Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Match the description with its term. This tax was repealed under the Tax Cuts and Jobs Act of 2 0 1 7 . The advantage

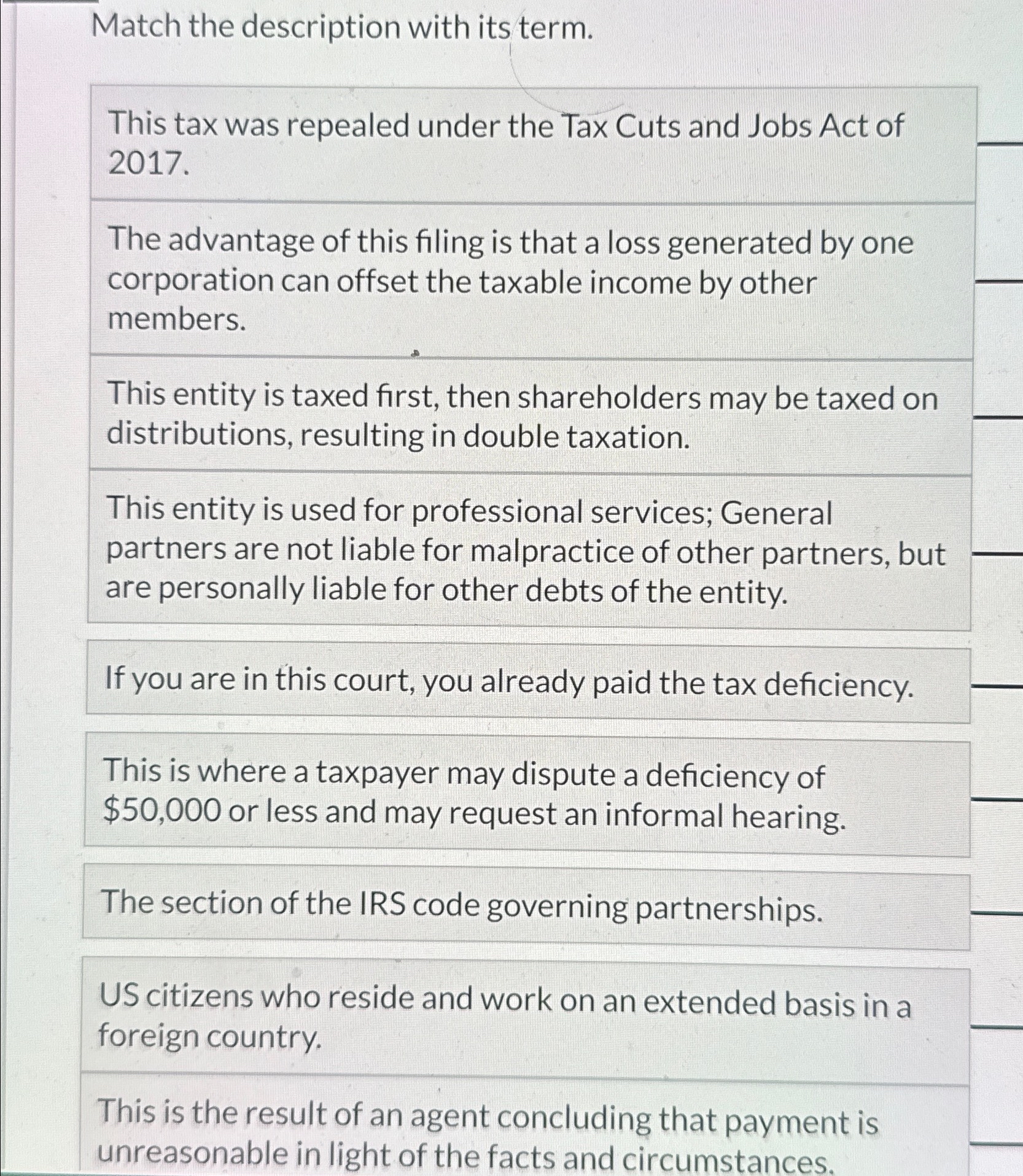

Match the description with its term.

This tax was repealed under the Tax Cuts and Jobs Act of

The advantage of this filing is that a loss generated by one corporation can offset the taxable income by other members.

This entity is taxed first, then shareholders may be taxed on distributions, resulting in double taxation.

This entity is used for professional services; General partners are not liable for malpractice of other partners, but are personally liable for other debts of the entity.

If you are in this court, you already paid the tax deficiency.

This is where a taxpayer may dispute a deficiency of $ or less and may request an informal hearing.

The section of the IRS code governing partnerships.

US citizens who reside and work on an extended basis in a foreign country.

This is the result of an agent concluding that payment is unreasonable in light of the facts and circumstances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started