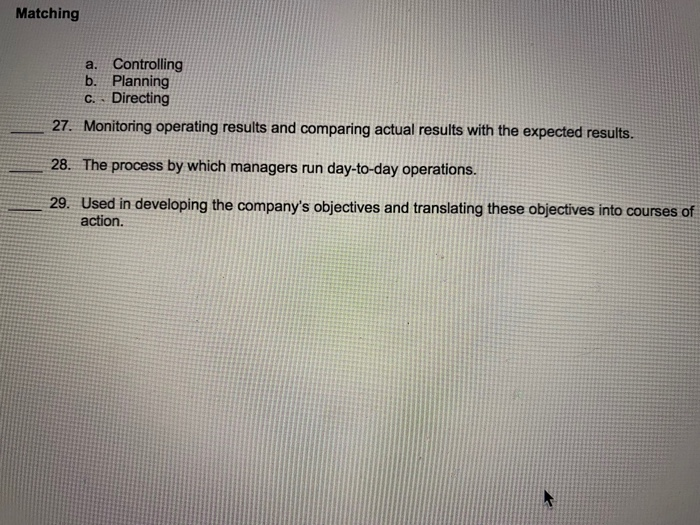

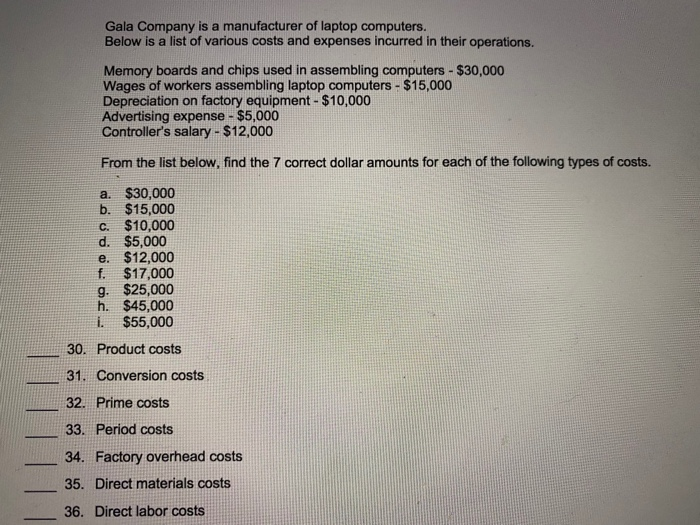

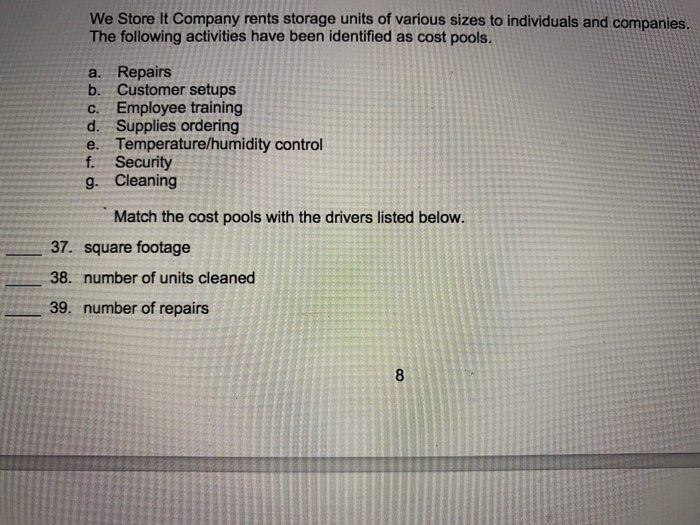

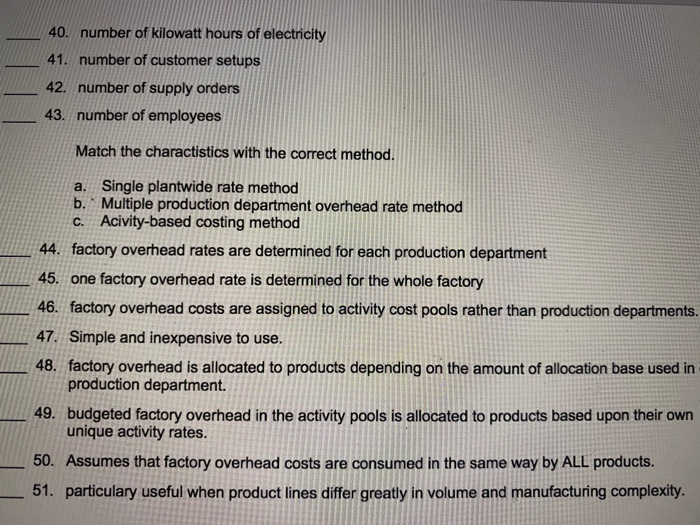

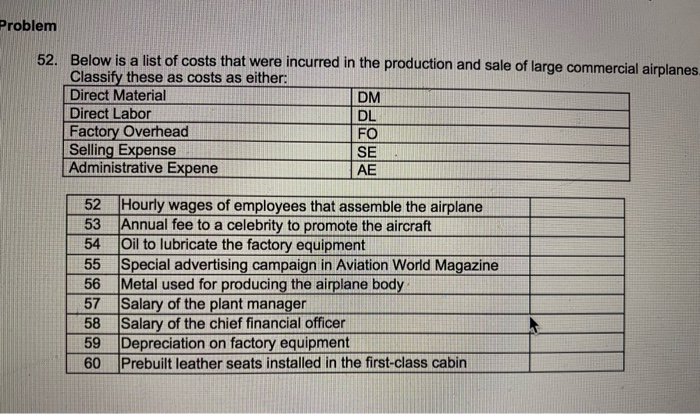

Matching a. Controlling b. Planning C. - Directing 27. Monitoring operating results and comparing actual results with the expected results. 28. The process by which managers run day-to-day operations. 29. Used in developing the company's objectives and translating these objectives into courses of action. Gala Company is a manufacturer of laptop computers. Below is a list of various costs and expenses incurred in their operations. Memory boards and chips used in assembling computers - $30,000 Wages of workers assembling laptop computers - $15,000 Depreciation on factory equipment - $10,000 Advertising expense - $5,000 Controller's salary - $12,000 From the list below, find the 7 correct dollar amounts for each of the following types of costs. a. $30,000 b. $15,000 C. $10,000 d. $5,000 e. $12,000 f. $17,000 g. $25,000 h. $45,000 i. $55,000 30. Product costs 31. Conversion costs 32. Prime costs 33. Period costs 34. Factory overhead costs 35. Direct materials costs 36. Direct labor costs We Store It Company rents storage units of various sizes to individuals and companies. The following activities have been identified as cost pools. a. Repairs b. Customer setups c. Employee training d. Supplies ordering e. Temperature/humidity control f. Security g. Cleaning Match the cost pools with the drivers listed below. 