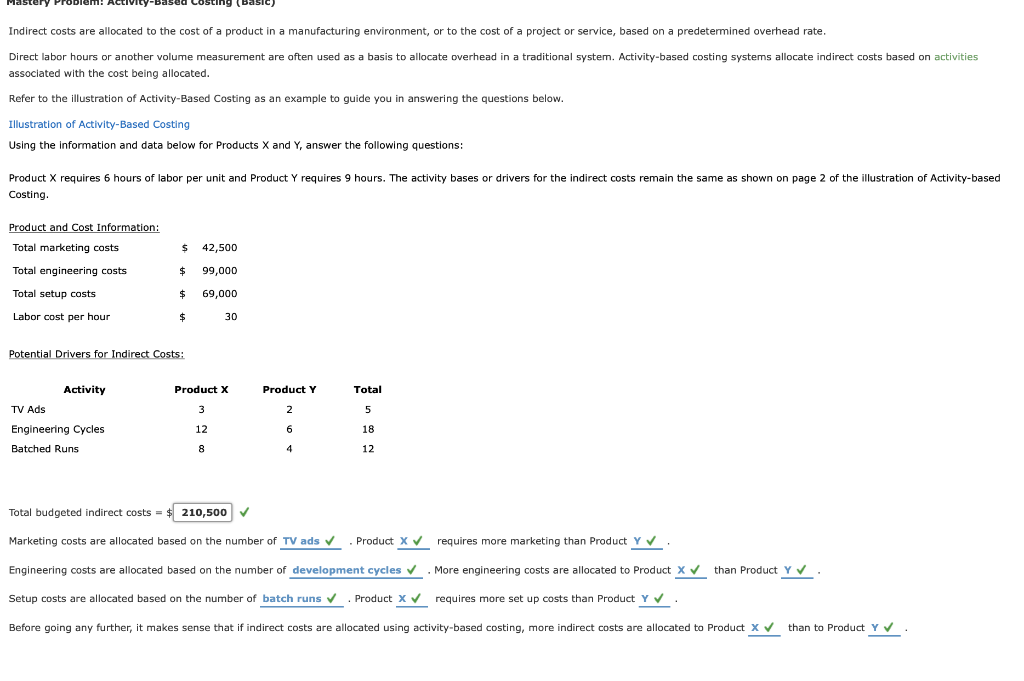

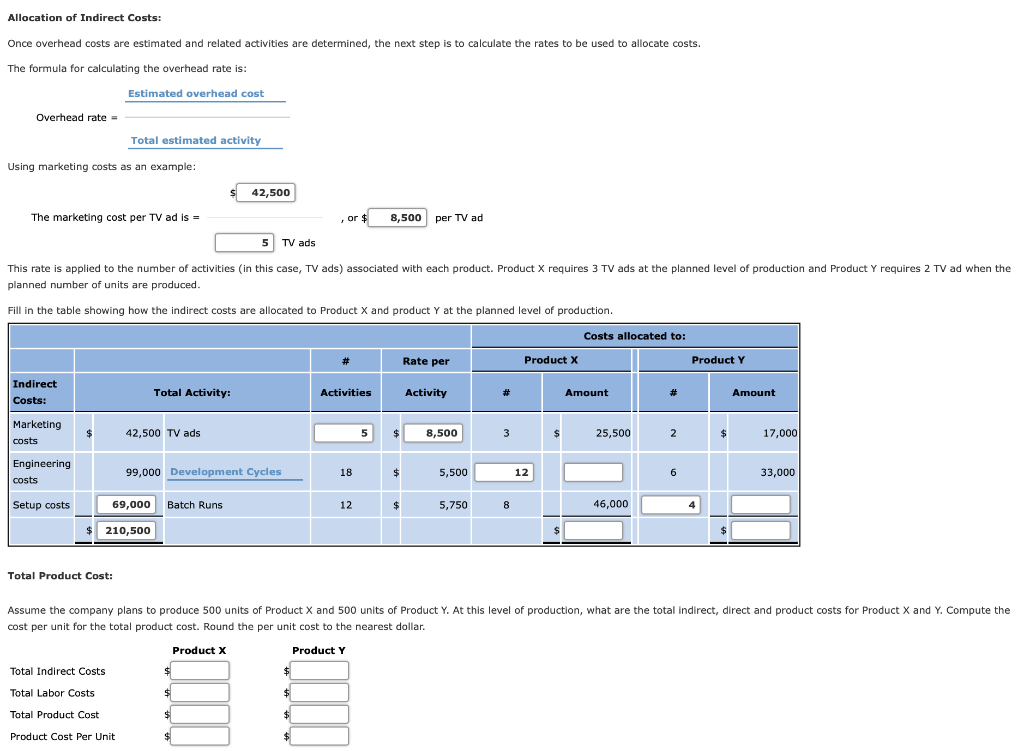

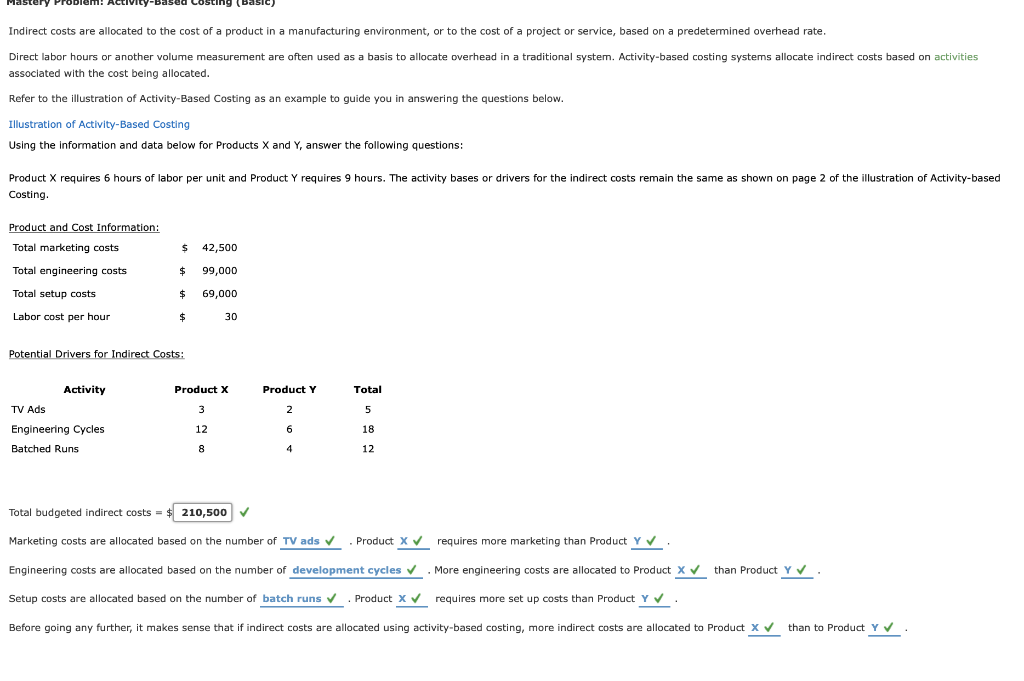

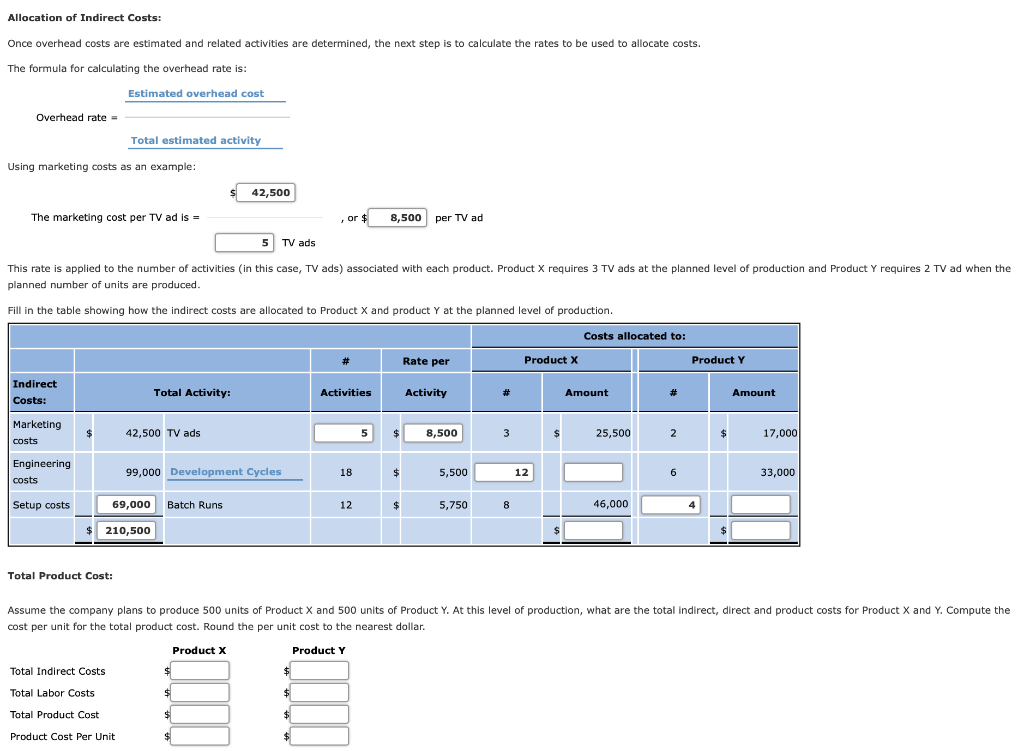

Mastery ProbremH ACtIvitY -Based Costing (Basic Indirect costs are allocated to the cost of a product in a manufacturing environment, or to the cost of a project or service, based on a predetermined overhead rate Direct labor hours or another volume measurement are often used as a basis to allocate overhead in a traditional system. Activity-based costing systems allocate indirect costs based on activities associated with the cost being allocated Refer to the illustration of Activity-Based Costing as an example to guide you in answering the questions below Illustration of Activity-Based Costing Using the ifmaion and data below for Products X and Y, answer the following questions: Product X requires 6 hours of labor per unit and Product Y requires 9 hours. The activity bases or drivers for the indirect costs remain the same as shown on page 2 of the illustration of Activity-based Costing rmation: Total marketing costs