Answered step by step

Verified Expert Solution

Question

1 Approved Answer

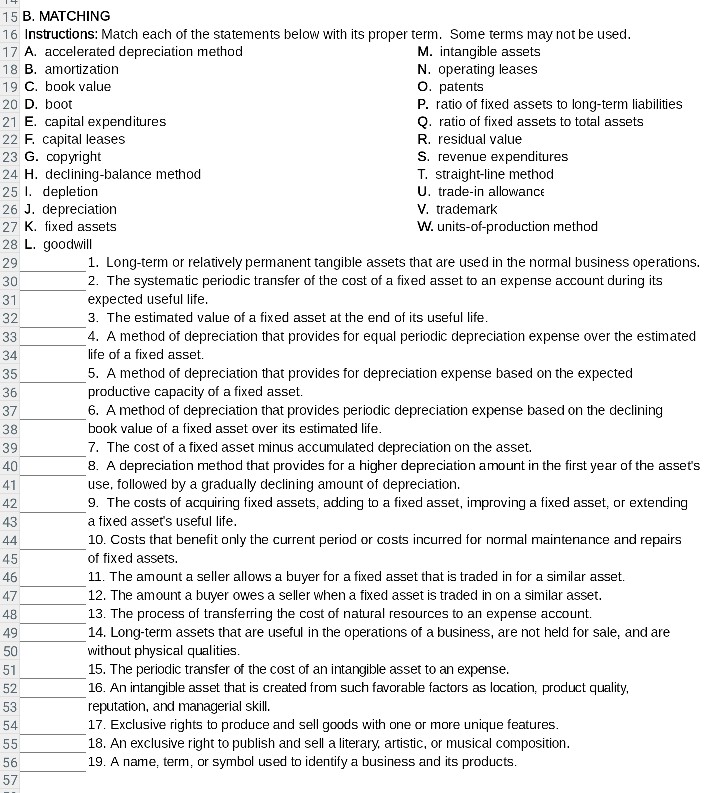

MATCHING: A. accelerated depreciation method B. amortization C. book value D. boot E. capital expenditures F. capital leases G. copyright 24 H. declining-balance method I.

MATCHING: A. accelerated depreciation method B. amortization C. book value D. boot E. capital expenditures F. capital leases G. copyright 24 H. declining-balance method I. depletion J. depreciation K. fixed assets L. goodwill M. intangible assets N. operating leases O. patents P. ratio of fixed assets to long-term liabilities Q. ratio of fixed assets to total assets R. residual value S. revenue expenditures T. straight-line method U. trade-in allowance V. trademark W. units-of-production method 1. Long-term or relatively permanent tangible assets that are used in the normal business operations. 2. The systematic periodic transfer of the cost of a fixed asset to an expense account during its expected useful life. 3, The estimated value of a fixed asset at the end of its useful life. 4. A method of depreciation that provides for equal periodic depreciation expense over the estimated life of a fixed asset. 5. A method of depreciation that provides for depreciation expense based on the expected productive capacity of a fixed asset. 6. A method of depreciation that provides periodic depreciation expense based on the declining book value of a fixed asset over its estimated life. 7. The cost of a fixed asset minus accumulated depreciation on the asset. 8. A depreciation method that provides for a higher depreciation amount in the first year of the assets use, followed by a gradually declining amount of depreciation. 9. The costs of acquiring fixed assets, adding to a fixed asset, improving a fixed asset, or extending a fixed assets useful life. 10. Costs that benefit only the current period or costs incurred for normal maintenance and repairs of fixed assets. 11. The amount a seller allows a buyer for a fixed asset that is traded in for a similar asset. 12. The amount a buyer owes a seller when a fixed asset is traded in on a similar asset. 13. The process of transferring the cost of natural resources to an expense account. 14. Long-term assets that are useful in the operations of a business, are not held for sale, and are without physical qualities. 15. The periodic transfer of the cost of an intangible asset to an expense. 16. An intangible asset that is created from such favorable factors as location, product quality reputation, and managerial skill. 17. Exclusive rights to produce and sell goods with one or more unique features. 18. An exclusive right to publish and sell a literary, artistic, or musical composition. 19. A name, term, or symbol used to identify a business and its products

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started