Answered step by step

Verified Expert Solution

Question

1 Approved Answer

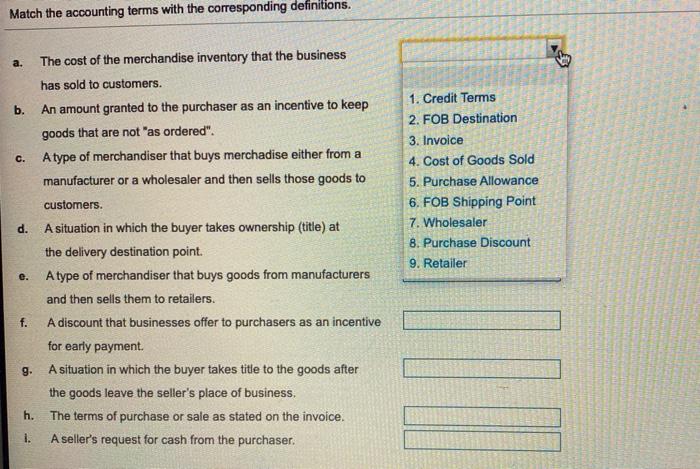

Match the accounting terms with the corresponding definitions. a. The cost of the merchandise inventory that the business has sold to customers. 1. Credit

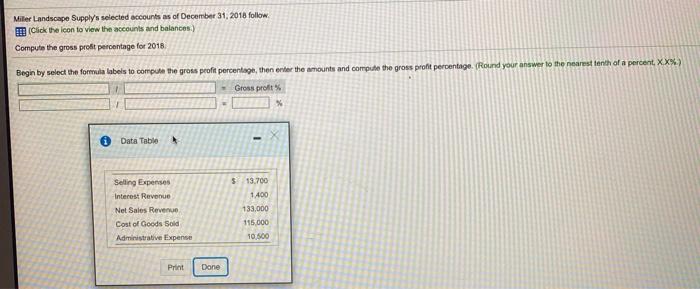

Match the accounting terms with the corresponding definitions. a. The cost of the merchandise inventory that the business has sold to customers. 1. Credit Tems b. An amount granted to the purchaser as an incentive to keep 2. FOB Destination goods that are not "as ordered". 3. Invoice Atype of merchandiser that buys merchadise either from a 4. Cost of Goods Sold C. manufacturer or a wholesaler and then sells those goods to 5. Purchase Allowance 6. FOB Shipping Point 7. Wholesaler 8. Purchase Discount customers. d. A situation in which the buyer takes ownership (title) at the delivery destination point. 9. Retailer A type of merchandiser that buys goods from manufacturers e. and then sells them to retailers. f. A discount that businesses offer to purchasers as an incentive for early payment. 9. A situation in which the buyer takes title to the goods after the goods leave the seller's place of business. h. The terms of purchase or sale as stated on the invoice. i. A seller's request for cash from the purchaser. Miler Landscape Supply's selected accounts as of December 31, 2018 follow. (Click the icon to view the accounts and balances.) Compute the gross profit percentage for 2018. Begin by select the formula labels to compute the gross profit percentage, then enter the amounts and compute the gross profit percentage. (Round your answer to the nearest tenth of a percent, X.X%) Gross profit % O Data Table Selling Expenses $ 13.700 Interest Revenue 1400 Net Sales Revenue 133.000 Cost of Goods Sold 115,000 Administrative Expense 10,500 Print Done

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

aThe correct match is Cost of Goods Sold bThe correct match is Purchase Allowance c The corre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started