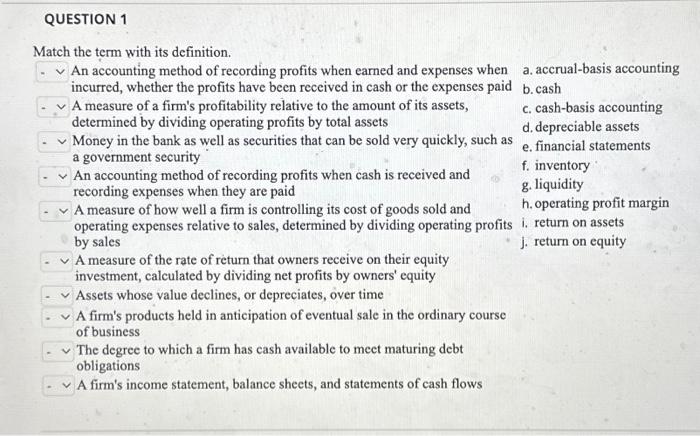

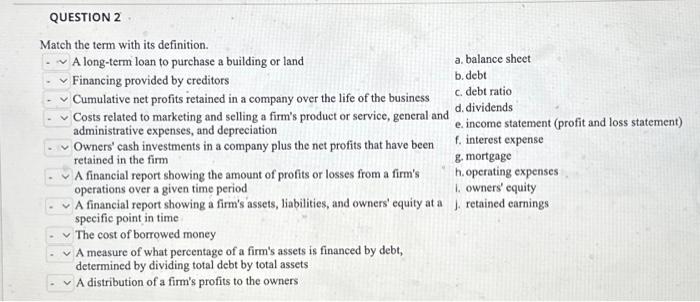

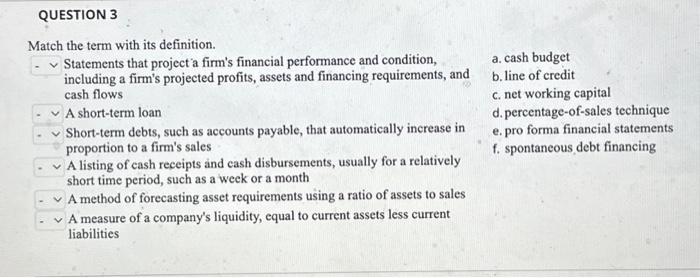

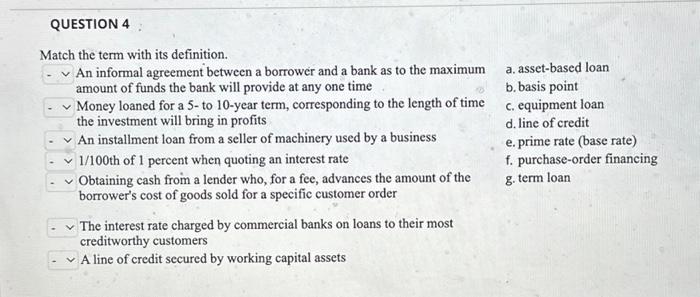

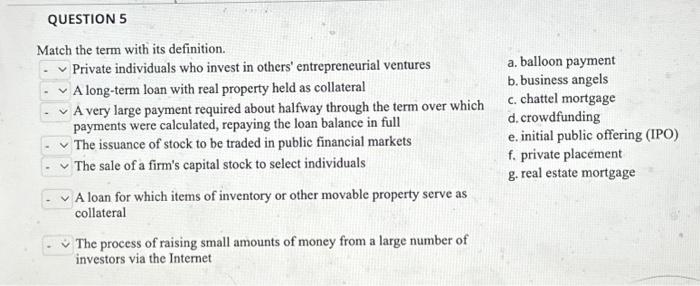

Match the term with its definition. An informal agreement between a borrower and a bank as to the maximum a. asset-based loan amount of funds the bank will provide at any one time b. basis point Money loaned for a 5-to 10-year term, corresponding to the length of time c. equipment loan the investment will bring in profits d. line of credit An installment loan from a seller of machinery used by a business e. prime rate (base rate) 1/100 th of 1 percent when quoting an interest rate f. purchase-order financing Obtaining cash from a lender who, for a fee, advances the amount of the g. term loan borrower's cost of goods sold for a specific customer order The interest rate charged by commercial banks on loans to their most creditworthy customers A line of credit secured by working capital assets Match the term with its definition. A long-term loan to purchase a building or land a. balance sheet Financing provided by creditors b. debt Cumulative net profits retained in a company over the life of the business c. debt ratio Costs related to marketing and selling a firm's product or service, general and d. dividends administrative expenses, and depreciation e. income statement (profit and loss statement) Owners' cash investments in a company plus the net profits that have been f. interest expense retained in the firm g. mortgage A financial report showing the amount of profits or losses from a firm's h. operating expenses operations over a given time period 1. owners' equity A financial report showing a firm's assets, liabilities, and owners' equity at a J. retained earnings specific point in time The cost of borrowed money A measure of what percentage of a firm's assets is financed by debt, determined by dividing total debt by total assets A distribution of a firm's profits to the owners Match the term with its definition. An accounting method of recording profits when earned and expenses when a. accrual-basis accounting incurred, whether the profits have been received in cash or the expenses paid b. cash A measure of a firm's profitability relative to the amount of its assets, determined by dividing operating profits by total assets Money in the bank as well as securities that can be sold very quickly, such as c. cash-basis accounting a government security d. depreciable assets e. financial statements An accounting method of recording profits when cash is received and f. inventory recording expenses when they are paid g. liquidity A measure of how well a firm is controlling its cost of goods sold and h. operating profit margin operating expenses relative to sales, determined by dividing operating profits i. return on assets by sales j. return on equity A measure of the rate of return that owners receive on their equity investment, calculated by dividing net profits by owners' equity Assets whose value declines, or depreciates, over time A firm's products held in anticipation of eventual sale in the ordinary course of business The degree to which a firm has cash available to meet maturing debt obligations A firm's income statement, balance sheets, and statements of cash flows Match the term with its definition. Statements that project a firm's financial performance and condition, a. cash budget including a firm's projected profits, assets and financing requirements, and b. line of credit cash flows c. net working capital A short-term loan d. percentage-of-sales technique Short-term debts, such as accounts payable, that automatically increase in e. pro forma financial statements proportion to a firm's sales f. spontaneous debt financing A listing of cash receipts and cash disbursements, usually for a relatively short time period, such as a week or a month A method of forecasting asset requirements using a ratio of assets to sales A measure of a company's liquidity, equal to current assets less current liabilities Match the term with its definition. Private individuals who invest in others' entrepreneurial ventures a. balloon payment A long-term loan with real property held as collateral b. business angels A very large payment required about halfway through the term over which c. chattel mortgage payments were calculated, repaying the loan balance in full d. crowdfunding The issuance of stock to be traded in public financial markets e. initial public offering (IPO) The sale of a firm's capital stock to select individuals f. private placement g. real estate mortgage A loan for which items of inventory or other movable property serve as collateral The process of raising small amounts of money from a large number of investors via the Internet