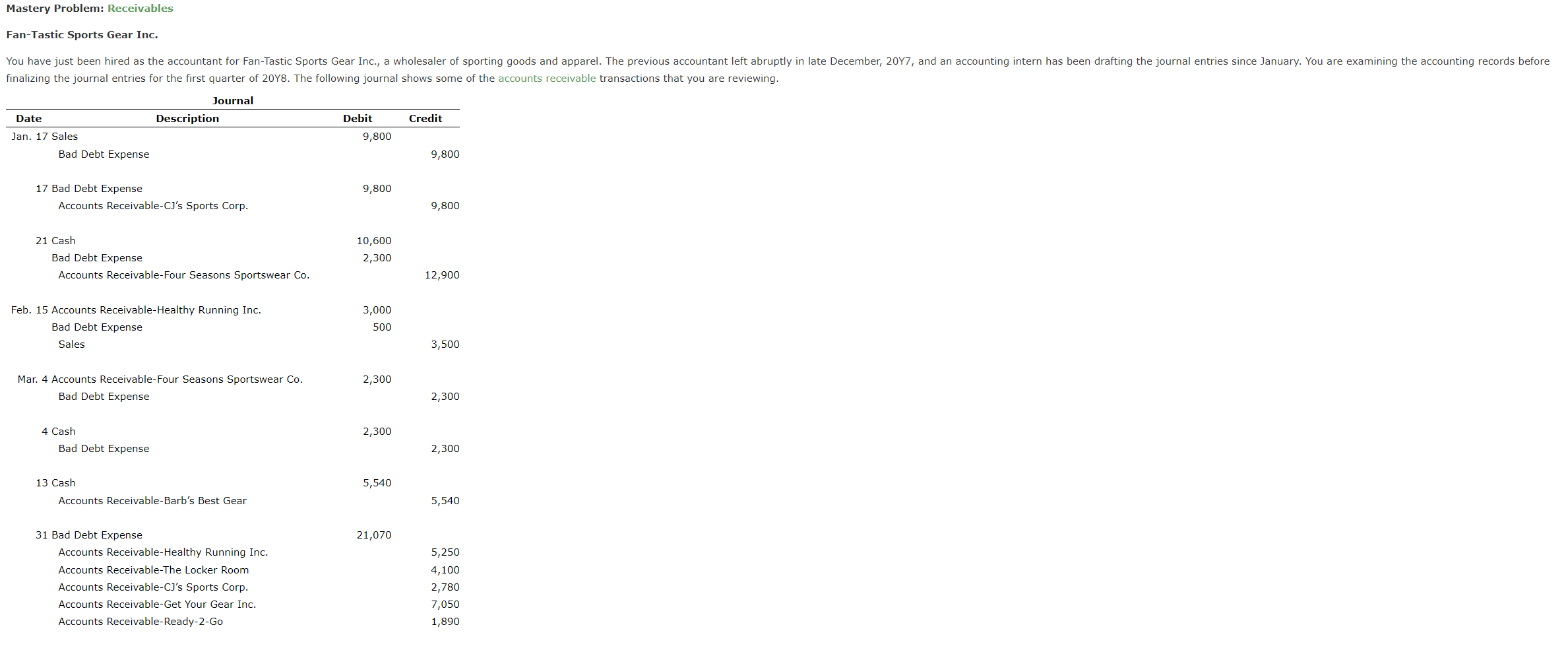

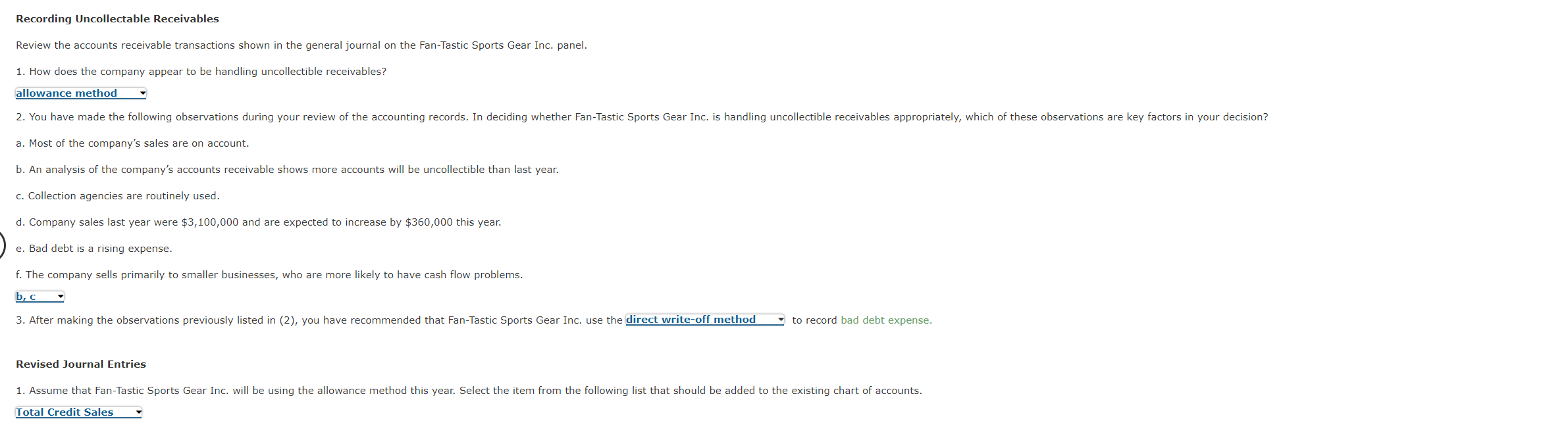

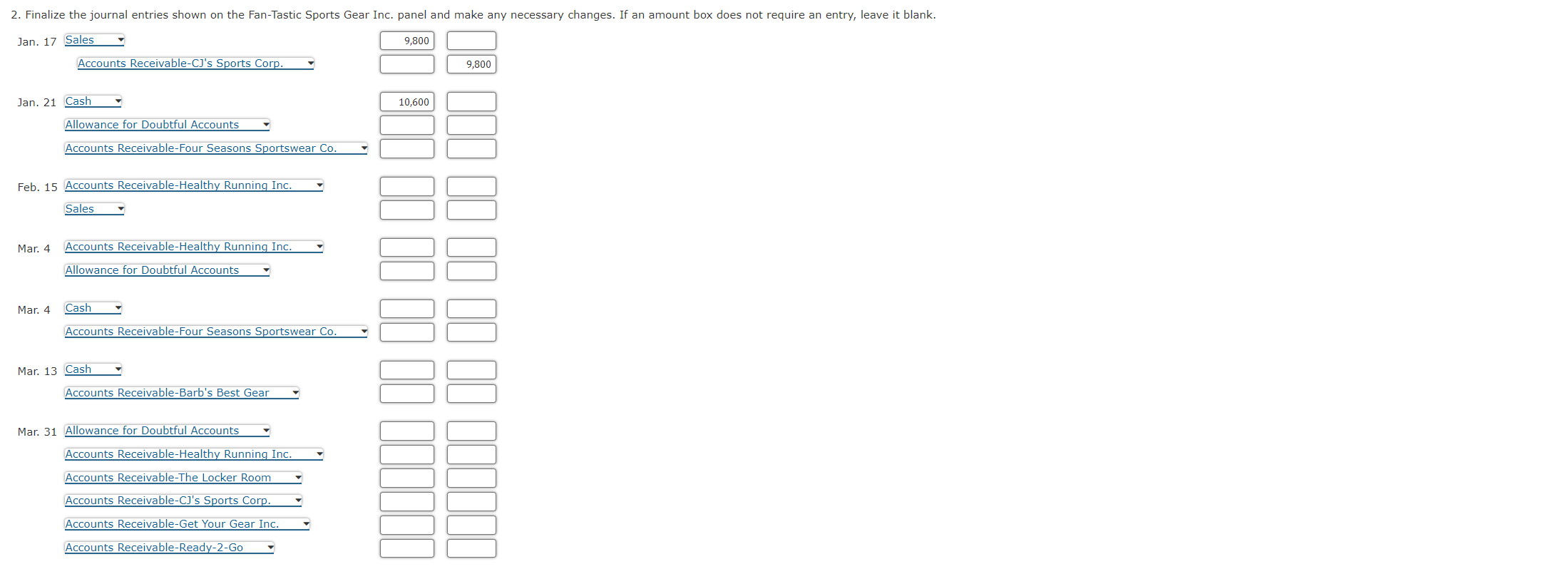

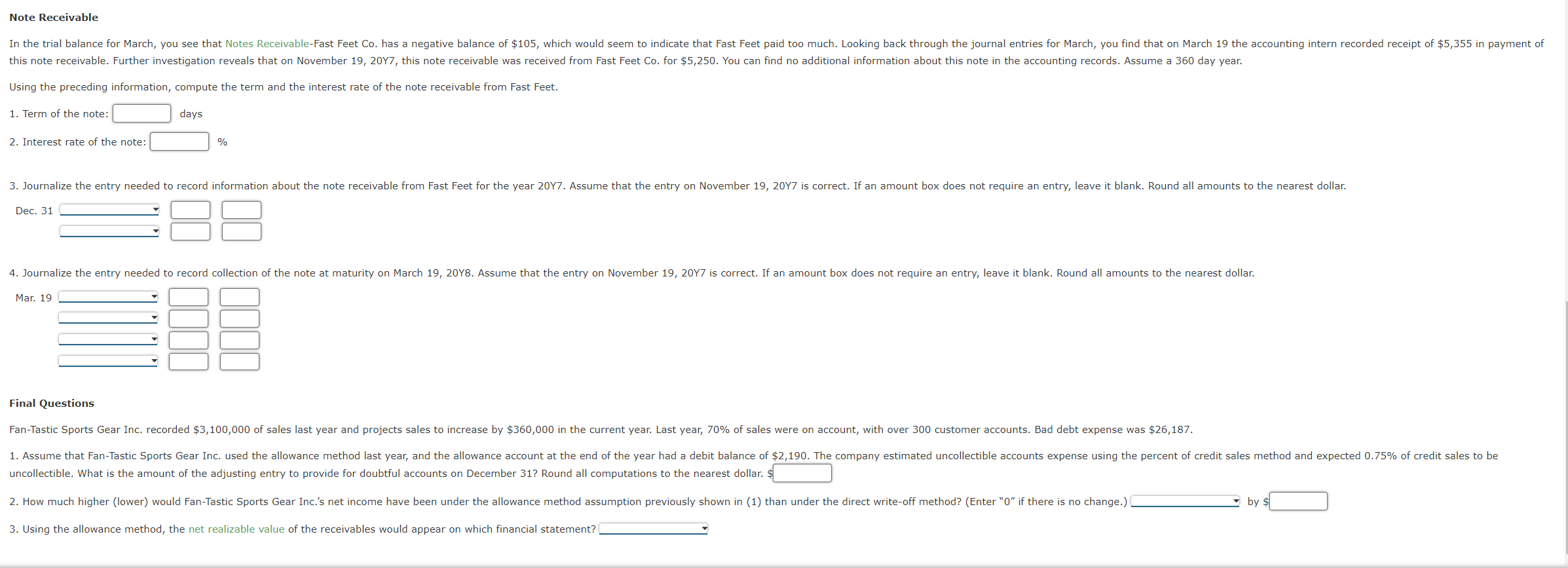

Mastery Problem: Receivables Fan-Tastic Sports Gear Inc. finalizing the journal entries for the first quarter of 20Y8. The following journal shows some of the accounts receivable transactions that you are reving. Review the accounts receivable transactions shown in the general journal on the Fan-Tastic Sports Gear Inc. panel. 1. How does the company appear to be handling uncollectible receivables? a. Most of the company's sales are on account. b. An analysis of the company's accounts receivable shows more accounts will be uncollectible than last year. c. Collection agencies are routinely used. d. Company sales last year were $3,100,000 and are expected to increase by $360,000 this year. e. Bad debt is a rising expense. f. The company sells primarily to smaller businesses, who are more likely to have cash flow problems. 3. After making the observations previously listed in (2), you have recommended that Fan-Tastic Sports Gear Inc. use the to record bad debt expense. Revised Journal Entries Feb. 15 Mar. 4 Mar. 4 Mar. 13 Cash Accounts Receivable-Barb's Best