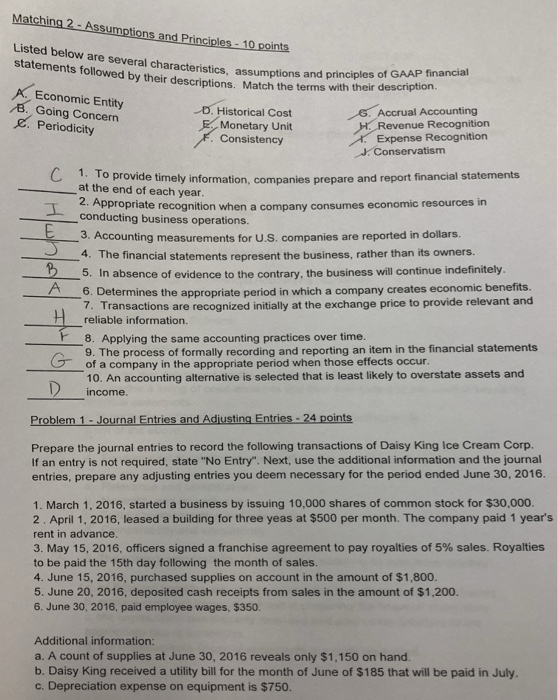

Matching 2-Assumptions and Principles- 10 points Listed below are several characteristics, assumptions a statements followed by their descriptions. M and principles of GAAP financial atch the terms with their description Economic Entity B. Going Concerrn E. Periodicity . Historical Cost Monetary Unit nistencypense Recognation Expense Recognition JConservatismm 1. To at the end of each year 2. Appropriate recognition when a company consumes economic resources in conducting business operations. 3. Accounting measurements for U.S. companies are reported in dollars. 4. The financial statements represent the business, rather than its owners. 5. In absence of evidence to the contrary, the business will continue indefinitely 6. Determines the appropriate period in which a company creates economic benefits. 7. Transactions are recognized initially at the exchange price to provide relevant and H reliable information. 8. Applying the same accounting practices over time. 9. The process of formally recording and reporting an item in the financial statements of a company in the appropriate period when those effects occur 10. An accounting alternative is selected that is least likely to overstate assets and income Problem 1- Journal Entries and Adjusting Entries -24 points Prepare the journal entries to record the following transactions of Daisy King ice Cream Corp. If an entry is not required, state "No Entry". Next, use the additional information and the journal entries, prepare any adjusting entries you deem necessary for the period ended June 30, 2016. 1. March 1, 2016, started a business by issuing 10,000 shares of common stock for $30,000. 2. April 1, 2016, leased a building for three yeas at $500 per month. The company paid 1 years rent in advance 3, May 15, 2016, officers signed a franchise agreement to pay royalties of 5% sales. Royalties to be paid the 15th day following the month of sales. 4. June 15, 2016, purchased supplies on account in the amount of $1,800 5. June 20, 2016, deposited cash receipts from sales in the amount of $1,200. 6. June 30, 2016, paid employee wages, $350. Additional informatiorn a. A count of supplies at June 30, 2016 reveals only $1,150 on hand. b. Daisy King received a utility bill for the month of June of $185 that will be paid in July c. Depreciation expense on equipment is $750