37. square footage 38. number of units cleaned 39. number of repairs 8 40. number of kilowatt hours of electricity 41. number of customer setups 42. number of supply orders 43. number of employees Match the charactistics with the correct method. a. Single plantwide rate method b. Multiple production department overhead rate method C. Acivity-based costing method 44. factory overhead rates are determined for each production department 45. one factory overhead rate is determined for the whole factory 46. factory overhead costs are assigned to activity cost pools rather than production departments. 47. Simple and inexpensive to use. 48. factory overhead is allocated to products depending on the amount of allocation base used in production department. 49. budgeted factory overhead in the activity pools is allocated to products based upon their own unique activity rates. 50. Assumes that factory overhead costs are consumed in the same way by ALL products. 51. particulary useful when product lines differ greatly in volume and manufacturing complexity. Problem 52. Below is a list of costs that were incurred in the production and sale of large commercial airplanes Classify these as costs as either: Direct Material DM Direct Labor DL Factory Overhead FO Selling Expense Administrative Expene AE SE 52 Hourly wages of employees that assemble the airplane 53 Annual fee to a celebrity to promote the aircraft 54 Oil to lubricate the factory equipment 55 Special advertising campaign in Aviation World Magazine 56 Metal used for producing the airplane body 57 Salary of the plant manager 58 Salary of the chief financial officer 59 Depreciation on factory equipment 60 Prebuilt leather seats installed in the first-class cabin