Answered step by step

Verified Expert Solution

Question

1 Approved Answer

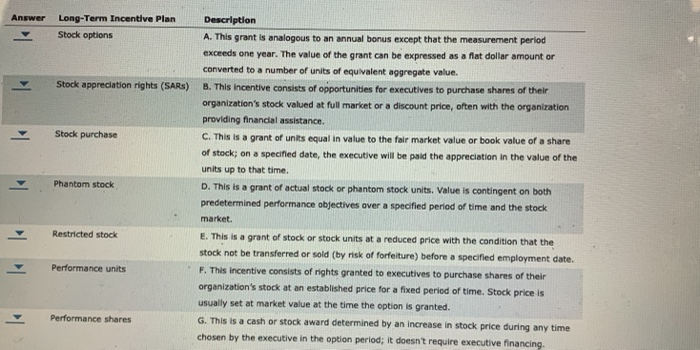

Match each description in the following table with a long term incentive plan by entering the letter of the description in the answer space next

Match each description in the following table with a long term incentive plan by entering the letter of the description in the answer space next to the correct incentive

Answer Long-Term Incentive Plan Stock options Stock appreciation rights (SAR) Stock purchase Phantom stock Description A. This grant is analogous to an annual bonus except that the measurement period exceeds one year. The value of the grant can be expressed as a flat dollar amount or converted to a number of units of equivalent aggregate value. B. This incentive consists of opportunities for executives to purchase shares of their organization's stock valued at full market or a discount price, often with the organization providing financial assistance. C. This is a grant of units equal in value to the fair market value or book value of a share of stock; on a specified date, the executive will be paid the appreciation in the value of the units up to that time. D. This is a grant of actual stock or phantom stock units. Value is contingent on both predetermined performance objectives over a specified period of time and the stock market. E. This is a grant of stock or stock units at a reduced price with the condition that the stock not be transferred or sold (by risk of forfeiture) before a specified employment date. F. This incentive consists of rights granted to executives to purchase shares of their organization's stock at an established price for a fixed period of time. Stock price is usually set at market value at the time the option is granted. G. This is a cash or stock award determined by an increase in stock price during any time chosen by the executive in the option period; it doesn't require executive financing. Restricted stock Performance units Performance shares Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started