Answered step by step

Verified Expert Solution

Question

1 Approved Answer

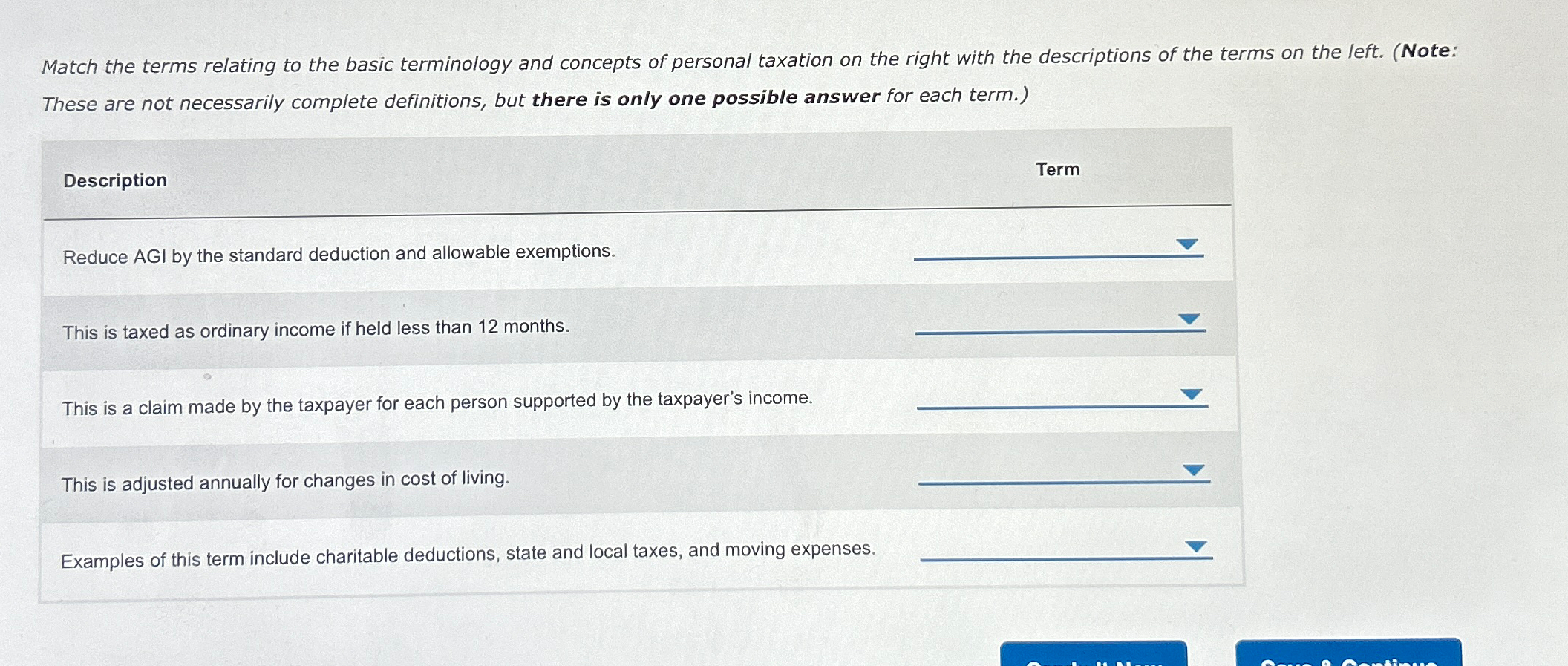

Match the terms relating to the basic terminology and concepts of personal taxation on the right with the descriptions of the terms on the left.

Match the terms relating to the basic terminology and concepts of personal taxation on the right with the descriptions of the terms on the left. Note: These are not necessarily complete definitions, but there is only one possible answer for each term.

Description

Term

Reduce AGI by the standard deduction and allowable exemptions.

This is taxed as ordinary income if held less than months.

This is a claim made by the taxpayer for each person supported by the taxpayer's income.

This is adjusted annually for changes in cost of living.

Examples of this term include charitable deductions, state and local taxes, and moving expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started