Gear Mar. 31 Allowance for Doubtful Accounts Accounts Receivable-Healthy Running Inc. Accounts Receivable-The Locker Room Accounts Receivable-C]'s Sports Corp. Accounts Receivable-Get Your Gear Inc. Accounts Receivable-Ready-2-Go Using the preceding information, compute the term and the interest rate of the note receivable from Fast Feet. 1. Term of the note: days 2. Interest rate of the note: % Dec. 31 Mi Final Questions uncollectible. What is the amount of the adjusting entry to provide for doubtful accounts on December 31 ? Round all computations to the nearest dollar. 9 by q 3. Using the allowance method, the net realizable value of the receivables would appear on which financial statement? Mastery Problem: Receivables Fan-Tastic Sports Gear Inc. finalizing the journal entries for the first quarter of 20Y8. The following journal shows some of the accounts receivable transactions that you are reving. Review the accounts receivable transactions shown in the general journal on the Fan-Tastic Sports Gear Inc. panel. 1. How does the company appear to be handling uncollectible receivables? a. Most of the company's sales are on account. b. An analysis of the company's accounts receivable shows more accounts will be uncollectible than last year. c. Collection agencies are routinely used. d. Company sales last year were $3,100,000 and are expected to increase by $360,000 this year. e. Bad debt is a rising expense. f. The company sells primarily to smaller businesses, who are more likely to have cash flow problems. 3. After making the observations previously listed in (2), you have recommended that Fan-Tastic Sports Gear Inc. use the to record bad debt expense. Revised Journal Entries Feb. 15 Mar. 4 Mar. 4 Mar. 13 Cash Accounts Receivable-Barb's Best Gear Mar. 31 Allowance for Doubtful Accounts Accounts Receivable-Healthy Running Inc. Accounts Receivable-The Locker Room Accounts Receivable-C]'s Sports Corp. Accounts Receivable-Get Your Gear Inc. Accounts Receivable-Ready-2-Go Using the preceding information, compute the term and the interest rate of the note receivable from Fast Feet. 1. Term of the note: days 2. Interest rate of the note: % Dec. 31 Mi Final Questions uncollectible. What is the amount of the adjusting entry to provide for doubtful accounts on December 31 ? Round all computations to the nearest dollar. 9 by q 3. Using the allowance method, the net realizable value of the receivables would appear on which financial statement