Total engineering costs Total setup costs Labor cost per hour $ 42,500 $99,000 69,000 30 Activity Product X Product Y Total TV Ads Engineering Cycles Batched Runs 12 18 12 Total budgeted indirect costs210,500] V Marketing costs are allocated based on the number of TV adsProduct X Vrequires more marketing than Product Y Engineering costs are allocated based on the number of development cycles . More engineering costs are allocated to Product X than Product Y Setup costs are allocated based on the number of batch runs . Product X requires more set up costs than Product Y . Before going any further, it makes sense that if indirect costs are allocated using activity-based costing, more indirect costs are allocated to Product X Vthan to Product Y Allocation of Indirect Costs: Once overhead costs are estimated and related activities are determined, the next step is to calculate the rates to be used to allocate costs. The formula for calculating the overhead rate is Estimated overhead cost Overhead rate = Total estimated activity Using marketing costs as an example 42,500 The marketing cost per TV ad is 8,500 per TV ad 5 TV ads This rate is applied to the number of activities (in this case, TV ads) associated with each product. Product X requires 3 TV ads at the planned level of production and Product Y requires 2 TV ad when the planned number of units are produced Fill in the table showing how the indirect costs are allocated to Product X and product Y at the planned level of production. Costs allocated to: Rate per Product X Product Y Indirect Total Activity: Activities Activity Amount Amount Costs: Marketing 42,500 TV ads 5$ 8,500 25,500 17,000 costs Engineering 99,000 Development Cycles 18 5,500 12 33,000 costs Setup costs 69,000 Runs 12 5,750 46,000 $210,500 Total Product Cost: Assume the company plans to produce 500 units of Product X and 500 units of Product Y. At this level of production, what are the total indirect, direct and product costs for Product X and Y. Compute the cost per unit for the total product cost. Round the per unit cost to the nearest dollar. Product X Product Y Total Indirect Costs Total Labor Costs Total Product Cost Product Cost Per Unit