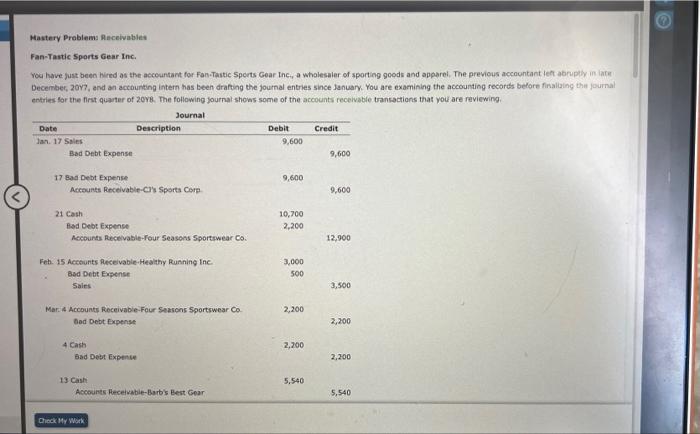

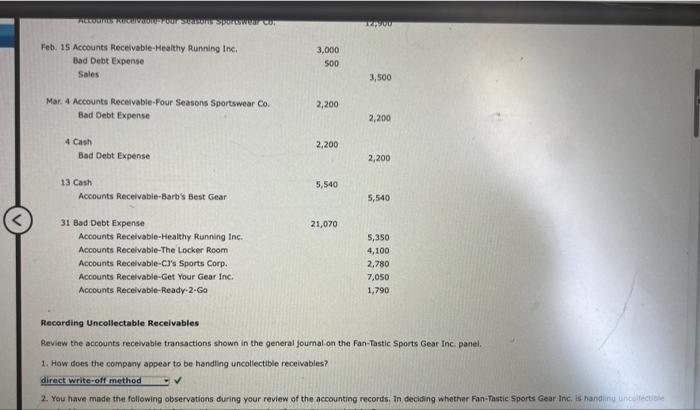

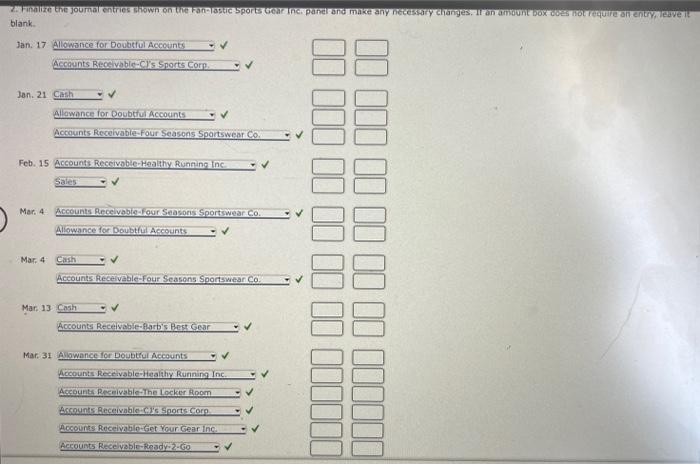

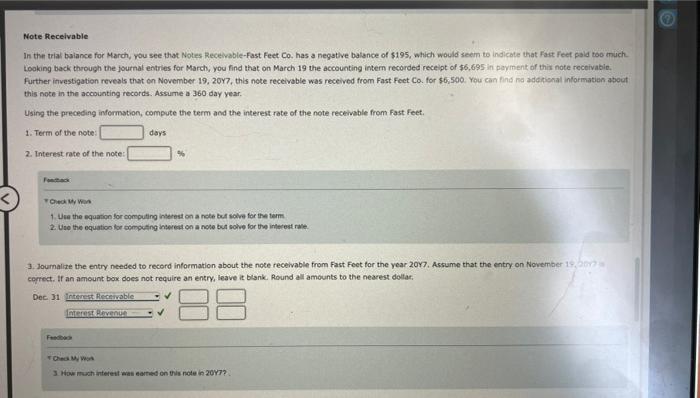

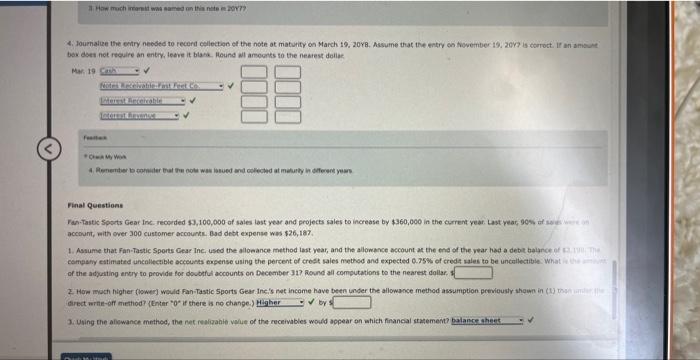

Mastery Problems Receivabies Fan-Tastic sports Gear Inc. You have just been hired as the accountant for Fan-Tastic Sperts Gear Inc.y a whalesaler of sporting goods and apparel. The previous accountant len abrupliy in iafet December, 20y7, and an accounting intem has been drafting the journal entries since January. You are examining the accounting records belore finaliaing thin journal entries for the first quarter of 20y8. The following journal shows some of the accounts receivable transactions that you are reviewing. Recording Uncollectable Receivables Review the accounts receivabie transactions shown in the general journal-on the Fan-Tastic Sports Gear Inc. panel. 1. How does the company appear to be handiling uncoliectible receivables? blank. In the trial baiance for March, you see that Notes Recevable-Fast Feet Co. has a negative batance of \$195, which would seem to indicate that Fast feet pald too inuch. Looking back through the journal entries for March, you find that on March 19 the accounting intem recorded receipt of $6,695 in poyment of thiis note receivable. Further investigation reveals that on November 19, 20Y7, this note receivable was received from Fast Feet Co. for 56,500 . You can find ra adicional informatien about this note in the accounting records. Assume a 360 day year. Using the preceding information, compute the term and the interest rate of the note rectivable from fast feet. 1. Term of the note: 2. Interest rate of the note: + cieas ib wis Vinal Questiont accovit, =ith over 300 custamer aconurhe. Bad debt expense was $26,187 compaty estimated uncollectible accects expense using the percent of crest sales method and expected Q.75\% of credt sales to be uncellectible. What of the adjuating enery to provide for doubthl accounts on December 317 . Aovind all computations to the nearest dollar, 1 direct write-off method? (Enter " 0 if there is no change.) 3. Uwing the aliewance mnthed, the net resigahie vorite of the receivables would agpear on which financial statement? Mastery Problems Receivabies Fan-Tastic sports Gear Inc. You have just been hired as the accountant for Fan-Tastic Sperts Gear Inc.y a whalesaler of sporting goods and apparel. The previous accountant len abrupliy in iafet December, 20y7, and an accounting intem has been drafting the journal entries since January. You are examining the accounting records belore finaliaing thin journal entries for the first quarter of 20y8. The following journal shows some of the accounts receivable transactions that you are reviewing. Recording Uncollectable Receivables Review the accounts receivabie transactions shown in the general journal-on the Fan-Tastic Sports Gear Inc. panel. 1. How does the company appear to be handiling uncoliectible receivables? blank. In the trial baiance for March, you see that Notes Recevable-Fast Feet Co. has a negative batance of \$195, which would seem to indicate that Fast feet pald too inuch. Looking back through the journal entries for March, you find that on March 19 the accounting intem recorded receipt of $6,695 in poyment of thiis note receivable. Further investigation reveals that on November 19, 20Y7, this note receivable was received from Fast Feet Co. for 56,500 . You can find ra adicional informatien about this note in the accounting records. Assume a 360 day year. Using the preceding information, compute the term and the interest rate of the note rectivable from fast feet. 1. Term of the note: 2. Interest rate of the note: + cieas ib wis Vinal Questiont accovit, =ith over 300 custamer aconurhe. Bad debt expense was $26,187 compaty estimated uncollectible accects expense using the percent of crest sales method and expected Q.75\% of credt sales to be uncellectible. What of the adjuating enery to provide for doubthl accounts on December 317 . Aovind all computations to the nearest dollar, 1 direct write-off method? (Enter " 0 if there is no change.) 3. Uwing the aliewance mnthed, the net resigahie vorite of the receivables would agpear on which financial statement